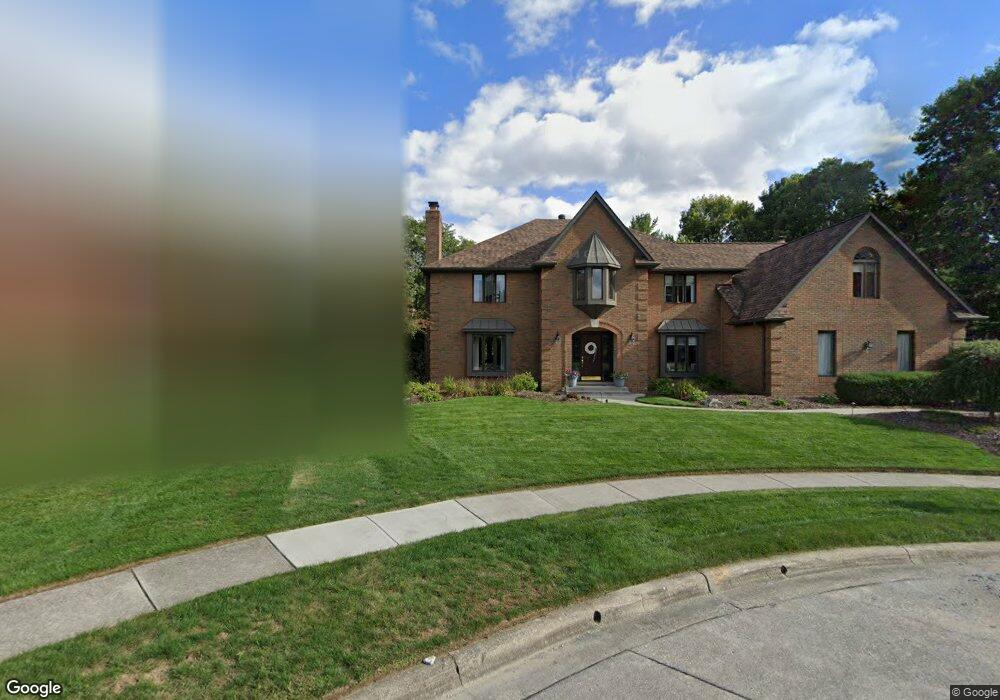

7670 Whitewood Ct Columbus, OH 43235

Estimated Value: $848,000 - $986,000

4

Beds

5

Baths

4,188

Sq Ft

$217/Sq Ft

Est. Value

About This Home

This home is located at 7670 Whitewood Ct, Columbus, OH 43235 and is currently estimated at $907,796, approximately $216 per square foot. 7670 Whitewood Ct is a home located in Franklin County with nearby schools including Worthington Hills Elementary School, McCord Middle School, and Worthington Kilbourne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 19, 2022

Sold by

Schneider David and Schneider Kimberly

Bought by

Calderone Vincent F and Calderone Kristin J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$703,400

Outstanding Balance

$670,591

Interest Rate

4.99%

Mortgage Type

New Conventional

Estimated Equity

$237,205

Purchase Details

Closed on

May 1, 2007

Sold by

Sprague Bethann K and Sprague Michael S

Bought by

Schneider David and Schneider Kimberly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$251,000

Interest Rate

6.21%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 2, 1988

Bought by

Sprague Bethann K

Purchase Details

Closed on

Jun 1, 1984

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Calderone Vincent F | $827,600 | Stewart Title | |

| Schneider David | $549,000 | Title First | |

| Sprague Bethann K | $345,000 | -- | |

| -- | $800,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Calderone Vincent F | $703,400 | |

| Previous Owner | Schneider David | $251,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $16,843 | $274,340 | $69,830 | $204,510 |

| 2023 | $16,106 | $274,330 | $69,825 | $204,505 |

| 2022 | $15,020 | $203,000 | $37,800 | $165,200 |

| 2021 | $13,857 | $203,000 | $37,800 | $165,200 |

| 2020 | $14,245 | $216,650 | $37,800 | $178,850 |

| 2019 | $12,764 | $175,180 | $31,500 | $143,680 |

| 2018 | $12,234 | $175,180 | $31,500 | $143,680 |

| 2017 | $11,438 | $175,180 | $31,500 | $143,680 |

| 2016 | $12,102 | $170,460 | $30,700 | $139,760 |

| 2015 | $12,104 | $170,460 | $30,700 | $139,760 |

| 2014 | $12,100 | $170,460 | $30,700 | $139,760 |

| 2013 | $5,686 | $161,000 | $27,895 | $133,105 |

Source: Public Records

Map

Nearby Homes

- 865 Colony Way

- 941 Clubview Blvd S

- 7522 Acela St

- 1101 Bluffway Dr

- 1539 Clubview Blvd S

- 1380 Tiehack Ct

- 1041 Rosebank Dr

- 90 Northwoods Blvd Unit B

- 1483 Dogwood Loop

- 210 Saint Antoine St Unit 25D

- Fiona B Plan at Loch Lomond - Loch Lomond Hills

- 1474 Dogwood Loop

- Fiona A Plan at Loch Lomond - Loch Lomond Hills

- Fiona D Plan at Loch Lomond - Loch Lomond Hills

- Fiona C Plan at Loch Lomond - Loch Lomond Hills

- 203 Saint Pierre St

- 67 Highland Pointe Cir Unit 67

- 8208 Copperfield Dr

- 8205 Longhorn Rd

- 1620 Park Row Dr Unit A

- 7682 Whitewood Ct

- 7669 Whitewood Ct

- 850 Northbridge Ln

- 864 Northbridge Ln

- 7675 Norhill Rd

- 7681 Whitewood Ct

- 834 Northbridge Ln

- 878 Northbridge Ln

- 839 Cherryfield Ave

- 827 Cherryfield Ave

- 867 Cherryfield Ave

- 901 Cherryfield Ave

- 7689 Norhill Rd

- 893 Cherryfield Ave

- 896 Northbridge Ln

- 810 Northbridge Ln

- 879 Cherryfield Ave

- 815 Cherryfield Ave

- 909 Cherryfield Ave

- 847 Northbridge Ln