6093 Stallion Oaks Rd El Cajon, CA 92019

Estimated Value: $747,000 - $1,042,000

3

Beds

2

Baths

1,456

Sq Ft

$597/Sq Ft

Est. Value

About This Home

This home is located at 6093 Stallion Oaks Rd, El Cajon, CA 92019 and is currently estimated at $869,304, approximately $597 per square foot. 6093 Stallion Oaks Rd is a home located in San Diego County with nearby schools including Dehesa School, Valhalla High, and Cabrillo Point Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 9, 2009

Sold by

Jones Steve Wayne and Jones Mary Louise

Bought by

Obrien Jeffrey Allen and Obrien Diane Michele Igney

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$287,201

Interest Rate

4.99%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 31, 2000

Sold by

Blue View Corp

Bought by

Jones Steve Wayne and Jones Mary Louise

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$51,000

Interest Rate

7.96%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jan 24, 2000

Sold by

Reed Robert P and Reed Cynthia

Bought by

Blue View Corp

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$51,000

Interest Rate

7.96%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Nov 10, 1994

Sold by

Mclean William Joe and Mclean Marianne

Bought by

Reed Robert P and Reed Cynthia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

9.08%

Mortgage Type

Construction

Purchase Details

Closed on

Oct 12, 1989

Purchase Details

Closed on

Nov 13, 1987

Purchase Details

Closed on

Nov 6, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Obrien Jeffrey Allen | $292,500 | Stewart Title | |

| Jones Steve Wayne | -- | Benefit Land Title Company | |

| Blue View Corp | $6,000 | Benefit Land Title Company | |

| Reed Robert P | $80,000 | Stewart Title | |

| -- | $85,000 | -- | |

| -- | $35,200 | -- | |

| -- | $21,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Obrien Jeffrey Allen | $287,201 | |

| Previous Owner | Jones Steve Wayne | $51,000 | |

| Previous Owner | Reed Robert P | $150,000 | |

| Closed | Jones Steve Wayne | $13,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,695 | $376,654 | $225,351 | $151,303 |

| 2024 | $4,695 | $369,270 | $220,933 | $148,337 |

| 2023 | $4,542 | $362,030 | $216,601 | $145,429 |

| 2022 | $4,548 | $354,932 | $212,354 | $142,578 |

| 2021 | $4,478 | $347,974 | $208,191 | $139,783 |

| 2020 | $4,429 | $344,407 | $206,057 | $138,350 |

| 2019 | $4,375 | $337,655 | $202,017 | $135,638 |

| 2018 | $6,719 | $331,035 | $198,056 | $132,979 |

| 2017 | $6,664 | $324,545 | $194,173 | $130,372 |

| 2016 | $3,994 | $318,182 | $190,366 | $127,816 |

| 2015 | $3,981 | $313,404 | $187,507 | $125,897 |

| 2014 | $3,829 | $307,265 | $183,834 | $123,431 |

Source: Public Records

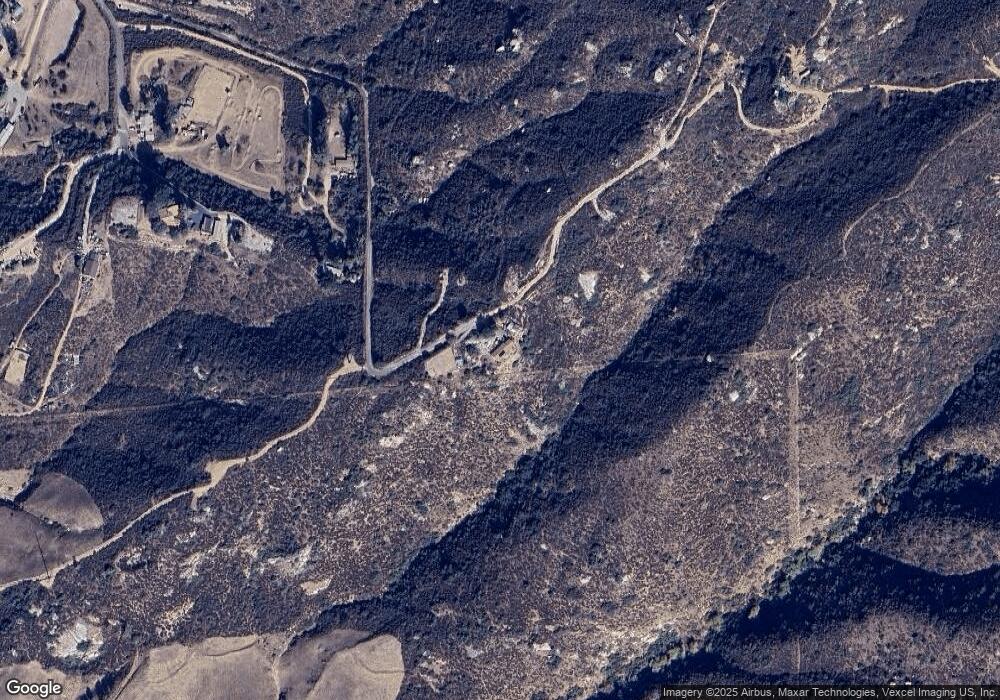

Map

Nearby Homes

- 6433 Dehesa Rd

- 0000 Sloane Canyon Rd Unit 2,3

- 1010 1/2 Wilson Ave

- 1631 Harbison Canyon Rd Unit 26

- 1631 Harbison Canyon Rd Unit 77

- 5352 Dehesa Rd

- 833 Renfro Way

- 14720 Quail Haven Ln

- 14761 Quail Haven Ln Unit 1

- 860 Renfro Way

- 0 Silverbrook Dr Unit PTP2505360

- 0 Silverbrook Dr Unit PTP2505357

- 965 Harbison Canyon Rd

- 447 Patrick Dr

- 723 Lingel Dr

- 365 Alpine Heights Rd

- 0 Dehesa Rd Unit OC24215586

- 0 Dehesa Rd Unit OC24215583

- 0 Dehesa Rd Unit OC24215580

- 328 Amy Way

- 5429 Sycuan Rd

- 0000 Stallion Oaks Rd Unit 3

- 5603 Stallion Oaks Rd

- 6099 Stallion Oaks Rd

- 5615 Stallion Oaks Rd

- 5602 Stallion Oaks Rd

- 5999 Stallion Oaks Rd

- 5604 Stallion Oaks Rd

- 5982 Stallion Oaks Rd

- 15926 Sequan Truck Trail

- 5973 Stallion Oaks Rd

- 5417 Dehesa Rd

- 5944 Stallion Oaks Rd

- 15922 Sequan Truck Trail

- 5513 Riggs Rd

- 5843 Stallion Oaks Rd

- 15910 Sequan Truck Trail

- 15918 Sequan Truck Trail

- 5521 Riggs Rd

- 5900 Stallion Oaks Rd Unit 12