7188 Hatteras Blvd Unit 2103 Panama City, FL 32404

Estimated Value: $283,000 - $294,000

4

Beds

2

Baths

1,787

Sq Ft

$161/Sq Ft

Est. Value

About This Home

This home is located at 7188 Hatteras Blvd Unit 2103, Panama City, FL 32404 and is currently estimated at $288,034, approximately $161 per square foot. 7188 Hatteras Blvd Unit 2103 is a home located in Bay County with nearby schools including Tommy Smith Elementary School, Merritt Brown Middle School, and Rutherford High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 19, 2024

Sold by

Hannabass Jamie Lou and Hannabass Steven Dale

Bought by

Graham-Richards Kaydian and Richards Terrence

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$303,375

Outstanding Balance

$299,555

Interest Rate

7.09%

Mortgage Type

VA

Estimated Equity

-$11,521

Purchase Details

Closed on

Nov 30, 2020

Sold by

D R Horton Inc

Bought by

Hannabass Steven Dale and Hannabass Jamie Lou

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$15,000

Interest Rate

2.71%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Graham-Richards Kaydian | $294,000 | None Listed On Document | |

| Hannabass Steven Dale | $231,200 | Dhi Title Of Florida Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Graham-Richards Kaydian | $303,375 | |

| Previous Owner | Hannabass Steven Dale | $15,000 | |

| Previous Owner | Hannabass Steven Dale | $135,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,103 | $209,879 | -- | -- |

| 2023 | $2,103 | $203,766 | $0 | $0 |

| 2022 | $1,885 | $197,831 | $0 | $0 |

| 2021 | $1,876 | $192,069 | $37,465 | $154,604 |

| 2020 | $345 | $28,700 | $28,700 | $0 |

| 2019 | $336 | $28,000 | $28,000 | $0 |

| 2018 | $39 | $3,200 | $0 | $0 |

Source: Public Records

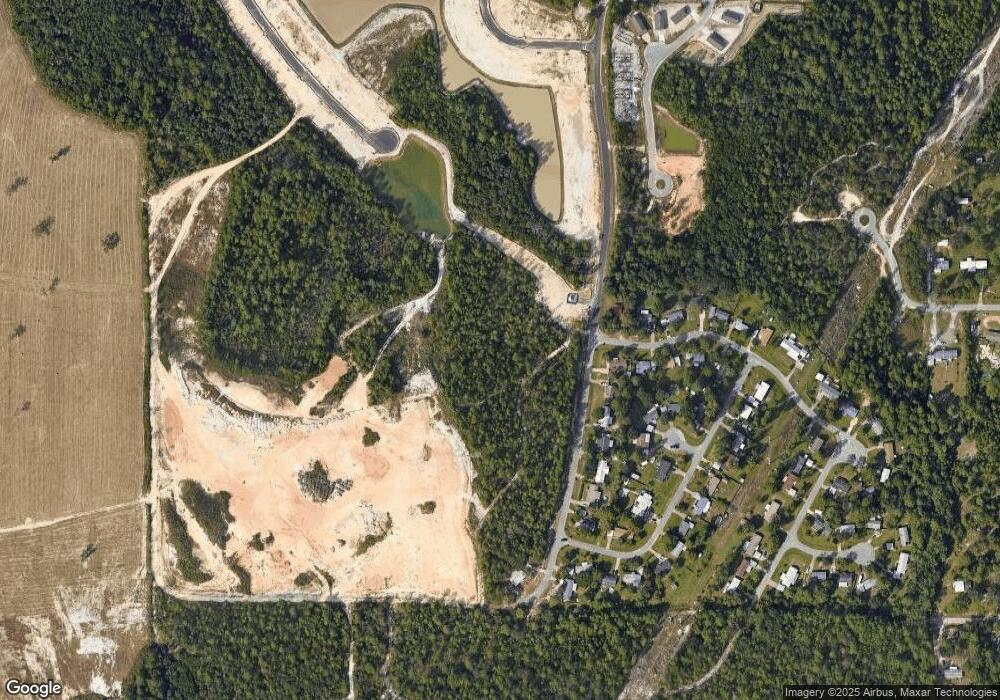

Map

Nearby Homes

- 7106 Penn Way

- 7123 Penn Way

- 6013 Nordic Dr

- 7141 Hatteras Blvd

- 5918 Nordic Dr

- 7307 Copenhagen Dr

- 7144 Hatteras Blvd

- 7113 Shimano Way

- 7117 Shimano Way

- 7173 Ellie B Dr

- 7158 Riverbrooke St

- 7225 Ellie B Dr

- 7120 Hatteras Blvd

- 7332 Copenhagen Ln

- 5820 Tiagra Dr

- 5817 Tiagra Dr

- 7245 Ellie B Dr

- 6110 Riverbrooke Dr

- 7112 Riverbrooke St

- 7131 Riverbrooke St

- 7188 Hatteras Blvd

- 7190 Hatteras Blvd Unit Lot 2104

- 7186 Hatteras Blvd Unit 2102

- 7192 Hatteras Blvd

- 7192 Hatteras Blvd Unit Lot 105

- 7184 Hatteras Blvd Unit Lot 2101

- 7109 Penn Way Unit 2088

- 7107 Penn Way Unit 2089

- 7115 Penn Way Unit Lot 2085

- 7111 Penn Way Unit Lot 87

- 7182 Hatteras Blvd

- 7182 Hatteras Blvd Unit Lot 2100

- 7113 Penn Way

- 7105 Penn Way Unit Lot 2090

- 7194 Hatteras Blvd Unit Lot 2106

- 7187 Hatteras Blvd

- 7187 Hatteras Blvd Unit 2005

- 7189 Hatteras Blvd Unit Lot 2004

- 7103 Penn Way

- 7103 Penn Way Unit Lot 91