7861 Bertha Ave Middletown, OH 45042

Madison Township NeighborhoodEstimated Value: $182,000 - $203,000

3

Beds

1

Bath

1,144

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 7861 Bertha Ave, Middletown, OH 45042 and is currently estimated at $188,676, approximately $164 per square foot. 7861 Bertha Ave is a home located in Butler County with nearby schools including Madison High School and Germantown Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2021

Sold by

Newman Sharon K

Bought by

Newman Victoria E and Newman Sharon K

Current Estimated Value

Purchase Details

Closed on

Sep 3, 2015

Sold by

Newman Victoria E

Bought by

Newman Sharon K and King Charles

Purchase Details

Closed on

Mar 12, 2013

Sold by

Newman Sharon K and Newman Victoria E

Bought by

Newman Sharon K and Newman Victoria E

Purchase Details

Closed on

Nov 28, 2011

Sold by

King Charles

Bought by

Newman Sharon K and Newman Victoria E

Purchase Details

Closed on

Jan 26, 2011

Sold by

Federal Home Loan Mortgage Corporation

Bought by

King Charles

Purchase Details

Closed on

Jan 11, 2011

Sold by

Viscevic Ardarth A

Bought by

Federal Home Loan Mortgage Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Newman Victoria E | -- | None Available | |

| Newman Victoria E | -- | None Listed On Document | |

| Newman Sharon K | -- | Attorney | |

| Newman Sharon K | -- | None Available | |

| Newman Sharon K | $22,000 | Attorney | |

| King Charles | $56,000 | None Available | |

| Federal Home Loan Mortgage Corp | $67,000 | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,379 | $42,920 | $6,490 | $36,430 |

| 2023 | $1,382 | $42,920 | $6,490 | $36,430 |

| 2022 | $1,086 | $31,680 | $6,490 | $25,190 |

| 2021 | $975 | $31,680 | $6,490 | $25,190 |

| 2020 | $1,013 | $31,680 | $6,490 | $25,190 |

| 2019 | $827 | $26,040 | $6,030 | $20,010 |

| 2018 | $828 | $26,040 | $6,030 | $20,010 |

| 2017 | $1,343 | $26,040 | $6,030 | $20,010 |

| 2016 | $1,304 | $24,690 | $6,030 | $18,660 |

| 2015 | $1,216 | $24,690 | $6,030 | $18,660 |

| 2014 | $1,482 | $24,690 | $6,030 | $18,660 |

| 2013 | $1,482 | $19,600 | $6,030 | $13,570 |

Source: Public Records

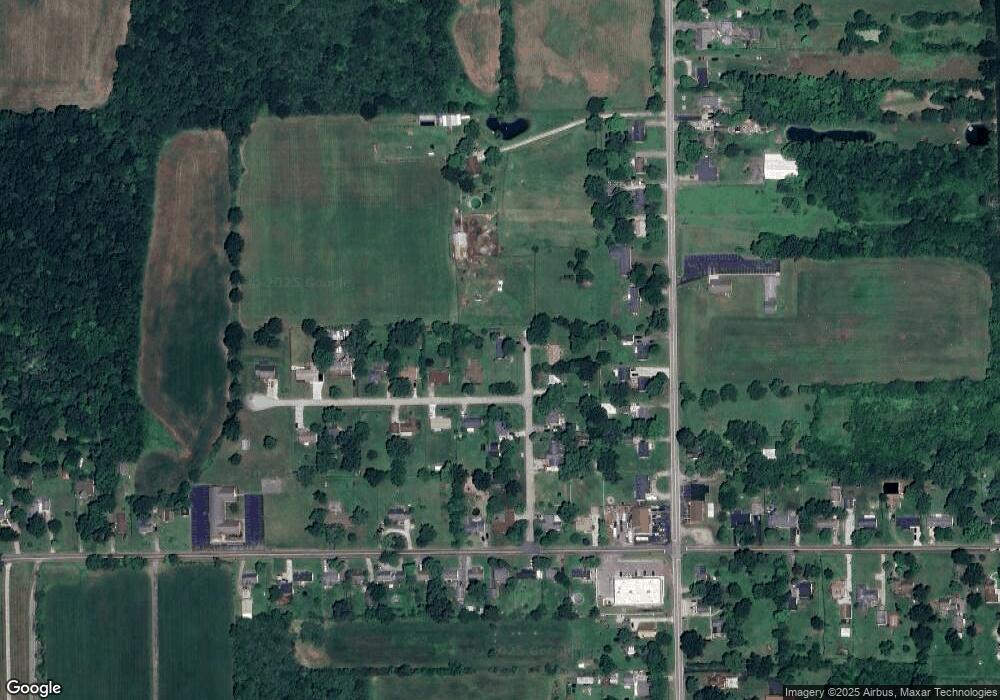

Map

Nearby Homes

- 7962 Middletown Germantown Rd

- 7916 Middletown Germantown Rd

- 10071 Eby Rd

- 8030- 8036 Hetzler Rd

- 9675 Germantown Middletown Pike

- 8508 Thomas Rd

- 13100 Prichard Rd

- 8384 Corlee Ln

- 8470 Corlee Rd

- 7331 Pinewood Dr

- 8702 Windsong Ct

- 8680 Plum Creek Ct

- 8007 Martz Paulin Rd

- 8211 Sue Ave

- 36 Sunset Place

- 6987 Dalewood Dr

- 7803 Lyn Dr

- 6828 Torrington Dr

- 6363 Germantown Rd

- 7721 Lyn Dr

- 8336 May Ave

- 8346 May Ave

- 7860 Bertha Ave

- 7850 Bertha Ave

- 7835 Bertha Ave

- 8347 May Ave

- 7840 Bertha Ave

- 8366 May Ave

- 8357 May Ave

- 7830 Bertha Ave

- 8367 May Ave

- 8376 May Ave

- 8346 Keister Rd

- 8377 May Ave

- 8336 Keister Rd

- 7851 Middletown Germantown Rd

- 7861 Middletown Germantown Rd

- 7812 Bertha Ave

- 7841 Middletown Germantown Rd

- 8386 May Ave