7549 Glen Laurel Way Memphis, TN 38125

Southern Shelby County NeighborhoodEstimated Value: $197,000 - $261,000

3

Beds

2

Baths

1,527

Sq Ft

$154/Sq Ft

Est. Value

About This Home

This home is located at 7549 Glen Laurel Way, Memphis, TN 38125 and is currently estimated at $235,712, approximately $154 per square foot. 7549 Glen Laurel Way is a home located in Shelby County with nearby schools including Highland Oaks Elementary School, Highland Oaks Middle School, and Southwind High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 13, 2010

Sold by

Deutsche Bank National Trust Company

Bought by

Giles Orlando

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,498

Interest Rate

4.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 22, 2010

Sold by

Partee Andrea

Bought by

Deutsche Bank National Trust Company

Purchase Details

Closed on

Feb 7, 2006

Sold by

Mark Matthews Development Co Llc

Bought by

Partee Andrea

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,096

Interest Rate

8%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Oct 21, 2005

Sold by

Land Solutions Llc

Bought by

Mark Matthews Development Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Giles Orlando | $113,000 | Landcastle Title Llc | |

| Deutsche Bank National Trust Company | $101,250 | None Available | |

| Partee Andrea | $171,370 | Home Surety Title & Escrow L | |

| Mark Matthews Development Llc | $364,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Giles Orlando | $111,498 | |

| Previous Owner | Partee Andrea | $137,096 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,507 | $53,775 | $12,825 | $40,950 |

| 2024 | $1,507 | $44,450 | $9,350 | $35,100 |

| 2023 | $1,507 | $44,450 | $9,350 | $35,100 |

| 2022 | $1,507 | $44,450 | $9,350 | $35,100 |

| 2021 | $1,534 | $44,450 | $9,350 | $35,100 |

| 2020 | $1,470 | $36,300 | $9,350 | $26,950 |

| 2019 | $1,470 | $36,300 | $9,350 | $26,950 |

| 2018 | $1,470 | $36,300 | $9,350 | $26,950 |

| 2017 | $1,492 | $36,300 | $9,350 | $26,950 |

| 2016 | $1,440 | $32,950 | $0 | $0 |

| 2014 | $1,440 | $32,950 | $0 | $0 |

Source: Public Records

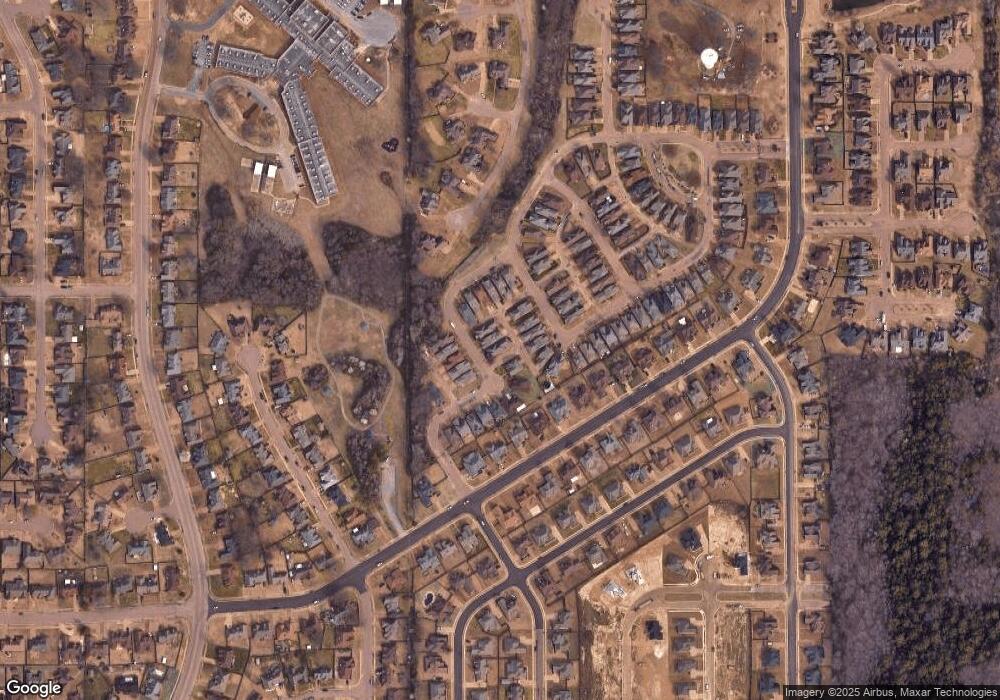

Map

Nearby Homes

- 7548 Easterly Ln

- 5308 Laurelfield Ln

- 5442 Riverstone Dr

- 5462 Stone Arch Cove

- 5466 Glennstone Cove S

- 5469 Briardale Dr

- 5458 Glenstone Cove

- 5324 Annandale Dr Unit 5324 Annandale Dr TN

- 5456 Stone Arch Place

- 5265 Annandale Dr

- 5563 Annandale Dr

- 5583 Liberty Ridge Cove

- 5468 Millers Glen Ln

- 5167 Silver Peak Ln

- 7420 Iris Cove

- 9387 Joe Lyon Blvd

- 9444 Geneva Loop E

- 7522 Starfire Cove

- 6400 State Line Rd

- 7352 Red River Cove

- 7553 Glen Laurel Way

- 7545 Glen Laurel Way

- 7557 Glen Laurel Way

- 7550 Glenlaurel Way

- 5339 Creek Laurel Way

- 5343 Creek Laurel Way

- 7543 Glen Laurel Way

- 5347 Creek Laurel Way

- 7530 Glenlaurel Way

- 7558 Glenlaurel Way

- 5333 Creek Laurel Way

- 7554 Glenlaurel Way

- 5351 Creek Laurel Way

- 7567 Glenlaurel Way

- 7531 Glen Laurel Way

- 7535 Glen Laurel Way

- 7562 Glenlaurel Way

- 7579 Glen Laurel Way

- 7571 Glenlaurel Way

- 7575 Glenlaurel Way