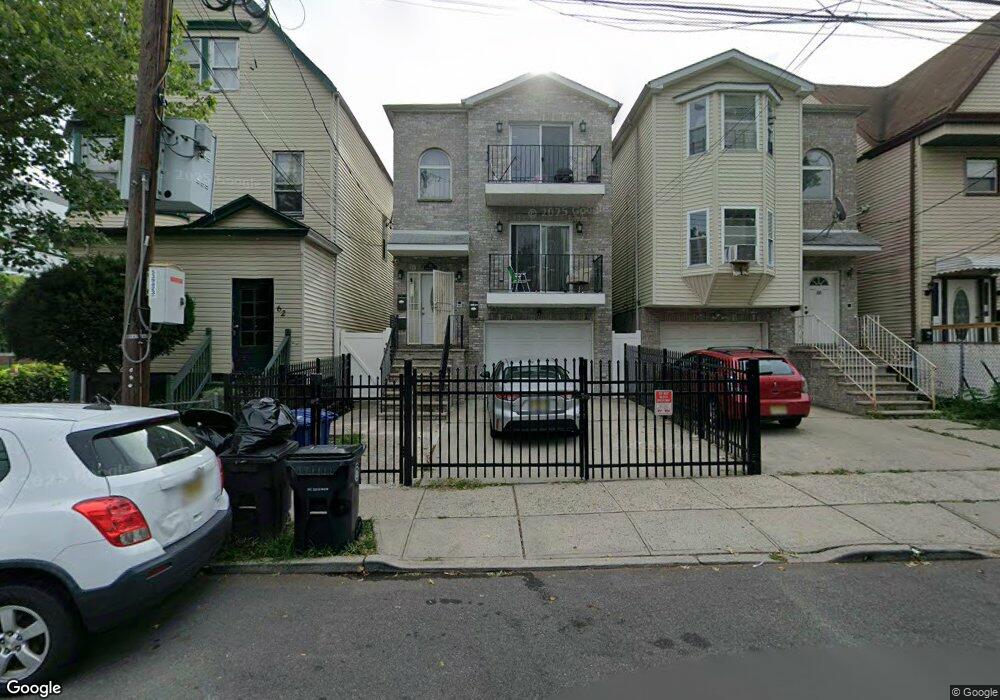

64 S 10th St Unit 1 Newark, NJ 07107

Fairmount NeighborhoodEstimated Value: $747,900 - $826,000

3

Beds

2

Baths

2,480

Sq Ft

$323/Sq Ft

Est. Value

About This Home

This home is located at 64 S 10th St Unit 1, Newark, NJ 07107 and is currently estimated at $800,975, approximately $322 per square foot. 64 S 10th St Unit 1 is a home located in Essex County with nearby schools including Sir Isaac Newton Elementary School, Camden Street Elementary School, and Harriet Tubman School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2024

Sold by

Ukueberuwa Francis and Huang Huihong Chloe

Bought by

Samaroo Amanda and Marripen Cris

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$565,308

Outstanding Balance

$558,431

Interest Rate

6.49%

Mortgage Type

New Conventional

Estimated Equity

$242,544

Purchase Details

Closed on

Dec 27, 2021

Sold by

Gleim Francisco A

Bought by

Ukueberuwa Francis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$472,000

Interest Rate

3.55%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 27, 2018

Sold by

Usa Hud

Bought by

Gleim Francisco A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$342,359

Interest Rate

4.5%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 11, 2010

Sold by

The Westinghouse Redevelopment Act Inc

Bought by

Thomas James E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$557,492

Interest Rate

4.25%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 30, 2009

Sold by

Us Bank National Association

Bought by

The Westinghouse Redevelopment Act Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

18%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 16, 2009

Sold by

Alves Fabiano D and Alves Marsha

Bought by

Us Bank National Association

Purchase Details

Closed on

Sep 2, 2005

Sold by

Porto Derilton

Bought by

Alves Fabiano

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$324,000

Interest Rate

7.37%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Mar 26, 2004

Sold by

Rows Stone

Bought by

Porto Derilton

Purchase Details

Closed on

Jan 7, 2000

Sold by

Hayes Horace

Bought by

Harris Kathy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,850

Interest Rate

8.15%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Samaroo Amanda | $766,000 | Worldwide Title | |

| Ukueberuwa Francis | $590,000 | Suarez Melissa | |

| Gleim Francisco A | $300,000 | -- | |

| Thomas James E | $565,000 | None Available | |

| The Westinghouse Redevelopment Act Inc | $179,250 | None Available | |

| Us Bank National Association | -- | None Available | |

| Alves Fabiano | $405,000 | -- | |

| Porto Derilton | $62,500 | -- | |

| Harris Kathy | $68,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Samaroo Amanda | $565,308 | |

| Previous Owner | Ukueberuwa Francis | $472,000 | |

| Previous Owner | Gleim Francisco A | $342,359 | |

| Previous Owner | Thomas James E | $557,492 | |

| Previous Owner | The Westinghouse Redevelopment Act Inc | $100,000 | |

| Previous Owner | Alves Fabiano | $324,000 | |

| Previous Owner | Harris Kathy | $90,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,181 | $273,100 | $21,300 | $251,800 |

| 2024 | $10,181 | $273,100 | $21,300 | $251,800 |

| 2022 | $7,648 | $204,700 | $21,300 | $183,400 |

| 2021 | $7,644 | $204,700 | $21,300 | $183,400 |

| 2020 | $7,779 | $204,700 | $21,300 | $183,400 |

| 2019 | $7,699 | $204,700 | $21,300 | $183,400 |

| 2018 | $7,560 | $204,700 | $21,300 | $183,400 |

| 2017 | $7,287 | $204,700 | $21,300 | $183,400 |

| 2016 | $7,042 | $204,700 | $21,300 | $183,400 |

| 2015 | $6,774 | $204,700 | $21,300 | $183,400 |

| 2014 | $6,348 | $204,700 | $21,300 | $183,400 |

Source: Public Records

Map

Nearby Homes