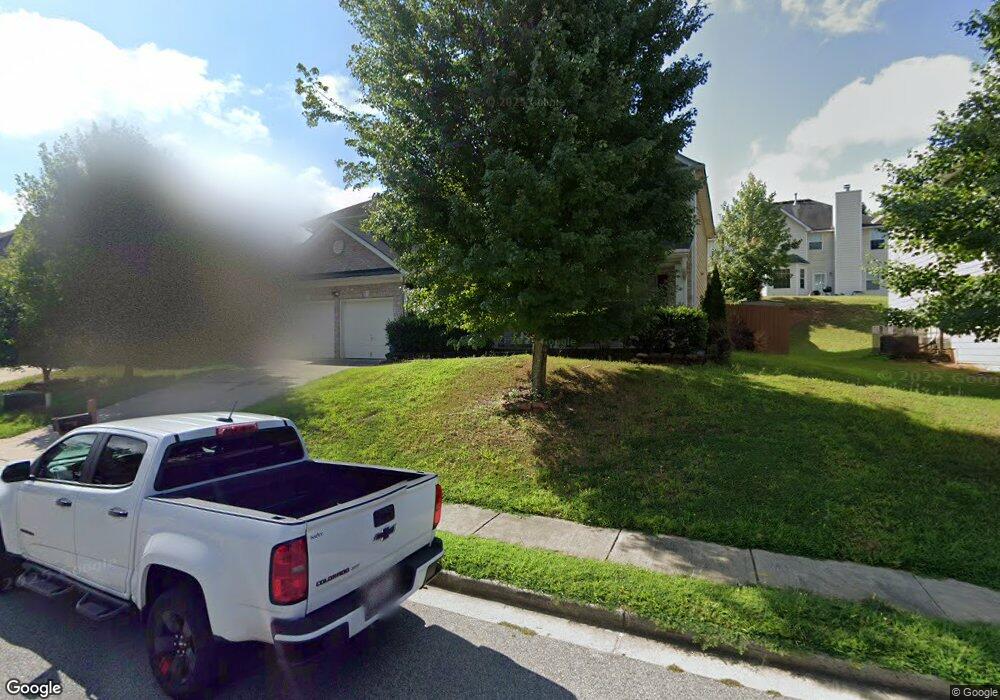

7450 Spoleto Loop Unit 49 Fairburn, GA 30213

Estimated Value: $335,000 - $355,277

4

Beds

3

Baths

2,800

Sq Ft

$122/Sq Ft

Est. Value

About This Home

This home is located at 7450 Spoleto Loop Unit 49, Fairburn, GA 30213 and is currently estimated at $342,819, approximately $122 per square foot. 7450 Spoleto Loop Unit 49 is a home located in Fulton County with nearby schools including E. C. West Elementary School, Bear Creek Middle School, and Creekside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 29, 2020

Sold by

Wilson William

Bought by

Wilson William and Jackson Takisha T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,924

Outstanding Balance

$195,832

Interest Rate

3.2%

Mortgage Type

FHA

Estimated Equity

$146,987

Purchase Details

Closed on

Sep 2, 2016

Sold by

Nancy Y

Bought by

Morrow William

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,848

Interest Rate

3.62%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 20, 2009

Sold by

Legacy Cmntys Of Cedar Grove L

Bought by

Charles Nancy Y

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,886

Interest Rate

5.53%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilson William | -- | -- | |

| Wilson William | $225,000 | -- | |

| Morrow William | $174,000 | -- | |

| Charles Nancy Y | $162,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wilson William | $220,924 | |

| Closed | Wilson William | $220,924 | |

| Previous Owner | Morrow William | $170,848 | |

| Previous Owner | Charles Nancy Y | $159,886 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,471 | $132,800 | $27,840 | $104,960 |

| 2023 | $5,471 | $165,960 | $38,040 | $127,920 |

| 2022 | $4,086 | $104,200 | $22,680 | $81,520 |

| 2021 | $3,593 | $89,760 | $19,080 | $70,680 |

| 2020 | $2,829 | $69,520 | $15,040 | $54,480 |

| 2019 | $2,569 | $65,040 | $9,760 | $55,280 |

| 2018 | $1,930 | $67,960 | $9,520 | $58,440 |

| 2017 | $1,976 | $48,480 | $10,600 | $37,880 |

| 2016 | $1,094 | $43,960 | $10,600 | $33,360 |

| 2015 | $1,098 | $43,960 | $10,600 | $33,360 |

| 2014 | $1,131 | $43,960 | $10,600 | $33,360 |

Source: Public Records

Map

Nearby Homes

- 7497 Spoleto Loop

- 7729 Waterlace Dr

- 6757 Delaware Bend

- 6753 Delaware Bend

- 7691 Brazos Trail

- 6791 Potomac Place

- 7565 Jennadee Dr

- 7512 Rivertown Rd

- 7580-LOT22 Rivertown Rd

- 7580 Rivertown Rd Unit LOT 14

- 0 Rivertown Rd Unit 10636914

- 0 Rivertown Rd Unit 10627089

- 7946 Gossamer Dr

- 6464 Edgewater Cove

- 7580 Rivertown 14 Rd

- 8030 Snapwell Dr

- 8051 Stillmist Dr

- 8004 Larksview Dr

- 7450 Spoleto Loop

- 7446 Spoleto Loop

- 7454 Spoleto Loop

- 7526 Spoleto Loop

- 7522 Spoleto Loop

- 7442 Spoleto Loop

- 7449 Spoleto Loop

- 7453 Spoleto Loop

- 7518 Spoleto Loop

- 7538 Spoleto Loop

- 7445 Spoleto Loop

- 7457 Spoleto Loop

- 7462 Spoleto Loop

- 7550 Spoleto Loop

- 7514 Spoleto Loop

- 7441 Spoleto Loop

- 7461 Spoleto Loop

- 7525 Spoleto Loop

- 7525 Spoleto Loop Unit 26

- 7521 Spoleto Loop