6015 Jacaranda Way Unit B Carpinteria, CA 93013

Estimated Value: $774,000 - $874,469

3

Beds

3

Baths

1,344

Sq Ft

$623/Sq Ft

Est. Value

About This Home

This home is located at 6015 Jacaranda Way Unit B, Carpinteria, CA 93013 and is currently estimated at $837,367, approximately $623 per square foot. 6015 Jacaranda Way Unit B is a home located in Santa Barbara County with nearby schools including Carpinteria Senior High School and The Howard School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 24, 2017

Sold by

Christensen Druce J and Christensen Renee J

Bought by

Christensen Bruce J and Christensen Renee J

Current Estimated Value

Purchase Details

Closed on

Sep 4, 2009

Sold by

Gendron Holly

Bought by

Christensen Bruce J and Christensen Renee J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,500

Interest Rate

5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 12, 1999

Sold by

Forren Johnnie R and Graves Anne Graves

Bought by

Gendron Holly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,000

Interest Rate

7.04%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christensen Bruce J | -- | None Available | |

| Christensen Bruce J | -- | First American Title Company | |

| Gendron Holly | -- | Chicago Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Christensen Bruce J | $325,500 | |

| Previous Owner | Gendron Holly | $115,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,080 | $600,213 | $283,972 | $316,241 |

| 2023 | $7,080 | $576,908 | $272,946 | $303,962 |

| 2022 | $6,826 | $565,597 | $267,595 | $298,002 |

| 2021 | $6,671 | $554,508 | $262,349 | $292,159 |

| 2020 | $6,585 | $548,823 | $259,659 | $289,164 |

| 2019 | $6,444 | $538,063 | $254,568 | $283,495 |

| 2018 | $6,328 | $527,514 | $249,577 | $277,937 |

| 2017 | $6,206 | $517,172 | $244,684 | $272,488 |

| 2016 | $5,813 | $480,000 | $227,000 | $253,000 |

| 2015 | $5,587 | $457,000 | $216,000 | $241,000 |

| 2014 | $4,931 | $415,000 | $196,000 | $219,000 |

Source: Public Records

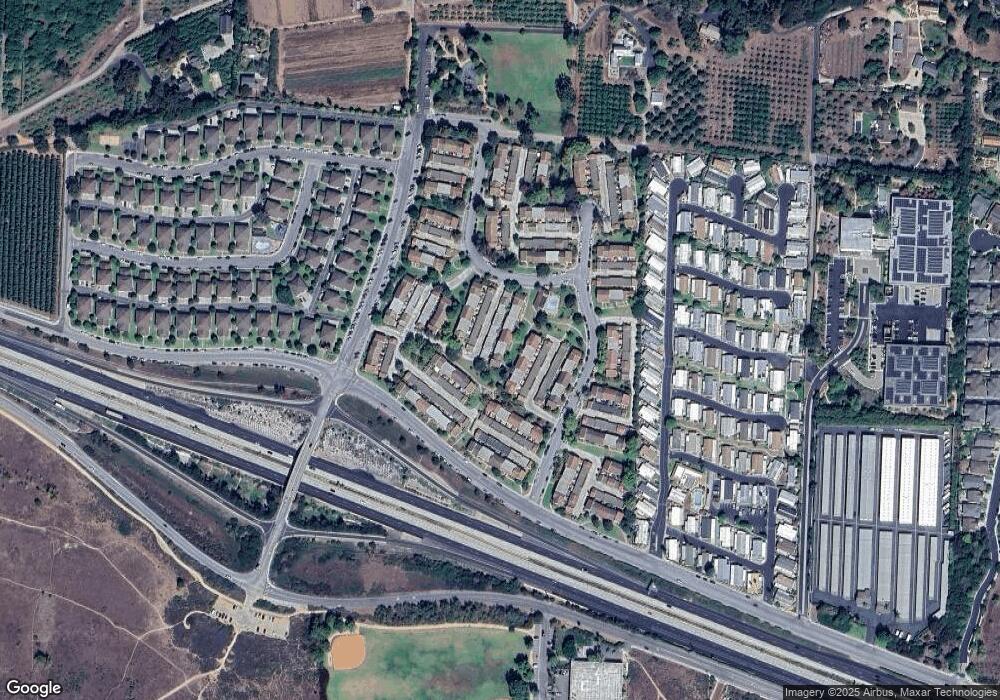

Map

Nearby Homes

- 5945 Hickory St Unit 4

- 5940 Birch St Unit 2

- 6180 Via Real Unit 29

- 6180 Via Real Unit 52

- 5700 Via Real Unit 138

- 6660 Gobernador Canyon Rd

- 0 Gobernador Canyon Rd

- 5455 8th St Unit 95

- 5455 8th St Unit 5

- 1090 Vallecito Rd

- 4869 Carpinteria Ave

- 8105 Buena Fortuna St

- 231 Linden Ave Unit 18

- 4980 Sandyland Rd

- 3080 Foothill Rd

- 220 Elm Ave Unit 9

- 4975 Sandyland Rd Unit 302

- 4677 Carpinteria Ave Unit P

- 7401 Shepard Mesa Rd

- 4731 4th St

- 6015 Jacaranda Way

- 6015 Jacaranda Way Unit L

- 6015 Jacaranda Way Unit K

- 6015 Jacaranda Way Unit J

- 6015 Jacaranda Way Unit I

- 6015 Jacaranda Way Unit H

- 6015 Jacaranda Way Unit G

- 6015 Jacaranda Way Unit F

- 6015 Jacaranda Way Unit E

- 6015 Jacaranda Way Unit D

- 6015 Jacaranda Way Unit C

- 6015 Jacaranda Way Unit A

- 6015 Jacaranda #E Unit E

- 6015 Jacaranda Way Apt D

- 6015 Jacaranda Wy #J Unit J

- 6027 Jacaranda Way Unit F

- 6027 Jacaranda Way

- 6027 Jacaranda #B Unit B

- 6027 Jacaranda #J Unit J

- 6027 Jacaranda #J