Estimated Value: $762,091 - $828,000

3

Beds

2

Baths

1,463

Sq Ft

$550/Sq Ft

Est. Value

About This Home

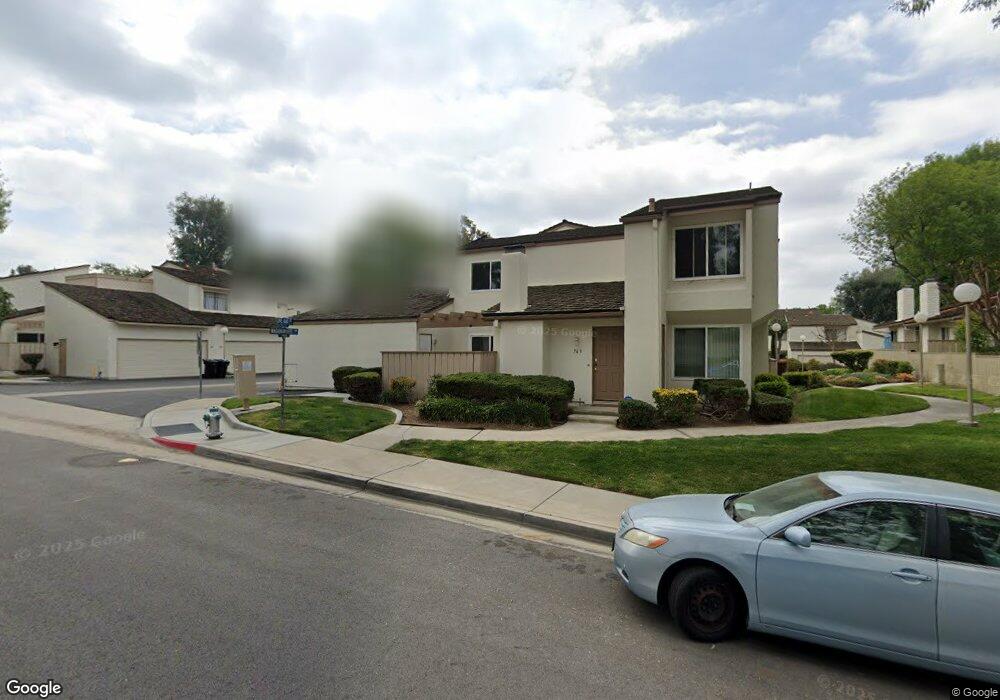

This home is located at 763 Wagon Wheel Cir, Brea, CA 92821 and is currently estimated at $805,023, approximately $550 per square foot. 763 Wagon Wheel Cir is a home located in Orange County with nearby schools including William E. Fanning Elementary School, Brea Junior High School, and Brea-Olinda High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2005

Sold by

Kim Cheon Koog and Lee Ok Hee

Bought by

Lee Ok Hee

Current Estimated Value

Purchase Details

Closed on

Nov 21, 2001

Sold by

Yourstone Brian M and Yourstone Joan C

Bought by

Kim Cheon Koog and Lee Ok Hee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,000

Outstanding Balance

$75,420

Interest Rate

6.51%

Estimated Equity

$729,603

Purchase Details

Closed on

Mar 1, 1999

Sold by

Jean Denkler

Bought by

Yourstone Brian M and Yourstone Joan C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$179,520

Interest Rate

6.73%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lee Ok Hee | -- | -- | |

| Kim Cheon Koog | $245,000 | Chicago Title Co | |

| Yourstone Brian M | $181,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kim Cheon Koog | $196,000 | |

| Previous Owner | Yourstone Brian M | $179,520 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,204 | $361,929 | $238,414 | $123,515 |

| 2024 | $4,204 | $354,833 | $233,739 | $121,094 |

| 2023 | $4,086 | $347,876 | $229,156 | $118,720 |

| 2022 | $4,043 | $341,055 | $224,662 | $116,393 |

| 2021 | $3,967 | $334,368 | $220,257 | $114,111 |

| 2020 | $3,939 | $330,940 | $217,999 | $112,941 |

| 2019 | $3,836 | $324,451 | $213,724 | $110,727 |

| 2018 | $3,778 | $318,090 | $209,534 | $108,556 |

| 2017 | $3,706 | $311,853 | $205,425 | $106,428 |

| 2016 | $3,633 | $305,739 | $201,397 | $104,342 |

| 2015 | $3,581 | $301,147 | $198,372 | $102,775 |

| 2014 | $3,477 | $295,248 | $194,486 | $100,762 |

Source: Public Records

Map

Nearby Homes

- 600 Pepper Tree Dr

- 500 Silver Canyon Way

- 360 Meadow Ct

- 358 Trabuco Canyon Way

- 1002 Mariposa Dr

- 38 Rogers Ct

- 753 Site Dr

- 648 Pepperwood Dr

- 448 W Central Ave

- 310 Pineridge St

- 1252 Tamarack Ave

- 145 S Poplar Ave Unit 20

- 127 S Redwood Ave

- 1445 Arrow Wood Dr

- 856 Williams St

- 1051 Site Dr Unit 236

- 1051 Site Dr Unit 255

- 1051 Site Dr Unit 25

- 1051 Site Dr Unit 251

- 1051 Site Dr Unit 233

- 753 Wagon Wheel Cir

- 733 Wagon Wheel Cir

- 762 Wagon Wheel Cir

- 752 Wagon Wheel Cir

- 742 Wagon Wheel Cir

- 754 Wagon Wheel Cir

- 764 Wagon Wheel Cir

- 744 Wagon Wheel Cir

- 732 Wagon Wheel Cir

- 734 Wagon Wheel Cir

- 724 Wagon Wheel Cir

- 252 Scenic Way

- 809 Vista Ct

- 256 Scenic Way

- 714 Wagon Wheel Cir

- 761 Wagon Wheel Cir

- 709 Wagon Wheel Cir

- 707 Wagon Wheel Cir

- 771 Wagon Wheel Cir

- 705 Wagon Wheel Cir

Your Personal Tour Guide

Ask me questions while you tour the home.