773 Corinia Ct Encinitas, CA 92024

Central Encinitas NeighborhoodEstimated Value: $2,907,000 - $3,703,000

5

Beds

5

Baths

3,913

Sq Ft

$824/Sq Ft

Est. Value

About This Home

This home is located at 773 Corinia Ct, Encinitas, CA 92024 and is currently estimated at $3,224,433, approximately $824 per square foot. 773 Corinia Ct is a home located in San Diego County with nearby schools including Olivenhain Pioneer Elementary, Diegueno Middle School, and La Costa Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2018

Sold by

Forgey Mike and Macconell Leight A

Bought by

Macconell Leigh A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,190,000

Outstanding Balance

$1,115,987

Interest Rate

5.37%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$2,108,446

Purchase Details

Closed on

Sep 21, 2006

Sold by

Allgire Richard W and Allgire Mary Ann

Bought by

Forgey Mike and Macconell Leigh A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,050,000

Interest Rate

7.37%

Mortgage Type

Negative Amortization

Purchase Details

Closed on

May 10, 1994

Sold by

Olivenhain Colony Ii Ltd

Bought by

Allgire Richard W and Allgire Mary Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,000

Interest Rate

8.42%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Macconell Leigh A | -- | Ticor Title San Diego | |

| Forgey Mike | $1,450,000 | Equity Title Co San Diego | |

| Allgire Richard W | $690,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Macconell Leigh A | $1,190,000 | |

| Closed | Forgey Mike | $1,050,000 | |

| Previous Owner | Allgire Richard W | $130,000 | |

| Closed | Allgire Richard W | $80,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $22,466 | $1,942,569 | $1,004,777 | $937,792 |

| 2024 | $22,466 | $1,904,480 | $985,076 | $919,404 |

| 2023 | $21,748 | $1,867,138 | $965,761 | $901,377 |

| 2022 | $21,615 | $1,830,528 | $946,825 | $883,703 |

| 2021 | $20,783 | $1,794,636 | $928,260 | $866,376 |

| 2020 | $20,313 | $1,720,000 | $860,000 | $860,000 |

| 2019 | $18,808 | $1,580,000 | $790,000 | $790,000 |

| 2018 | $17,563 | $1,450,000 | $725,000 | $725,000 |

| 2017 | $16,525 | $1,350,000 | $675,000 | $675,000 |

| 2016 | $15,678 | $1,300,000 | $650,000 | $650,000 |

| 2015 | $15,836 | $1,300,000 | $650,000 | $650,000 |

| 2014 | $15,691 | $1,300,000 | $650,000 | $650,000 |

Source: Public Records

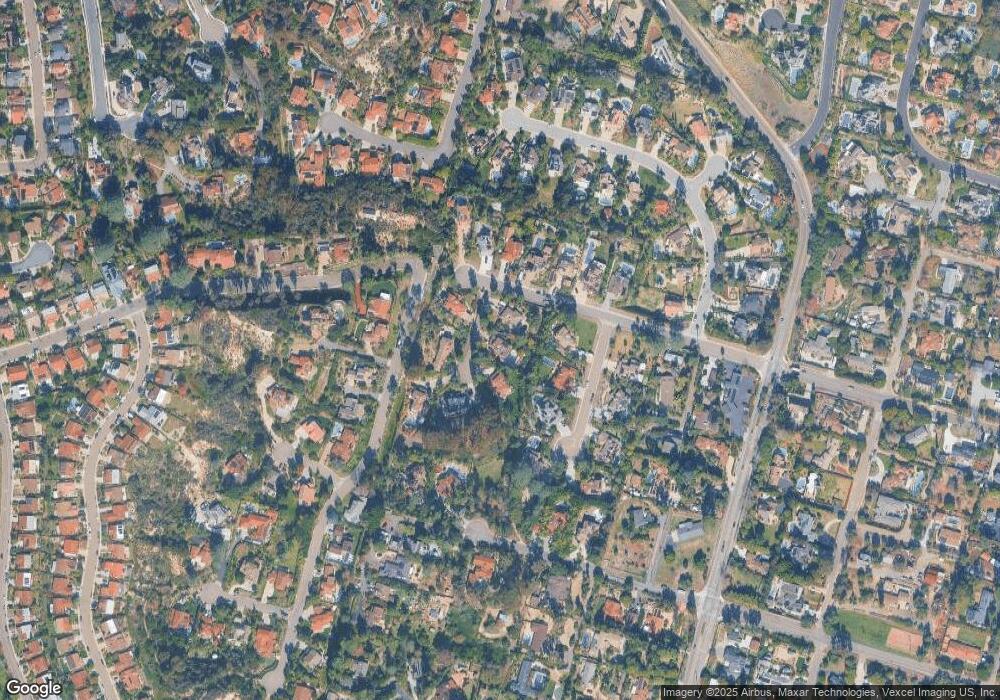

Map

Nearby Homes

- 905 Olive Crest Dr

- 516 Whisper Wind Dr

- 612 Lucylle Ln

- 0 Calle Rancho Vista Unit 18 250040119

- 2037 Countrywood Way

- 324 Countrywood Ln

- 155 Countrywood Ln

- 528 Flores de Oro

- 3424 Camino Alegre Unit 1

- 1830 Gatepost Rd

- 1986 Azure Way Unit 107

- 1824 Eastwood Ln

- 459 Flores de Oro

- 277 Via Del Cerrito

- 3028 Paseo Cielo

- 1105 Catania Ct Unit 201

- 804 & 814 Clark Ave

- 3736 38 Via Rancho Michelle

- 200 202 Neptune Ave

- 772 Conestoga Ct

- 777 Corinia Ct

- 769 Corinia Ct

- 764 Jacquelene Ct

- 776 Jacquelene Ct

- 772 Corinia Ct

- 764 Corinia Ct

- 776 Corinia Ct

- 752 Jacquelene Ct

- 768 Corinia Ct

- 740 Jacquelene Ct

- 2266 11th St

- 2238 11th St

- 2280 11th St

- 765 Jacquelene Ct

- 777 Jacquelene Ct

- 2224 11th St

- 2314 11th St

- 2205 Mountain Vista Dr

- 430 Whitewood Place

- 2210 11th St

Your Personal Tour Guide

Ask me questions while you tour the home.