605 Timber Oaks Rd Unit 5 Edison, NJ 08820

Estimated Value: $496,000 - $527,000

2

Beds

2

Baths

1,232

Sq Ft

$418/Sq Ft

Est. Value

About This Home

This home is located at 605 Timber Oaks Rd Unit 5, Edison, NJ 08820 and is currently estimated at $514,793, approximately $417 per square foot. 605 Timber Oaks Rd Unit 5 is a home located in Middlesex County with nearby schools including James Madison Primary School, James Madison Intermediate School, and John Adams Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 16, 2019

Sold by

Ner Maybelyn

Bought by

Gomez Nelson Andre

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,000

Outstanding Balance

$221,263

Interest Rate

3.82%

Mortgage Type

New Conventional

Estimated Equity

$293,530

Purchase Details

Closed on

Sep 17, 2009

Sold by

Miedowicz Patricia

Bought by

Ner Maybelyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$237,000

Interest Rate

5.01%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 28, 1999

Sold by

Tang I P

Bought by

Miedowicz Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,400

Interest Rate

7.49%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gomez Nelson Andre | $320,000 | Foundation Title Llc | |

| Ner Maybelyn | $267,000 | None Available | |

| Miedowicz Patricia | $134,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gomez Nelson Andre | $288,000 | |

| Previous Owner | Ner Maybelyn | $237,000 | |

| Previous Owner | Miedowicz Patricia | $115,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,697 | $129,300 | $65,000 | $64,300 |

| 2024 | $7,656 | $129,300 | $65,000 | $64,300 |

| 2023 | $7,656 | $129,300 | $65,000 | $64,300 |

| 2022 | $7,658 | $129,300 | $65,000 | $64,300 |

| 2021 | $7,348 | $129,300 | $65,000 | $64,300 |

| 2020 | $7,563 | $129,300 | $65,000 | $64,300 |

| 2019 | $6,993 | $129,300 | $65,000 | $64,300 |

| 2018 | $7,101 | $129,300 | $65,000 | $64,300 |

| 2017 | $6,951 | $129,300 | $65,000 | $64,300 |

| 2016 | $6,537 | $129,300 | $65,000 | $64,300 |

| 2015 | $6,289 | $129,300 | $65,000 | $64,300 |

| 2014 | $6,111 | $129,300 | $65,000 | $64,300 |

Source: Public Records

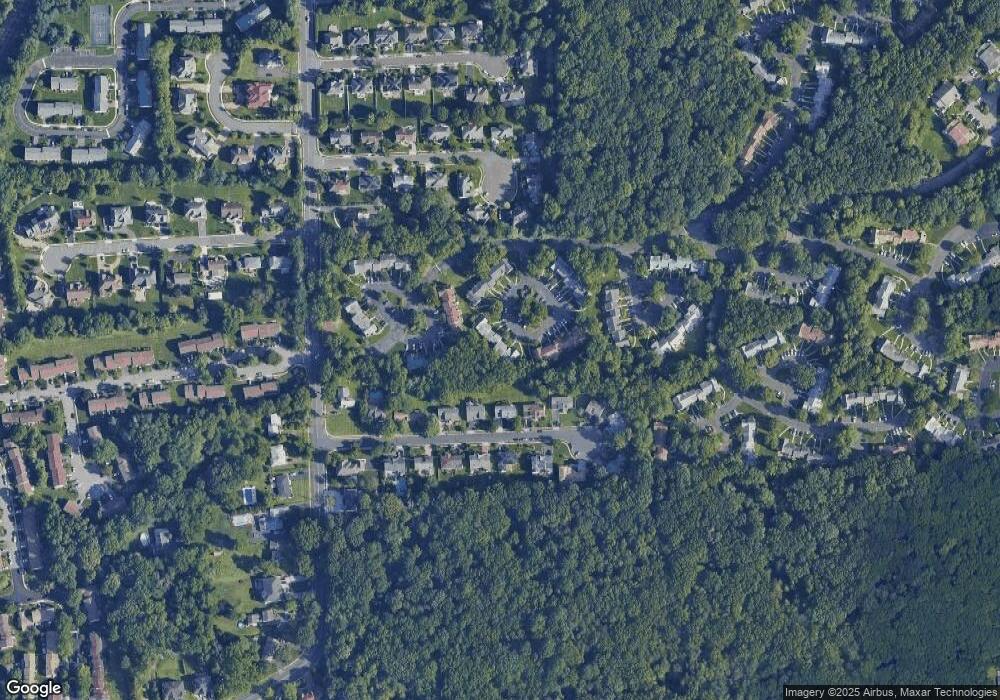

Map

Nearby Homes

- 3801 Cricket Cir

- 28 Hawthorn Dr Unit 28

- 28 Hawthorn Dr

- 3606 Springbrook Dr

- 3606 Spring Brook Dr

- 4807 Stonehedge Rd

- 3 Anthony Ave

- 9 Vallata Place

- 166 Hidden Hollow Ct

- 24 Norton St

- 31 Hickory Hollow Ct

- 145 Maplewood Ct Unit 145D

- 10 Milford Ct

- 3 Old Hickory Ln

- 25 Lamar Ave

- 11 Madaline Dr

- 4 Hemlock Dr

- 302 Westgate Dr

- 338 Westgate Dr Unit 338

- 404 Westgate Dr

- 1104 Timber Oaks Rd

- 3004 Cricket Cir

- 3902 Cricket Cir

- 3101 Cricket Cir

- 602 Timber Oaks Rd

- 2501 Cricket Cir

- 3707 Cricket Cir

- 2905 Cricket Cir

- 3804 Cricket Cir

- 2506 Cricket Cir

- 3605 Cricket Cir

- 2704 Cricket Cir Unit 4

- 2502 Cricket Cir

- 2602 Cricket Cir Unit 2

- 3505 Cricket Cir

- 3001 Cricket Cir

- 1007 Timber Oaks Rd

- 1007 Timber Oaks Rd Unit 1007

- 3805 Cricket Cir

- 3103 Cricket Cir Unit 3