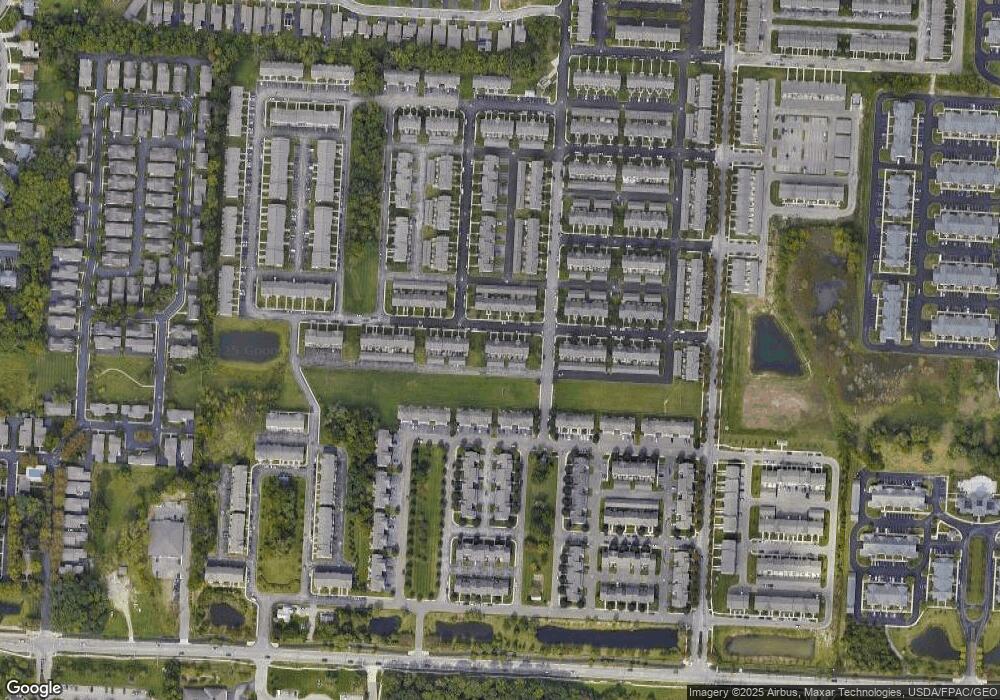

6245 Needletail Rd Unit 32-624 Columbus, OH 43230

Preserve South NeighborhoodEstimated Value: $268,000 - $280,000

2

Beds

3

Baths

1,494

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 6245 Needletail Rd Unit 32-624, Columbus, OH 43230 and is currently estimated at $274,094, approximately $183 per square foot. 6245 Needletail Rd Unit 32-624 is a home located in Franklin County with nearby schools including Avalon Elementary School, Northgate Intermediate, and Woodward Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2015

Sold by

Head Danielle L

Bought by

Heard David and Heard Tina

Current Estimated Value

Purchase Details

Closed on

Apr 30, 2013

Sold by

Huston Susan K and Ristow Susan K

Bought by

Head Danielle L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,800

Outstanding Balance

$22,900

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$251,194

Purchase Details

Closed on

Jul 23, 2009

Sold by

Preserve Crossing Ltd

Bought by

Huston Susan K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,080

Interest Rate

5.21%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Heard David | $123,000 | Attorney | |

| Head Danielle L | $122,000 | Real Living Title Box | |

| Huston Susan K | $146,400 | Connor Land |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Head Danielle L | $109,800 | |

| Previous Owner | Huston Susan K | $117,080 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,651 | $79,670 | $16,810 | $62,860 |

| 2023 | $3,606 | $79,660 | $16,800 | $62,860 |

| 2022 | $3,064 | $57,650 | $6,130 | $51,520 |

| 2021 | $3,069 | $57,650 | $6,130 | $51,520 |

| 2020 | $3,074 | $57,650 | $6,130 | $51,520 |

| 2019 | $2,869 | $46,140 | $4,910 | $41,230 |

| 2018 | $1,432 | $46,140 | $4,910 | $41,230 |

| 2017 | $1,511 | $46,140 | $4,910 | $41,230 |

| 2016 | $3,051 | $44,910 | $7,180 | $37,730 |

| 2015 | $2,701 | $44,910 | $7,180 | $37,730 |

| 2014 | $2,707 | $44,910 | $7,180 | $37,730 |

| 2013 | $141 | $4,725 | $4,725 | $0 |

Source: Public Records

Map

Nearby Homes

- 6200 Downwing Ln Unit 20

- 6169 Needletail Rd

- 3826 Wood Stork Ln Unit 68

- 6263 Wagtail Rd Unit 13

- 6232 Joes Hopper Rd Unit 52

- 3753 Brightwell Ln

- 4705 Wenham Park Unit 15B

- 4062 Summerstone Dr

- 6019 Bentgate Ln Unit 60192

- 4651 E Johnstown Rd

- 4135 Pathfield Dr

- 4636 Collingville Way Unit 22

- 597 Piney Glen Dr Unit 597

- 1199 Riva Ridge Blvd

- 636 Grove Cir Unit 1803

- 6214 Brickside Dr Unit 24

- 4185 Windsor Bridge Place Unit 44185

- 3920 Lewis Link Dr

- 4331 Bridgeside Place

- 4574 N Hamilton Rd

- 6245 Needletail Rd

- 6249 Needletail Rd Unit 32-624

- 6249 Needletail Rd

- 6253 Needletail Rd

- 6237 Needletail Rd Unit 32

- 6237 Needletail Rd

- 6241 Needletail Rd

- 6257 Needletail Rd

- 6261 Needletail Rd

- 6261 Needletail Rd Unit 32-626

- 6246 Needletail Rd

- 6265 Needletail Rd Unit 32-626

- 6265 Needletail Rd

- 6225 Needletail Rd

- 6221 Needletail Rd

- 6242 Needletail Rd Unit 33

- 6242 Needletail Rd Unit 33-624

- 6242 Needletail Rd

- 6254 Needletail Rd

- 6238 Needletail Rd Unit 33-623