6771 Palermi Place Unit 23 Carlsbad, CA 92011

Aviara NeighborhoodEstimated Value: $1,685,252 - $2,033,000

3

Beds

3

Baths

2,632

Sq Ft

$706/Sq Ft

Est. Value

About This Home

This home is located at 6771 Palermi Place Unit 23, Carlsbad, CA 92011 and is currently estimated at $1,858,063, approximately $705 per square foot. 6771 Palermi Place Unit 23 is a home located in San Diego County with nearby schools including Aviara Oaks Elementary, Aviara Oaks Middle, and Sage Creek High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 15, 2006

Sold by

Bellando Roberts Patricia A

Bought by

Bellando Roberts Patricia Ann

Current Estimated Value

Purchase Details

Closed on

Jan 23, 2006

Sold by

Kropholler Jeffrey L

Bought by

Bellando Roberts Patricia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$675,000

Outstanding Balance

$369,906

Interest Rate

5.85%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$1,488,157

Purchase Details

Closed on

Sep 12, 2002

Sold by

Benjamin Mark

Bought by

Kropholler Jeffrey L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Interest Rate

4.75%

Purchase Details

Closed on

May 13, 2002

Sold by

Brehm Aviara Group Llc

Bought by

Benjamin Mark

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Interest Rate

6.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bellando Roberts Patricia Ann | -- | None Available | |

| Bellando Roberts Patricia A | $975,000 | Multiple | |

| Kropholler Jeffrey L | -- | Multiple | |

| Kropholler Jeffrey L | $630,000 | Southland Title | |

| Benjamin Mark | $520,000 | Commonwealth Land Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bellando Roberts Patricia A | $675,000 | |

| Previous Owner | Kropholler Jeffrey L | $500,000 | |

| Previous Owner | Benjamin Mark | $400,000 | |

| Closed | Kropholler Jeffrey L | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,917 | $1,332,310 | $864,461 | $467,849 |

| 2024 | $13,917 | $1,306,187 | $847,511 | $458,676 |

| 2023 | $13,846 | $1,280,577 | $830,894 | $449,683 |

| 2022 | $13,632 | $1,255,468 | $814,602 | $440,866 |

| 2021 | $12,094 | $1,100,000 | $758,000 | $342,000 |

| 2020 | $11,586 | $1,050,000 | $724,000 | $326,000 |

| 2019 | $11,602 | $1,050,000 | $724,000 | $326,000 |

| 2018 | $10,817 | $1,000,000 | $690,000 | $310,000 |

| 2017 | $11,291 | $1,040,000 | $718,000 | $322,000 |

| 2016 | $9,041 | $850,000 | $587,000 | $263,000 |

| 2015 | $9,139 | $850,000 | $587,000 | $263,000 |

| 2014 | $9,171 | $800,000 | $553,000 | $247,000 |

Source: Public Records

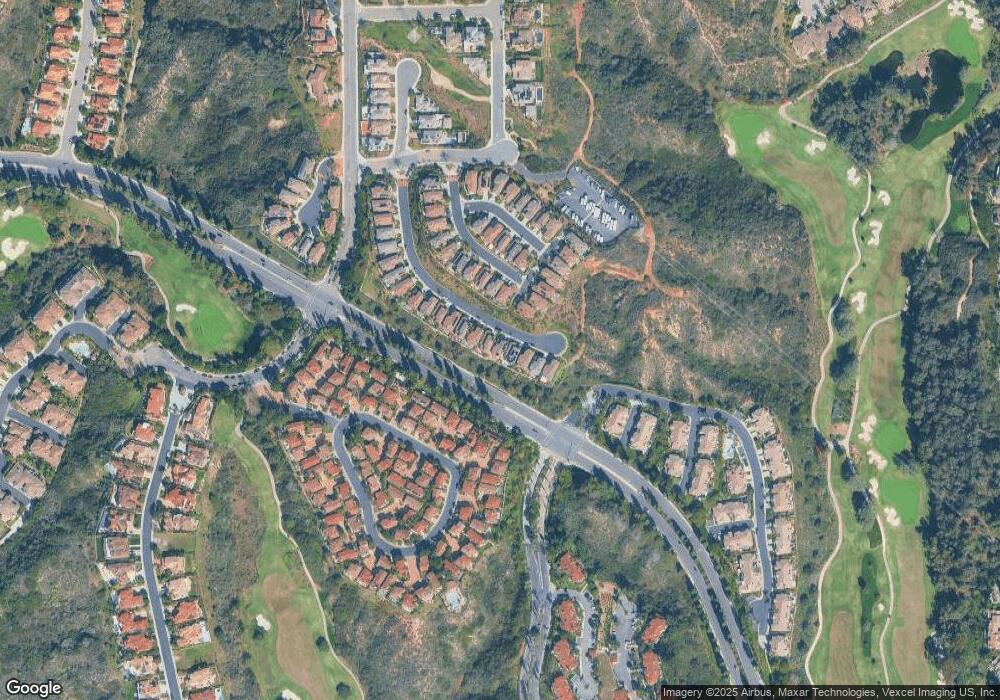

Map

Nearby Homes

- 6647 Encelia Place

- 6325 Alexandri Cir

- 7215 Daffodil Place

- 6485 Alexandri Cir

- 6467 Alexandri Cir Unit 75

- 6419 Alexandri Cir

- 6777 Lonicera St

- 6438 Lilium Ln

- 1341 Mallard Ct

- 7012 Goldenrod Way

- 1845 Cliff Swallow Ln

- 6903 Quail Place

- 7212 Columbine Dr

- 6915 Pear Tree Dr

- 6557 Coneflower Dr

- 6911 Quail Place Unit C

- 6901 Tourmaline Place

- 1933 Alga Rd Unit C

- 25 El Camino Real

- 7013 Lavender Way

- 6799 Palermi Place

- 6775 Palermi Place

- 6763 Palermi Place

- 6767 Palermi Place Unit 22

- 6783 Palermi Place

- 6759 Palermi Place Unit 20

- 6773 Frenata Place

- 6787 Palermi Place

- 6769 Frenata Place Unit 38

- 6777 Frenata Place

- 6781 Frenata Place Unit 41

- 6785 Frenata Place

- 6765 Frenata Place Unit 37

- 6791 Palermi Place

- 6761 Frenata Place

- 6789 Frenata Place

- 7077 Surfbird Cir

- 6795 Palermi Place

- 7097 Surfbird Cir

- 7073 Surfbird Cir