6385 Honeytree Ln Central Point, OR 97502

Estimated Value: $422,530 - $479,000

3

Beds

2

Baths

2,000

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 6385 Honeytree Ln, Central Point, OR 97502 and is currently estimated at $451,177, approximately $225 per square foot. 6385 Honeytree Ln is a home located in Jackson County with nearby schools including Jewett Elementary School, Scenic Middle School, and Crater High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 16, 2011

Sold by

Sullivan Douglas T and Sullivan Linda F

Bought by

Overturf Mark A and Metcalf Melanie C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,817

Outstanding Balance

$110,864

Interest Rate

4.63%

Mortgage Type

FHA

Estimated Equity

$340,313

Purchase Details

Closed on

Jul 17, 2002

Sold by

Hopkins Leslie A and Hopkins Wanda

Bought by

Sullivan Douglas T and Sullivan Linda F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,811

Interest Rate

6.69%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Overturf Mark A | $165,000 | Amerititle | |

| Sullivan Douglas T | $149,900 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Overturf Mark A | $160,817 | |

| Previous Owner | Sullivan Douglas T | $147,811 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,836 | $203,910 | $116,890 | $87,020 |

| 2024 | $2,836 | $197,980 | $59,870 | $138,110 |

| 2023 | $2,733 | $192,220 | $58,130 | $134,090 |

| 2022 | $2,668 | $192,220 | $58,130 | $134,090 |

| 2021 | $2,531 | $186,630 | $56,440 | $130,190 |

| 2020 | $2,484 | $181,200 | $54,790 | $126,410 |

| 2019 | $2,446 | $170,810 | $51,650 | $119,160 |

| 2018 | $2,371 | $165,840 | $50,150 | $115,690 |

| 2017 | $2,323 | $165,840 | $50,150 | $115,690 |

| 2016 | $2,245 | $156,330 | $47,270 | $109,060 |

| 2015 | $2,176 | $156,330 | $47,270 | $109,060 |

| 2014 | $1,841 | $147,360 | $44,570 | $102,790 |

Source: Public Records

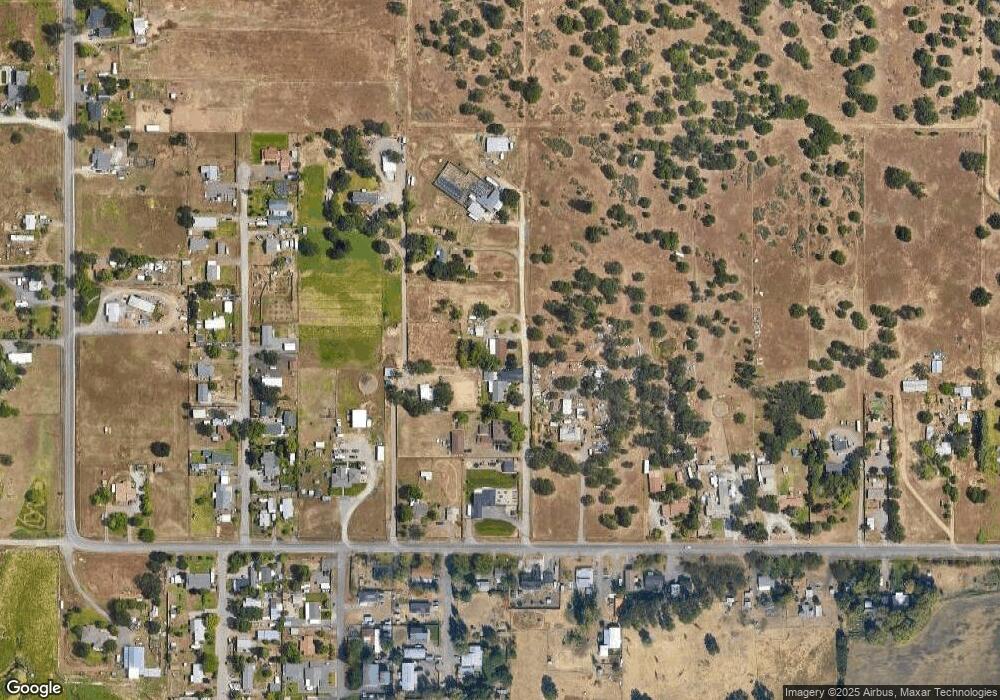

Map

Nearby Homes

- 6199 Wilson Ln

- 6850 Downing Rd Unit 44

- 6850 Downing Rd Unit 65

- 644 Raven

- 4035 Rock Way

- 2035 Rabun Way

- 335 Applewood Dr

- 225 Wilson Rd

- 1409 Twin Rocks Dr

- 0 Peninger Rd

- 4922 Gebhard Rd

- 920 N 10th St

- 356 Marian Ave Unit 40

- 2248 Evan Way

- 2225 New Haven Dr

- 2330 Savannah Dr

- 1010 N 3rd St

- 327 Brookhaven Dr

- 2598 St James Way

- 4626 N Pacific Hwy

- 6367 Honeytree Ln

- 6335 Honeytree Ln

- 6407 Honeytree Ln

- 6340 Honeytree Ln

- 6315 Honeytree Ln

- 1560 Gibbon Rd

- 1602 Gibbon Rd

- 1564 Gibbon Rd

- 6482 Wilson Ln

- 1551 Gibbon Rd

- 6428 Wilson Ln

- 1495 Gibbon Rd

- 1416 Gibbon Rd

- 6528 Wilson Ln

- 1467 Gibbon Rd

- 6412 Wilson Ln

- 1579 Gibbon Rd

- 6552 Wilson Ln

- 1644 Gibbon Rd

- 6195 Iris Ln