78710 Darby Rd Bermuda Dunes, CA 92203

Estimated Value: $486,000 - $799,000

2

Beds

1

Bath

1,228

Sq Ft

$516/Sq Ft

Est. Value

About This Home

This home is located at 78710 Darby Rd, Bermuda Dunes, CA 92203 and is currently estimated at $633,124, approximately $515 per square foot. 78710 Darby Rd is a home located in Riverside County with nearby schools including James Monroe Elementary School, Colonel Mitchell Paige Middle School, and Palm Desert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2014

Sold by

Gutierrez Pedro P

Bought by

Chavez Socorro

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$600,000

Outstanding Balance

$455,857

Interest Rate

4.17%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$177,267

Purchase Details

Closed on

Jun 25, 2014

Sold by

Chavez Socorro and Rosales Socorro

Bought by

Rosales Isaac and Rosales Ashley Nicole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$600,000

Outstanding Balance

$455,857

Interest Rate

4.17%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$177,267

Purchase Details

Closed on

Jun 27, 2006

Sold by

Millman Joseph J and Millman Sheila

Bought by

Rosales Socorro

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$360,000

Interest Rate

6.57%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chavez Socorro | -- | First American Title Company | |

| Rosales Isaac | -- | First American Title Company | |

| Rosales Socorro | $400,000 | Southland Title Corporation |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rosales Isaac | $600,000 | |

| Closed | Rosales Socorro | $360,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,353 | $527,110 | $413,111 | $113,999 |

| 2023 | $6,353 | $506,643 | $397,070 | $109,573 |

| 2022 | $6,107 | $496,710 | $389,285 | $107,425 |

| 2021 | $5,988 | $486,971 | $381,652 | $105,319 |

| 2020 | $5,873 | $481,979 | $377,739 | $104,240 |

| 2019 | $5,759 | $472,530 | $370,333 | $102,197 |

| 2018 | $5,647 | $463,266 | $363,072 | $100,194 |

| 2017 | $5,529 | $454,183 | $355,953 | $98,230 |

| 2016 | $5,391 | $445,278 | $348,974 | $96,304 |

| 2015 | $5,411 | $438,591 | $343,733 | $94,858 |

| 2014 | $5,318 | $430,000 | $337,000 | $93,000 |

Source: Public Records

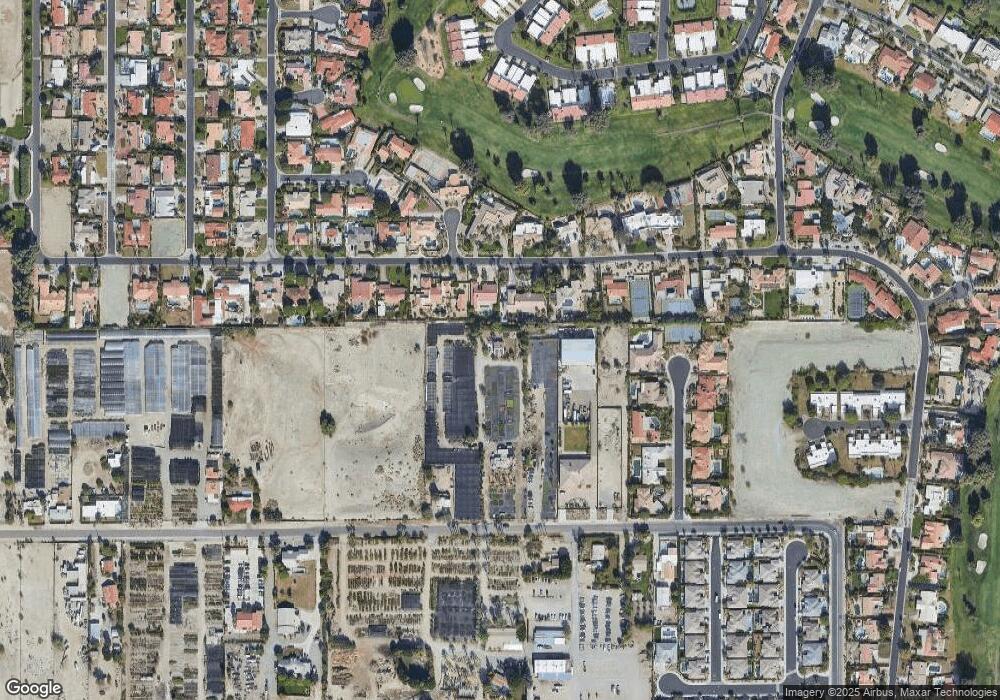

Map

Nearby Homes

- 76594 Starlight Ln

- 78770 Starlight Ln

- 78860 Zenith Way

- 78810 Montego Bay Cir

- 79124 Starlight Ln

- 79132 Starlight Ln

- 78895 Galaxy Dr

- 79045 Montego Bay Dr

- 037 Baracoa Dr

- 78707 Torino Dr

- 78910 Montego Bay Cir

- 79100 Barwick Place

- 42540 Baracoa Dr

- 78805 Saint Thomas Dr

- 43229 Lacovia Dr

- 42320 Baracoa Dr Unit 20

- 78721 Siena Ct

- 43265 Lacovia Dr

- 78691 Siena Ct

- 78870 Meridian Way

- 78765 Starlight Ln

- 78745 Starlight Ln

- 78805 Starlight Ln

- 78682 Darby Rd

- 78725 Starlight Ln

- 73 Starlight Ln

- 40000 Starlight Ln

- 0 Starlight Ln

- 78801 Starlight Ln

- 78705 Starlight Ln

- 78700 Starlight Ln

- 78790 Darby Rd

- 78 Darby Rd

- 78690 Starlight Ln

- 78766 Darby Rd

- 78772 Darby Rd

- 78680 Starlight Ln

- 78850 Darby Rd

- 78685 Starlight Ln

- 78710 Cove Place