709 SE 201st Rd Warrensburg, MO 64093

Estimated Value: $254,199 - $323,000

--

Bed

--

Bath

1,517

Sq Ft

$187/Sq Ft

Est. Value

About This Home

This home is located at 709 SE 201st Rd, Warrensburg, MO 64093 and is currently estimated at $283,066, approximately $186 per square foot. 709 SE 201st Rd is a home located in Johnson County with nearby schools including Leeton Elementary School, Leeton Middle School, and Leeton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 21, 2016

Sold by

Walker Anthony W and Walker Stephanie N

Bought by

Stacy Joseph M and Stacy Patricia J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Interest Rate

3.57%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 16, 2012

Sold by

Weeks Marten and Walker Stephanie N

Bought by

Walker Anthony W and Walker Stephanie N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$24,000

Interest Rate

3.9%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Oct 26, 2010

Sold by

Us Bank National Assn

Bought by

Weeks Martin and Weeks Leila

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stacy Joseph M | -- | Western Missouri Title Co | |

| Walker Anthony W | -- | None Available | |

| Weeks Martin | -- | None Available | |

| Weeks Martn | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Stacy Joseph M | $52,000 | |

| Previous Owner | Walker Anthony W | $24,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $963 | $13,969 | $0 | $0 |

| 2023 | $963 | $13,969 | $0 | $0 |

| 2022 | $924 | $13,391 | $0 | $0 |

| 2021 | $926 | $13,451 | $0 | $0 |

| 2020 | $891 | $12,868 | $0 | $0 |

| 2019 | $890 | $12,868 | $0 | $0 |

| 2017 | $823 | $12,753 | $0 | $0 |

| 2016 | $817 | $12,753 | $0 | $0 |

| 2015 | $865 | $12,753 | $0 | $0 |

| 2014 | $871 | $12,720 | $0 | $0 |

Source: Public Records

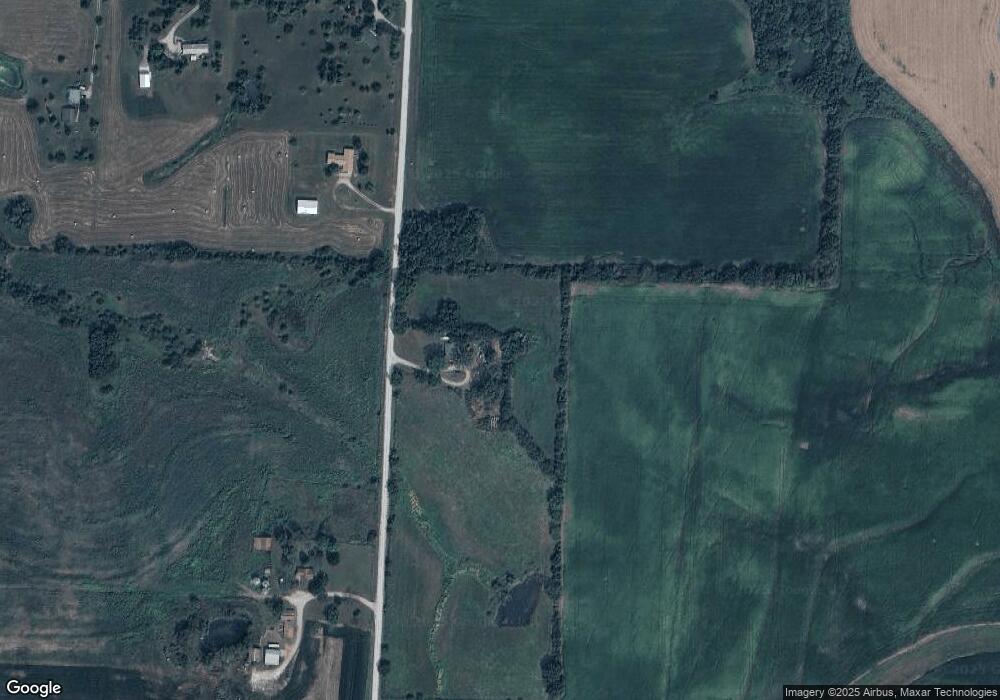

Map

Nearby Homes

- 711 SE 251st Rd

- TBD SE Hwy Pp N A

- 161 SW 11th Rd

- 363 SE Pp Hwy

- 45 SW 675th Rd

- 25 SW 600th Rd

- 198 SE 455th Rd

- 198 SE 455 Rd

- 9 SW 500th Rd

- 167 SE County Road Y N A

- 133 SW 145th Rd

- 7 SW 400th Rd

- 169 SW 800th Rd

- 0 SE 401st Rd

- 000 SE 401st Rd

- 828 SE 601st Rd

- Tract A-1 Southeast 651st Rd

- 144 SE 250th Rd

- 195 SE 250th Rd

- 240 SE 131st Rd

- 696 SE 201st Rd

- 721 SE 201st Rd

- 172 SE 685th Rd

- TBD SE 685th Rd

- ?? SE 685

- ??? SE 685

- 170 SE 685th Rd

- 166 SE 685th Rd

- 169 SE 685th Rd

- 765 SE 201 Rd

- 165 SE 685th Rd

- 165 SE 685th Rd

- 165 SE 685th Rd

- 755 SE 201st Rd

- 674 SE 251st Rd

- 254 SE 675th Rd

- 150 SE 650th Rd

- 781 SE 201st Rd

- 646 SE 251st Rd

- 279 SE 675th Rd