7515 Edgerton Rd De Soto, KS 66018

Estimated Value: $284,000 - $355,478

2

Beds

1

Bath

1,100

Sq Ft

$291/Sq Ft

Est. Value

About This Home

This home is located at 7515 Edgerton Rd, De Soto, KS 66018 and is currently estimated at $319,739, approximately $290 per square foot. 7515 Edgerton Rd is a home located in Johnson County with nearby schools including Starside Elementary School, Lexington Trails Middle School, and De Soto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 21, 2025

Sold by

Hall Margit Ck and Hall Margit C

Bought by

Kaltenekker Margit C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$264,550

Outstanding Balance

$262,960

Interest Rate

6.85%

Mortgage Type

FHA

Estimated Equity

$56,779

Purchase Details

Closed on

May 4, 2023

Sold by

Hall Barton M

Bought by

Hall Margit C Kaltenekke

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.28%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 16, 2020

Sold by

Hall Barton M

Bought by

Hall Barton M and Hall Margit Ck

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kaltenekker Margit C | -- | First Source Title | |

| Hall Margit C Kaltenekke | -- | None Listed On Document | |

| Hall Barton M | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kaltenekker Margit C | $264,550 | |

| Previous Owner | Hall Margit C Kaltenekke | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,031 | $18,937 | $2,322 | $16,615 |

| 2023 | $2,178 | $19,793 | $2,379 | $17,414 |

| 2022 | $1,889 | $17,096 | $2,373 | $14,723 |

| 2021 | $1,558 | $13,595 | $2,325 | $11,270 |

| 2020 | $1,346 | $17,106 | $7,689 | $9,417 |

| 2019 | $2,084 | $17,644 | $8,190 | $9,454 |

| 2018 | $1,609 | $13,526 | $7,019 | $6,507 |

| 2017 | $1,157 | $3,404 | $2,289 | $1,115 |

| 2016 | $1,162 | $9,453 | $3,800 | $5,653 |

| 2015 | $1,227 | $9,762 | $3,500 | $6,262 |

| 2013 | -- | $9,491 | $3,074 | $6,417 |

Source: Public Records

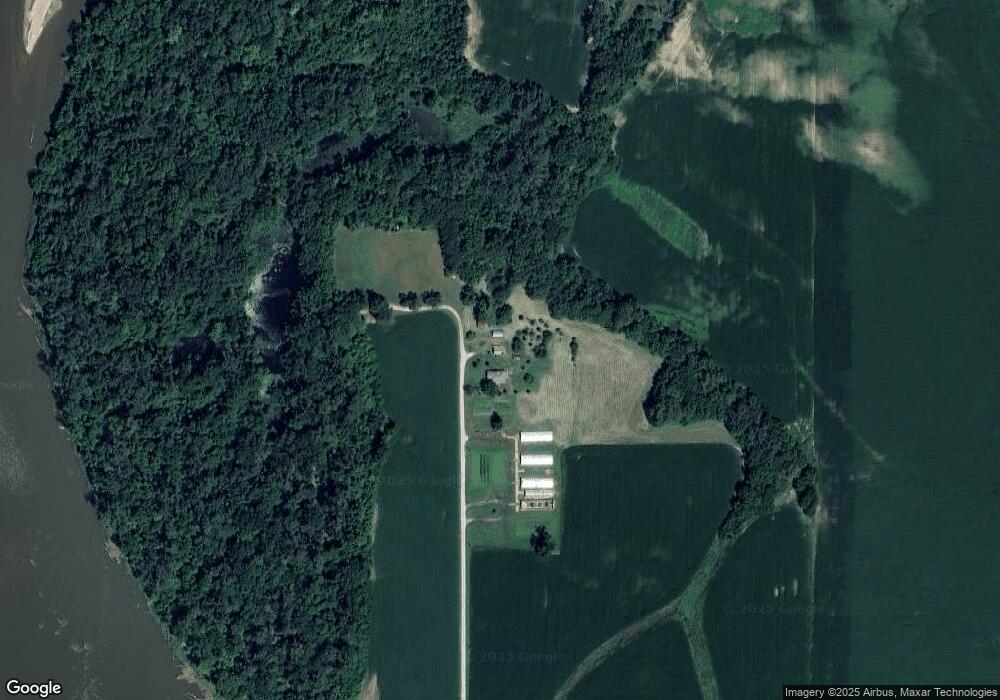

Map

Nearby Homes

- Tract 4 Golden Rd

- 00000 174th St

- 0 5 Street Ct

- Parcel 5A SE Stanley Rd

- Parcel 3A SE Stanley Rd

- Parcel 4A SE Stanley Rd

- 207 Bowen St

- 11374 198th St

- 0 Golden Rd Unit HMS2559950

- 0 Golden Rd Unit 23524027

- 13348 185th St

- 8335 Frederick Ct

- 8386 Timber Trails Dr

- 13519 185th St

- 34571 W 83rd St

- 29655 W 83rd St

- 8315 Primrose St

- 8459 Primrose St

- 20840 Golden Rd

- 34275 W 84th Terrace

- 7950 Edgerton Rd

- 19094 Golden Rd

- 19258 Golden Rd

- 12541 189th St

- 18738 Golden Rd

- Tract 3 Golden Rd

- Tract 1-5 Golden Rd

- Tract 5 Golden Rd

- Tract 2 Golden Rd

- 00000 Golden Rd

- Lot 5 Golden Rd

- Lot 4 Golden Rd

- 8230 Edgerton Rd

- 18631 Golden Rd

- 7490 Sunflower Rd

- 0 Block 23 7-12 and Block 16 Lots 7-12 Tho Unit Lots 11274246

- Lot 6 206th St

- 0000 Golden Rd

- Land Hwy 32

- Lots 5 & 6 206th St