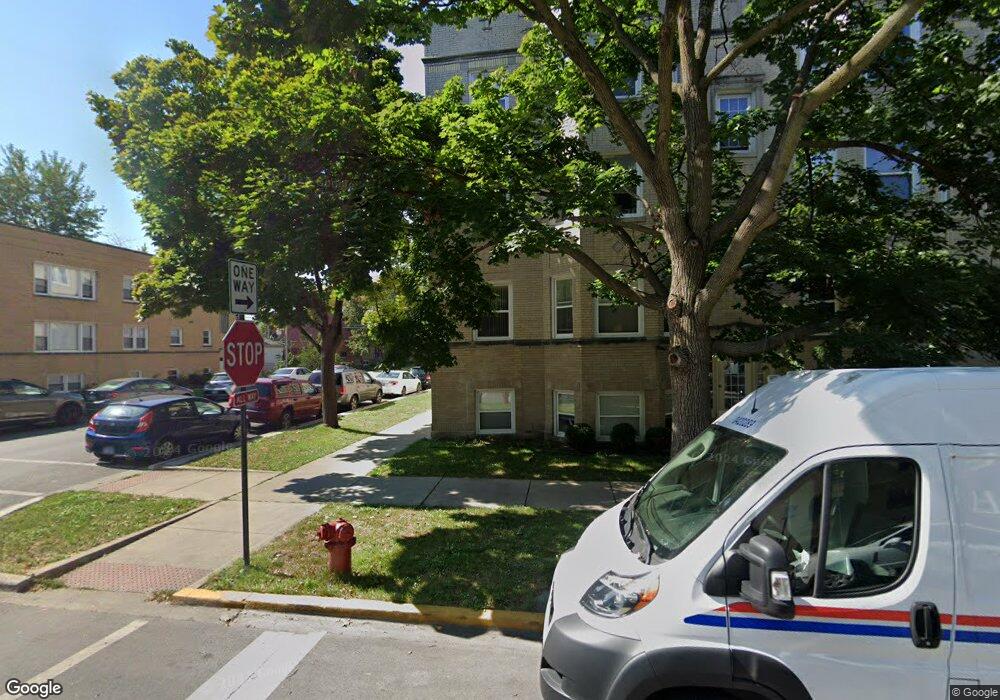

6100 N Mozart St Unit GB Chicago, IL 60659

West Ridge NeighborhoodEstimated Value: $149,000 - $192,000

2

Beds

1

Bath

18,920

Sq Ft

$9/Sq Ft

Est. Value

About This Home

This home is located at 6100 N Mozart St Unit GB, Chicago, IL 60659 and is currently estimated at $167,825, approximately $8 per square foot. 6100 N Mozart St Unit GB is a home located in Cook County with nearby schools including Clinton Elementary School, Mather High School, and Yeshivas Tiferes Tzvi Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2022

Sold by

Chicago Title Land Trust Company

Bought by

Hussein Qeenah and Alipio Phil Jung

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,255

Outstanding Balance

$120,830

Interest Rate

6.13%

Mortgage Type

New Conventional

Estimated Equity

$46,995

Purchase Details

Closed on

Mar 29, 2021

Sold by

Ferrando Lilia

Bought by

Chicago Title Land Trust Company and Trust Number 8002385702

Purchase Details

Closed on

Feb 21, 2013

Sold by

Gilbert Andrea and Orm Andrea

Bought by

Ferrando Lilia

Purchase Details

Closed on

Aug 30, 2004

Sold by

6100 N Mozart Llc

Bought by

Orm Andrea and Costello Trena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,410

Interest Rate

9.2%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hussein Qeenah | $133,000 | None Listed On Document | |

| Chicago Title Land Trust Company | $115,000 | Landtrust National Ttl Svcs | |

| Ferrando Lilia | $49,000 | Citywide Title Corporation | |

| Ferrando Lilia | $49,000 | None Available | |

| Orm Andrea | $175,000 | Metropolitan Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hussein Qeenah | $126,255 | |

| Previous Owner | Orm Andrea | $157,410 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,734 | $13,276 | $1,490 | $11,786 |

| 2023 | $2,665 | $12,960 | $1,208 | $11,752 |

| 2022 | $2,665 | $12,960 | $1,208 | $11,752 |

| 2021 | $1,936 | $12,959 | $1,208 | $11,751 |

| 2020 | $366 | $4,743 | $724 | $4,019 |

| 2019 | $381 | $5,326 | $724 | $4,602 |

| 2018 | $373 | $5,326 | $724 | $4,602 |

| 2017 | $530 | $5,838 | $644 | $5,194 |

| 2016 | $669 | $5,838 | $644 | $5,194 |

| 2015 | $589 | $5,838 | $644 | $5,194 |

| 2014 | $479 | $5,148 | $604 | $4,544 |

| 2013 | $1,246 | $9,478 | $604 | $8,874 |

Source: Public Records

Map

Nearby Homes

- 6214 N Mozart St Unit 3E

- 6226 N Mozart St Unit 2N

- 6235 N Mozart St

- 6212 N Sacramento Ave

- 6215 N Washtenaw Ave

- 5838 N Sacramento Ave

- 5830 N Lincoln Ave Unit 2W

- 5830 N Lincoln Ave Unit 2E

- 5830 N Lincoln Ave Unit 3E

- 5830 N Lincoln Ave Unit 1E

- 6312 N Fairfield Ave Unit 3B

- 5824 N Lincoln Ave Unit 1N

- 5824 N Lincoln Ave Unit GN

- 5824 N Lincoln Ave Unit 3N

- 6215 N Talman Ave

- 6210 N Albany Ave

- 5829 N Washtenaw Ave

- 6040 N Troy St Unit 306

- 6144 N Maplewood Ave

- 5848 N Virginia Ave

- 6100 N Mozart St Unit 2

- 6100 N Mozart St Unit 61001

- 2842 W Glenlake Ave Unit 28421

- 2840 W Glenlake Ave Unit 28401

- 2842 W Glenlake Ave Unit 28422

- 2842 W Glenlake Ave Unit 28423

- 6100 N Mozart St Unit 61002

- 2840 W Glenlake Ave Unit 28403

- 6100 N Mozart St Unit 61003

- 2840 W Glenlake Ave Unit 28402

- 6100 N Mozart St Unit 6100G

- 6100 N Mozart St Unit 3B

- 2842 W Glenlake Ave Unit 3

- 6100 N Mozart St Unit 1B

- 6100 N Mozart St Unit G

- 6100 N Mozart St Unit 3

- 2842 W Glenlake Ave Unit 1E

- 6100 N Mozart St Unit 1

- 2840 W Glenlake Ave Unit 2D

- 2838 W Glenlake Ave Unit 28383