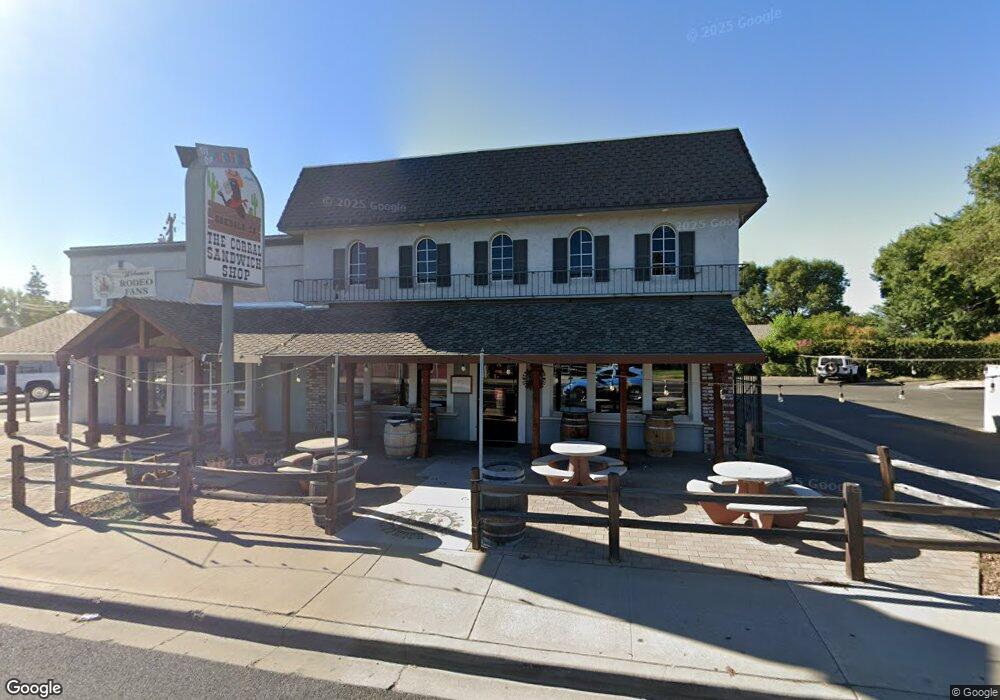

730 W F St Oakdale, CA 95361

Estimated Value: $646,729

--

Bed

--

Bath

--

Sq Ft

0.32

Acres

About This Home

This home is located at 730 W F St, Oakdale, CA 95361 and is currently estimated at $646,729. 730 W F St is a home located in Stanislaus County with nearby schools including Magnolia Elementary School, Oakdale Junior High School, and East Stanislaus High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 14, 2022

Sold by

Rosaia Daniel and Rosaia Vittoria

Bought by

Rosaia And Sciascia Family 2022 Revocable Tru

Current Estimated Value

Purchase Details

Closed on

Feb 5, 2019

Sold by

Farinha Anthony J and Farinha Judith A

Bought by

Rosaia Daniel and Sciascia Vittoria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Interest Rate

4.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 28, 2008

Sold by

Farinha Anthony J and Farinha Judith A

Bought by

Farinha Anthony J and Farinha Judith A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$278,000

Interest Rate

6.59%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rosaia And Sciascia Family 2022 Revocable Tru | -- | -- | |

| Rosaia Daniel | $450,000 | Chicago Title Co | |

| Farinha Anthony J | -- | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rosaia Daniel | $185,000 | |

| Previous Owner | Farinha Anthony J | $278,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,775 | $517,384 | $223,101 | $294,283 |

| 2024 | $5,476 | $507,240 | $218,727 | $288,513 |

| 2023 | $5,269 | $488,795 | $214,439 | $274,356 |

| 2022 | $5,179 | $479,212 | $210,235 | $268,977 |

| 2021 | $5,094 | $469,816 | $206,113 | $263,703 |

| 2020 | $4,972 | $459,000 | $204,000 | $255,000 |

| 2019 | $1,714 | $157,478 | $47,951 | $109,527 |

| 2018 | $1,690 | $154,391 | $47,011 | $107,380 |

| 2017 | $1,661 | $151,365 | $46,090 | $105,275 |

| 2016 | $1,632 | $148,398 | $45,187 | $103,211 |

| 2015 | $1,612 | $146,170 | $44,509 | $101,661 |

| 2014 | $1,597 | $143,308 | $43,638 | $99,670 |

Source: Public Records

Map

Nearby Homes

- 24 N Bryan Ave

- 140 Blankenship Ave

- 64 School Ave

- 1105 W G St

- 147 West Ave

- 166 Stanislaus Ave

- 325 W H St

- 262 California 108

- 1342 Pontiac St

- 209 N 1st Ave

- 886 Ranchland Way

- 219 S 2nd Ave

- 429 Ranger Ct Unit 111

- 151 S 3rd Ave

- 161 S 3rd Ave

- 901 Meadowlands Dr

- 980 Silver Spur Cir Unit 41

- 1625 Valmor Ct

- 968 Greger St Unit 91

- 557 Stetson Dr

- 35 N Bryan Ave

- 708 W F St

- 41 N Bryan Ave

- 32 N Bryan Ave

- 20 Blankenship Ave

- 737 W F St

- 40 N Bryan Ave

- 723 W F St

- 43 Lambuth Ave

- 31 Lambuth Ave

- 57 Lambuth Ave

- 105 N Bryan Ave

- 119 S Bryan Ave

- 100 Blankenship Ave

- 65 Lambuth Ave

- 810 Olive St

- 110 Blankenship Ave

- 121 N Bryan Ave

- 738 W G St

- 101 Blankenship Ave