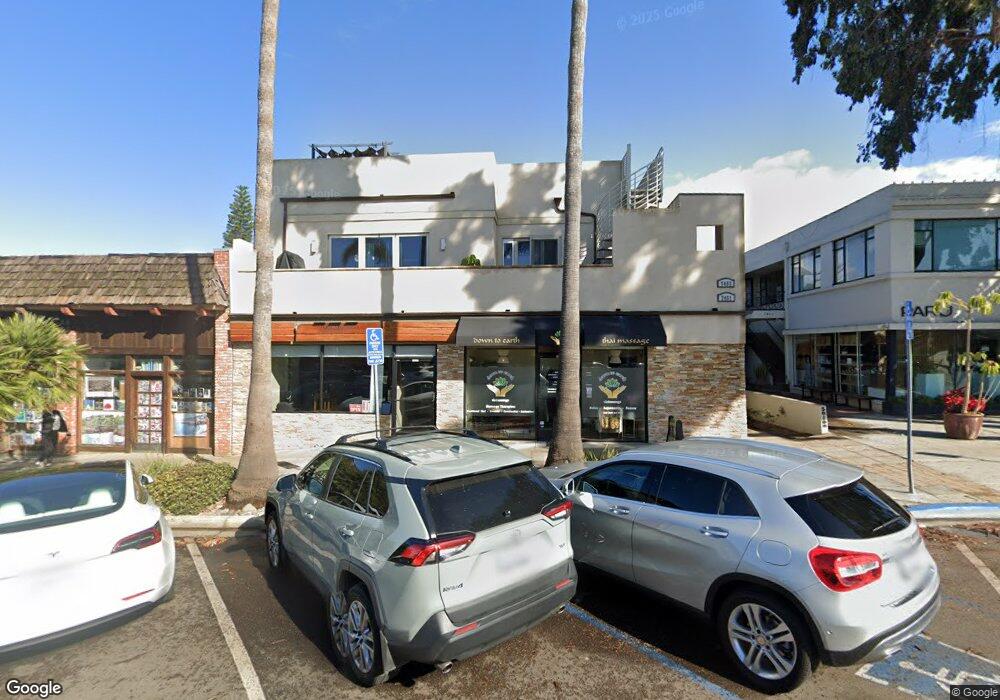

7449 Girard Ave La Jolla, CA 92037

The Village NeighborhoodEstimated Value: $1,414,692

--

Bed

--

Bath

1,640

Sq Ft

$863/Sq Ft

Est. Value

About This Home

This home is located at 7449 Girard Ave, La Jolla, CA 92037 and is currently estimated at $1,414,692, approximately $862 per square foot. 7449 Girard Ave is a home located in San Diego County with nearby schools including La Jolla Elementary School, Muirlands Middle School, and La Jolla High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2013

Sold by

Moussighi Massoud and Moussighi Symphony Melody

Bought by

Mash 2013 Llc

Current Estimated Value

Purchase Details

Closed on

Apr 2, 2013

Sold by

Vista Girard Llc

Bought by

Moussighi Massoud and Moussighi Symphony Melody

Purchase Details

Closed on

Sep 30, 2009

Sold by

Irwin David J

Bought by

Vista Girard Llc

Purchase Details

Closed on

Jul 9, 2004

Sold by

Irwin David John and Irwin David J

Bought by

Irwin David J

Purchase Details

Closed on

Mar 25, 2003

Sold by

Irwin Sally Parker

Bought by

Irwin Daniel Barrett

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,000

Interest Rate

5.75%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mash 2013 Llc | -- | None Available | |

| Moussighi Massoud | $600,000 | Chicago Title Company | |

| Vista Girard Llc | -- | None Available | |

| Vista Girard Llc | -- | None Available | |

| Irwin David J | -- | -- | |

| Irwin Daniel Barrett | -- | Chicago Title Co | |

| Irwin David John | -- | Chicago Title Co | |

| Irwin David John | $275,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Irwin David John | $325,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,537 | $738,846 | $369,423 | $369,423 |

| 2024 | $9,537 | $724,360 | $362,180 | $362,180 |

| 2023 | $9,322 | $710,158 | $355,079 | $355,079 |

| 2022 | $9,074 | $696,234 | $348,117 | $348,117 |

| 2021 | $8,999 | $682,584 | $341,292 | $341,292 |

| 2020 | $8,896 | $675,586 | $337,793 | $337,793 |

| 2019 | $8,748 | $662,340 | $331,170 | $331,170 |

| 2018 | $7,665 | $649,354 | $324,677 | $324,677 |

| 2017 | $8,033 | $636,622 | $318,311 | $318,311 |

| 2016 | $7,365 | $624,140 | $312,070 | $312,070 |

| 2015 | $7,256 | $614,766 | $307,383 | $307,383 |

| 2014 | $7,142 | $602,724 | $301,362 | $301,362 |

Source: Public Records

Map

Nearby Homes

- 7452 Herschel Ave

- 7447 Herschel Ave

- 7376 Fay Ave

- 7372 Fay Ave

- 1138 Virginia Way

- 7310 Fay Ave

- 1040 Genter St Unit 103

- 1040 Genter St Unit 104

- 7560 Eads Ave Unit 12

- 935 Genter St Unit 306

- 7601 Eads Ave

- 1001 Genter St Unit 2H

- 7216 Fay Ave

- 7520 Draper Ave Unit 3

- 7214 Fay Ave

- 726 Silver St

- 708 Silver St

- 718 Silver St

- 7733 Girard Ave Unit 13

- 7635 Draper Ave Unit LU4

- 7441 7441 Girard Av B

- 7447 Girard Ave

- 7445 Girard Ave

- 7451 Girard Ave

- 7453 Girard Ave

- 7463 Girard Ave

- 7434 Girard Ave

- 7432 Girard Ave

- 1027 Pearl St

- 7434 Herschel Ave

- 7434 Herschel Ave Unit 9

- 7434 Herschel Ave Unit 8

- 7434 Herschel Ave Unit 7

- 7434 Herschel Ave Unit 6

- 7434 Herschel Ave Unit 5

- 7434 Herschel Ave Unit 4

- 7434 Herschel Ave Unit 3

- 7434 Herschel Ave Unit 2

- 7434 Herschel Ave Unit 1

- 7444 Herschel Ave