7762 Winding Way Fair Oaks, CA 95628

Estimated Value: $883,000 - $1,496,596

4

Beds

4

Baths

4,990

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 7762 Winding Way, Fair Oaks, CA 95628 and is currently estimated at $1,222,649, approximately $245 per square foot. 7762 Winding Way is a home located in Sacramento County with nearby schools including Carmichael Elementary School, John Barrett Middle School, and Del Campo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 12, 2011

Sold by

Haleva Jerome M and Ecker Sharon

Bought by

Haleva Jerry M and Ecker Sharon

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,000

Interest Rate

3.95%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 28, 2006

Sold by

Haleva Jerome M and Ecker Sharon A

Bought by

Haleva Jerry M and Ecker Sharon

Purchase Details

Closed on

Jul 2, 1998

Sold by

Ecker Haleva Jerome Michael and Ecker Sharon A

Bought by

Haleva Jerome M and Ecker Sharon A

Purchase Details

Closed on

Dec 30, 1996

Sold by

Ecker Haleva Jerome Michael and Ecker Sharon A

Bought by

Haleva Jerome Michael and Ecker Sharon A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$472,000

Interest Rate

7.53%

Purchase Details

Closed on

Jan 17, 1995

Sold by

Barsotti Adele

Bought by

Haleva Jerome Michael and Ecker Sharon A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Haleva Jerry M | -- | Fidelity National Title | |

| Haleva Jerome M | -- | Fidelity National Title | |

| Haleva Jerry M | -- | None Available | |

| Haleva Jerome M | -- | -- | |

| Haleva Jerome M | -- | -- | |

| Haleva Jerome Michael | -- | Stewart Title | |

| Haleva Jerome Michael | $173,000 | Placer Title Compan |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Haleva Jerome M | $111,000 | |

| Previous Owner | Haleva Jerome Michael | $472,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,036 | $1,091,790 | $335,929 | $755,861 |

| 2024 | $13,036 | $1,070,384 | $329,343 | $741,041 |

| 2023 | $12,648 | $1,049,397 | $322,886 | $726,511 |

| 2022 | $12,601 | $1,028,821 | $316,555 | $712,266 |

| 2021 | $12,363 | $1,008,649 | $310,349 | $698,300 |

| 2020 | $12,186 | $998,307 | $307,167 | $691,140 |

| 2019 | $11,876 | $978,734 | $301,145 | $677,589 |

| 2018 | $11,614 | $959,544 | $295,241 | $664,303 |

| 2017 | $11,497 | $940,730 | $289,452 | $651,278 |

| 2016 | $10,738 | $922,285 | $283,777 | $638,508 |

| 2015 | $10,553 | $908,433 | $279,515 | $628,918 |

| 2014 | $10,331 | $890,639 | $274,040 | $616,599 |

Source: Public Records

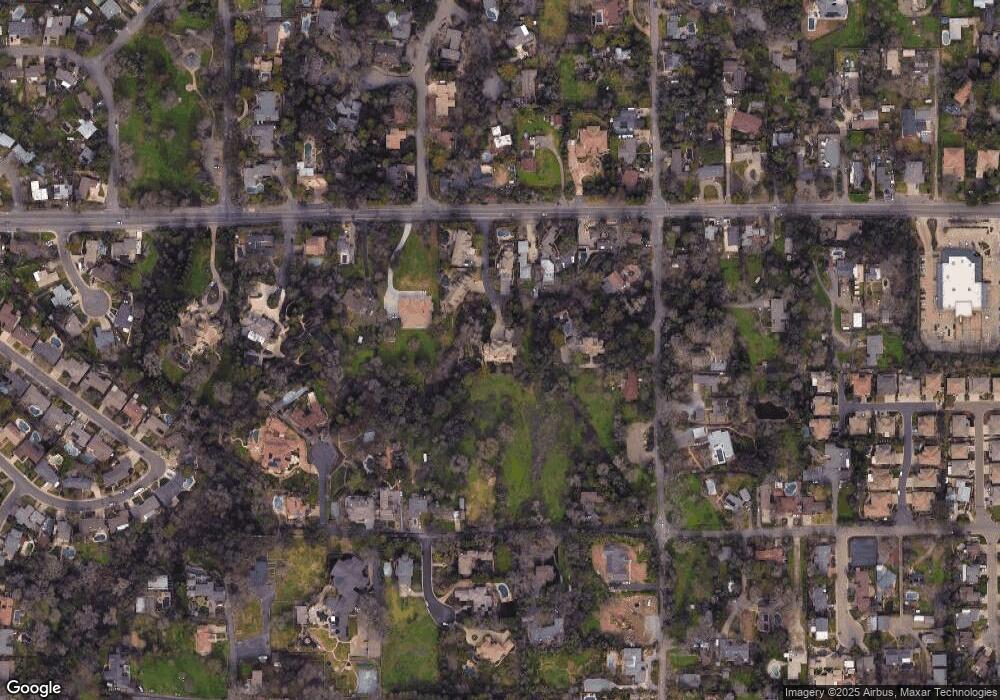

Map

Nearby Homes

- 4040 Minnesota Ave

- 4433 New York Ave

- 4215 New York Ave

- 4516 New York Ave

- 7621 Palisade Way

- 4339 Stencar Dr

- 4345 Bannister Rd

- 4144 Brookhill Dr

- 4025 New York Ave Unit 208

- 7932 Orange Ave

- 7940 Orange Ave

- 7938 Orange Ave

- 7934 Orange Ave

- 10236 Fair Oaks Blvd

- 7930 Orange Ave

- 7440 Tierra Way

- 7649 Ridge St

- 7832 Ahl Way

- 4079 Bridge St

- 7657 Sunset Ave

- 7760 Winding Way

- 7776 Winding Way

- 7764 Winding Way

- 7748 Winding Way

- 7756 Winding Way

- 7780 Winding Way

- 4307 New York Ave

- 4305 New York Ave

- 7759 Lemon St

- 7738 Winding Way

- 7738 Winding Way

- 4333 New York Ave

- 7786 Winding Way

- 4400 Shady Oak Way

- 0 New York Ave Unit 20067545

- 5231 New York Ave

- 7732 Winding Way

- 7745 Lemon St

- 4341 New York Ave

- 7743 Lemon St