6421 Kumbya Rd Placerville, CA 95667

Estimated Value: $392,000 - $752,000

3

Beds

2

Baths

1,691

Sq Ft

$335/Sq Ft

Est. Value

About This Home

This home is located at 6421 Kumbya Rd, Placerville, CA 95667 and is currently estimated at $566,935, approximately $335 per square foot. 6421 Kumbya Rd is a home located in El Dorado County with nearby schools including Sutter's Mill Elementary School, Gold Trail School, and El Dorado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 2, 2025

Sold by

Thelma I Steward Survivors Trust and Gossner Terry

Bought by

Gossner Jordan K and Gossner Terry E

Current Estimated Value

Purchase Details

Closed on

May 11, 2011

Sold by

Gorsline Vicki

Bought by

Steward Thelma I

Purchase Details

Closed on

May 4, 2011

Sold by

Gorsline Vicki and Ault Pamela

Bought by

Gorsline Vicki

Purchase Details

Closed on

Jan 25, 2011

Sold by

Gorsline Vicki

Bought by

Gorsline Vicki and Ault Pamela

Purchase Details

Closed on

Nov 12, 2007

Sold by

Oliver Basel M and Oliver Seana A

Bought by

Oliver Basel Murl and Oliver Seana Arbletta

Purchase Details

Closed on

Dec 2, 2003

Sold by

Oliver Basel M and Oliver Arbletta

Bought by

Hood Gary and Hood Renee

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gossner Jordan K | -- | None Listed On Document | |

| Steward Thelma I | $337,000 | Placer Title Company | |

| Gorsline Vicki | -- | Placer Title Co | |

| Gorsline Vicki | -- | None Available | |

| Oliver Basel Murl | -- | None Available | |

| Hood Gary | -- | First American Title Co |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,398 | $431,741 | $115,299 | $316,442 |

| 2024 | $4,398 | $423,277 | $113,039 | $310,238 |

| 2023 | $4,291 | $414,978 | $110,823 | $304,155 |

| 2022 | $4,248 | $406,842 | $108,650 | $298,192 |

| 2021 | $4,189 | $398,866 | $106,520 | $292,346 |

| 2020 | $4,133 | $394,777 | $105,428 | $289,349 |

| 2019 | $4,070 | $387,037 | $103,361 | $283,676 |

| 2018 | $3,955 | $379,449 | $101,335 | $278,114 |

| 2017 | $3,887 | $372,010 | $99,349 | $272,661 |

| 2016 | $3,828 | $364,716 | $97,401 | $267,315 |

| 2015 | $3,773 | $359,239 | $95,939 | $263,300 |

| 2014 | $3,773 | $352,204 | $94,060 | $258,144 |

Source: Public Records

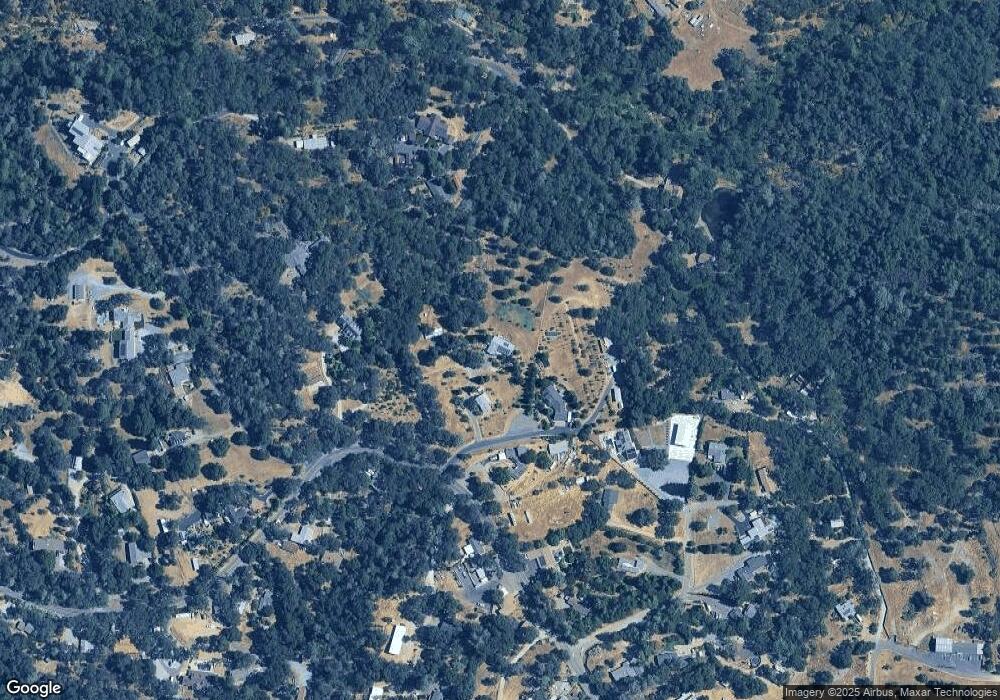

Map

Nearby Homes

- 3031 Rising Hill Ct

- 2840 Winesap Cir

- 2865 Winesap Cir

- 1525 Cold Springs Rd Unit 61

- 1525 Cold Springs Rd Unit 48

- 1525 Cold Springs Rd Unit 97

- 2620 Colin Rd

- 2446 Prado Vista Rd

- 2794 Hidden Springs Cir Unit 15A

- 2780 Hidden Springs Cir Unit 9

- 3300 Karma Ln

- 2820 Hidden Springs Cir

- 2929 Glenwood Ln Unit 121

- 2945 Glenwood Ln

- 2933 Glenwood Ln

- 2832 Hidden Springs Cir

- 2874 Hidden Springs Cir

- 2846 Hidden Springs Cir

- 6498 American Way

- 2854 Hidden Springs Cir

- 0 Petri Ln

- 0 Petri Ln Unit 18012322

- 0 Petri Ln Unit 19002155

- 6425 Kumbya Rd

- 2071 Cold Springs Rd

- 2051 Cold Springs Rd

- 3067 Good Shepard Ln

- 3061 Good Shepard Ln

- 2060 Cold Springs Rd

- 2530 Blacks Ln

- 2101 Cold Springs Rd

- 2092 Cold Springs Rd

- 1990 Beals Rd

- 1860 Beals Rd

- 3073 Good Shepard Ln

- 3041 Good Shepard Ln

- 2102 Cold Springs Rd

- 3011 Good Shepard Ln

- 2040 Cold Springs Rd

- 2010 Cold Springs Rd