6919 Willow Tree Ln Dayton, OH 45424

Estimated Value: $201,657 - $216,000

2

Beds

2

Baths

1,343

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 6919 Willow Tree Ln, Dayton, OH 45424 and is currently estimated at $208,664, approximately $155 per square foot. 6919 Willow Tree Ln is a home located in Montgomery County with nearby schools including Wayne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 19, 2019

Sold by

Bundy Robert M and Bundy Brenda

Bought by

Turdo Karen Dale and Turdo Anthony Ronald

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$113,905

Interest Rate

4.3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 2, 2016

Sold by

Stewart Gary

Bought by

Bundy Robert M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$35,000

Interest Rate

3.52%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 7, 2011

Sold by

Stewart Lucille

Bought by

Stewart James R and Stewart Gary

Purchase Details

Closed on

Jul 19, 2004

Sold by

Henson Nell F

Bought by

Stewart Lucille

Purchase Details

Closed on

Nov 14, 1996

Sold by

Henson Nell F

Bought by

Henson Nell F

Purchase Details

Closed on

Jan 30, 1995

Sold by

Stanislaw Marilyn J

Bought by

Henson Nell F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Turdo Karen Dale | $119,900 | Vantage Land Title | |

| Bundy Robert M | $47,500 | Home Services Title Llc | |

| Bundy Robert M | $47,500 | Home Services Title Llc | |

| Stewart James R | -- | None Available | |

| Stewart Lucille | $120,000 | -- | |

| Henson Nell F | -- | -- | |

| Henson Nell F | -- | Landmark Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Turdo Karen Dale | $113,905 | |

| Previous Owner | Bundy Robert M | $35,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,302 | $55,330 | $11,590 | $43,740 |

| 2023 | $2,302 | $55,330 | $11,590 | $43,740 |

| 2022 | $1,995 | $39,200 | $8,400 | $30,800 |

| 2021 | $2,160 | $39,200 | $8,400 | $30,800 |

| 2020 | $2,575 | $39,200 | $8,400 | $30,800 |

| 2019 | $2,274 | $30,610 | $7,000 | $23,610 |

| 2018 | $2,281 | $30,610 | $7,000 | $23,610 |

| 2017 | $2,266 | $30,610 | $7,000 | $23,610 |

| 2016 | $2,281 | $29,230 | $7,000 | $22,230 |

| 2015 | $2,282 | $29,230 | $7,000 | $22,230 |

| 2014 | $2,252 | $29,230 | $7,000 | $22,230 |

| 2012 | -- | $40,370 | $9,800 | $30,570 |

Source: Public Records

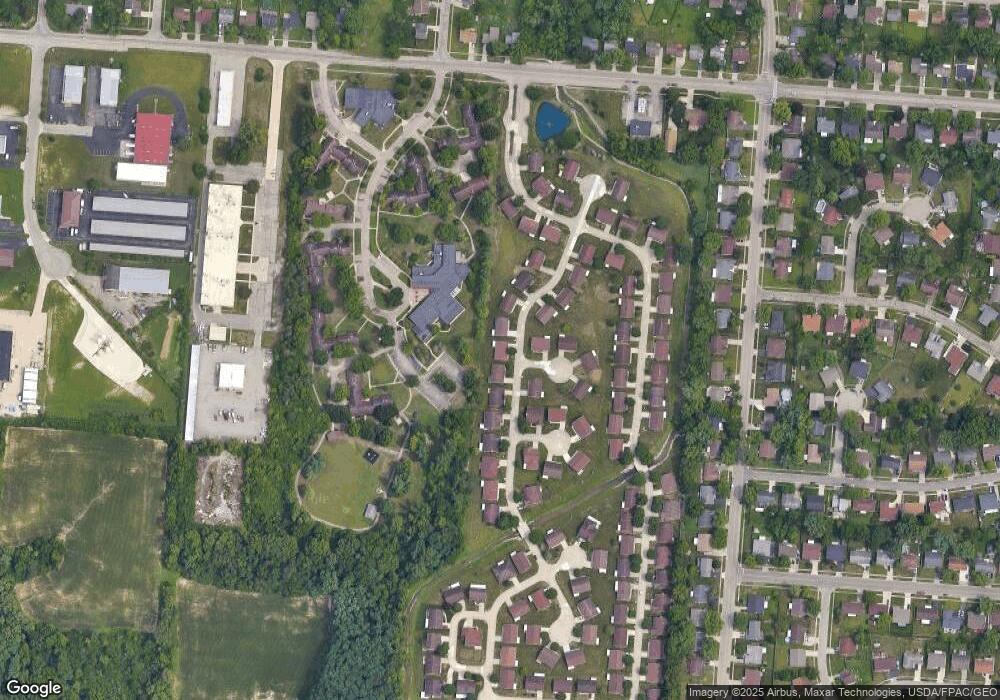

Map

Nearby Homes

- 5907 Beech Ct

- 6936 Willow Tree Ln

- 6724 Willow Creek Dr

- 6805 Willow Creek Dr

- 6828 Willow Creek Dr

- 6686 Oakwood Ln

- 4931 Longford Rd

- 7077 Sandalview Dr

- 4834 Lodgeview Dr

- 4815 Flagstone Ct

- 4731 Deerwood Ct

- 6514 Wrenview Ct

- Milford Plan at Canal Heights

- Cortland Plan at Canal Heights

- Chatham Plan at Canal Heights

- Fairfax Plan at Canal Heights

- Johnstown Plan at Canal Heights

- Newcastle Plan at Canal Heights

- Holcombe Plan at Canal Heights

- Bellamy Plan at Canal Heights

- 6911 Willow Tree Ln

- 6927 Willow Tree Ln

- 5911 Beech Ct

- 6907 Willow Tree Ln

- 6910 Willow Tree Ln

- 6935 Willow Tree Ln

- 6895 Willow Tree Ln

- 5811 Poplar Ct

- 6943 Willow Tree Ln

- 6944 Willow Tree Ln

- 5807 Poplar Ct

- 5910 Beech Ct

- 5903 Beech Ct

- 6951 Willow Tree Ln

- 6952 Willow Tree Ln

- 5802 Poplar Ct

- 5803 Poplar Ct

- 6879 Willow Tree Ln

- 6789 Willow Creek Dr

- 6781 Willow Creek Dr