777 Honey Grove Ln Nipomo, CA 93444

Estimated Value: $779,000 - $1,064,000

3

Beds

2

Baths

1,655

Sq Ft

$541/Sq Ft

Est. Value

About This Home

This home is located at 777 Honey Grove Ln, Nipomo, CA 93444 and is currently estimated at $895,189, approximately $540 per square foot. 777 Honey Grove Ln is a home located in San Luis Obispo County with nearby schools including Dorothea Lange Elementary School, Mesa Middle School, and Nipomo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2005

Sold by

Madden Wayne D and Madden Rebecca Rose

Bought by

Madden Waynd D and Madden Rebecca Rose

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Outstanding Balance

$182,250

Interest Rate

5.72%

Mortgage Type

New Conventional

Estimated Equity

$712,939

Purchase Details

Closed on

Aug 2, 2004

Sold by

Madden Wayne and Madden Rebecca Rose

Bought by

Madden Wayne D and Madden Rebecca Rose

Purchase Details

Closed on

Feb 22, 1999

Sold by

R H Newdoll Construction Inc

Bought by

Madden Wayne and Madden Rebecca Rose

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,750

Interest Rate

6.76%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Madden Waynd D | -- | Fidelity Title Company | |

| Madden Wayne D | -- | Fidelity Title Company | |

| Madden Wayne D | -- | -- | |

| Madden Wayne | $185,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Madden Wayne D | $350,000 | |

| Closed | Madden Wayne | $175,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,909 | $290,002 | $125,404 | $164,598 |

| 2024 | $2,875 | $284,317 | $122,946 | $161,371 |

| 2023 | $2,875 | $278,743 | $120,536 | $158,207 |

| 2022 | $2,830 | $273,278 | $118,173 | $155,105 |

| 2021 | $2,823 | $267,920 | $115,856 | $152,064 |

| 2020 | $2,790 | $265,174 | $114,669 | $150,505 |

| 2019 | $2,772 | $259,975 | $112,421 | $147,554 |

| 2018 | $2,737 | $254,878 | $110,217 | $144,661 |

| 2017 | $2,684 | $249,881 | $108,056 | $141,825 |

| 2016 | $2,530 | $244,983 | $105,938 | $139,045 |

| 2015 | $2,493 | $241,304 | $104,347 | $136,957 |

| 2014 | $2,399 | $236,578 | $102,303 | $134,275 |

Source: Public Records

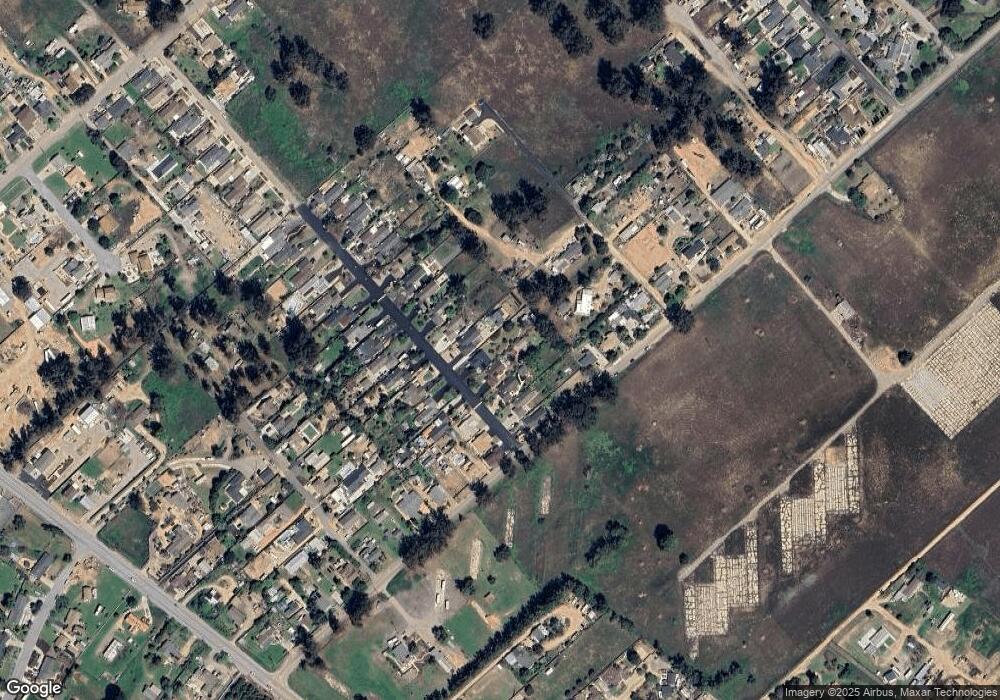

Map

Nearby Homes

- 725 Monarch Ln

- 840 Story St

- 522 Higos Way

- 483 Violet Ave

- 945 Jeanette Ln

- 626 Juno Ct

- 426 Polaris Dr

- 424 Bermuda Place

- 468 Neptune Dr

- 450 Avenida de Socios Unit 12

- 1127 Starlite Dr

- 368 Avenida de Amigos

- 393 Uranus Ct

- 1180 Starlite Dr

- 232 Scarlett Cir

- 525 Grande Ave Unit D

- 261 Hazel Ln

- Mesa Plan at Hill Street Terraces - Hill Street Series

- Pacific Plan at Hill Street Terraces - Hill Street Series

- Monarch Plan at Hill Street Terraces - Hill Street Series

- 781 Honey Grove Ln

- 765 Honey Grove Ln

- 755 Honey Grove Ln

- 787 Honey Grove Ln

- 786 Honey Grove Ln

- 745 Honey Grove Ln

- 791 Honey Grove Ln

- 792 Honey Grove Ln

- 772 Honey Grove Ln

- 760 Honey Grove Ln

- 797 Honey Grove Ln

- 741 Honey Grove Ln

- 782 Honey Grove Ln

- 756 Honey Grove Ln

- 796 Honey Grove Ln

- 784 Southland St

- 746 Honey Grove Ln

- 735 Honey Grove Ln

- 712 Southland St

- 712 Southland St