654 W Camelback Rd Unit 13 Phoenix, AZ 85013

Uptown Phoenix NeighborhoodEstimated payment $2,180/month

Total Views

38,158

0.11

Acre

$3,409,091

Price per Acre

4,753

Sq Ft Lot

Highlights

- No HOA

- 2-minute walk to 7Th Ave/Camelback

- Level Lot

- Madison Richard Simis School Rated A-

- Partially Fenced Property

About This Lot

Small strategic lot near 7th Ave & Camelback. Adjacent to large Multifamily apartments opening in 2024. Zoning is C-2, Intermediate Commercial. No auto use or food truck allowed by Zoning. Pole sign grandfathered in.

Property Details

Property Type

- Land

Est. Annual Taxes

- $2,791

Lot Details

- 4,753 Sq Ft Lot

- Partially Fenced Property

- Block Wall Fence

- Level Lot

- Property is zoned C-2

Community Details

- No Home Owners Association

- Evans Addition To Orangewood Block 1 Lots 1&2 Subdivision

Listing and Financial Details

- Tax Lot 13

- Assessor Parcel Number 162-26-007-B

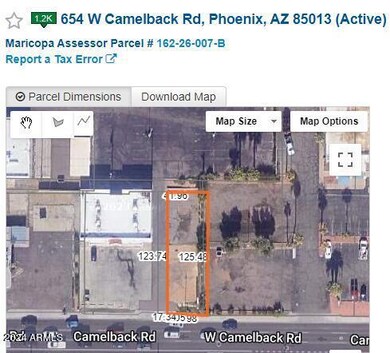

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,831 | $21,728 | -- | -- |

| 2024 | $2,791 | $21,340 | -- | -- |

| 2023 | $2,791 | $28,713 | $26,792 | $1,921 |

| 2022 | $2,787 | $29,698 | $27,895 | $1,803 |

| 2021 | $2,892 | $30,564 | $28,692 | $1,872 |

| 2020 | $2,846 | $30,942 | $29,052 | $1,890 |

| 2019 | $2,784 | $31,374 | $29,556 | $1,818 |

| 2018 | $2,715 | $24,516 | $22,698 | $1,818 |

| 2017 | $2,588 | $23,742 | $22,032 | $1,710 |

| 2016 | $2,498 | $20,340 | $18,774 | $1,566 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 03/03/2024 03/03/24 | For Sale | $375,000 | -- | -- |

Source: Arizona Regional Multiple Listing Service (ARMLS)

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | -- | None Available | |

| Cash Sale Deed | $24,000 | Grand Canyon Title Agency In | |

| Interfamily Deed Transfer | -- | -- | |

| Interfamily Deed Transfer | -- | -- | |

| Cash Sale Deed | $86,000 | Fidelity Title | |

| Trustee Deed | -- | Fidelity National Title |

Source: Public Records

Source: Arizona Regional Multiple Listing Service (ARMLS)

MLS Number: 6671831

APN: 162-26-007B

Nearby Homes

- 21 W Pasadena Ave Unit 3

- 15 W Medlock Dr

- 902 W Oregon Ave

- 5215 N 11th Ave

- 4750 N Central Ave Unit J17

- 4750 N Central Ave Unit K16

- 4750 N Central Ave Unit 7

- 4750 N Central Ave Unit 8

- 4750 N Central Ave Unit 3J

- 4750 N Central Ave Unit 7B

- 4750 N Central Ave Unit 10K

- 4750 N Central Ave Unit B14

- 4750 N Central Ave Unit C2

- 4750 N Central Ave Unit 3A

- 4750 N Central Ave Unit 14P

- 4750 N Central Ave Unit 6

- 1095 E Indian School Rd Unit 200

- 330 W Minnezona Ave

- 537 W Missouri Ave

- 5334 N 3rd Ave Unit 6

- 500 W Camelback Rd

- 337 W Pasadena Ave Unit 5

- 325 W Pasadena Ave

- 4737 N 7th Ave

- 365 W Pierson St

- 357 W Pierson St

- 302 W Medlock Dr Unit 6

- 340 W Highland Ave Unit 8

- 909 W Colter St

- 37 W Medlock Dr

- 740 W Elm St Unit FL2-ID1363347P

- 740 W Elm St Unit 220

- 530 W Oregon Ave

- 740 W Elm St Unit 116

- 740 W Elm St Unit 264

- 740 W Elm St Unit 110

- 740 W Elm St Unit 243

- 21 W Pasadena Ave Unit 3

- 5306 N 8th Ave

- 201 W Coolidge St