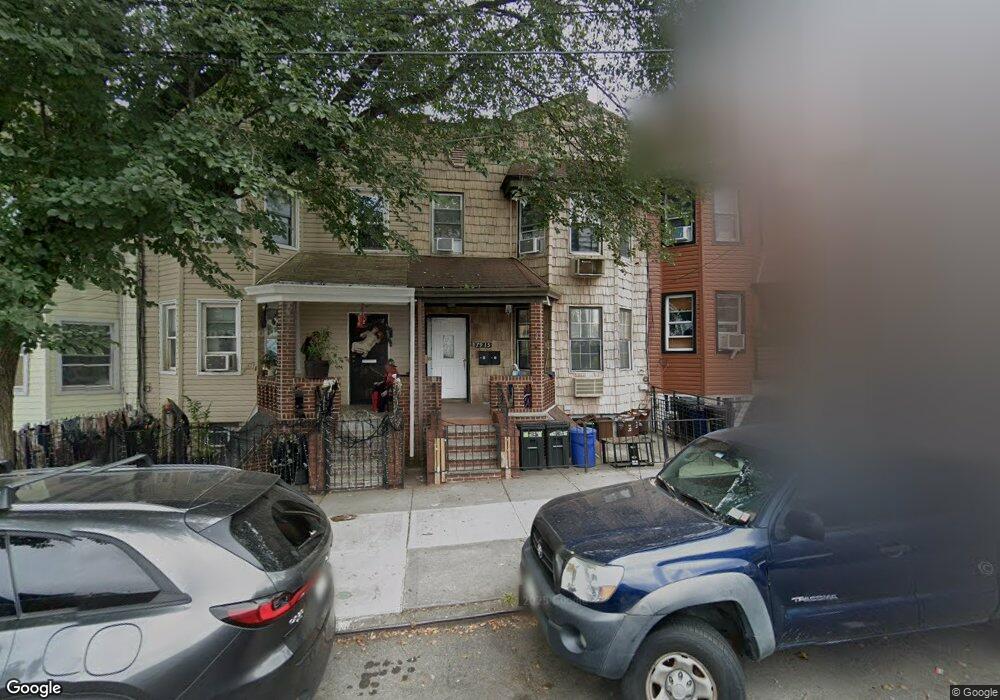

79-15 60th Ln Unit 2 Flushing, NY 11385

Glendale NeighborhoodEstimated Value: $865,691 - $1,110,000

3

Beds

1

Bath

1,660

Sq Ft

$578/Sq Ft

Est. Value

About This Home

This home is located at 79-15 60th Ln Unit 2, Flushing, NY 11385 and is currently estimated at $959,423, approximately $577 per square foot. 79-15 60th Ln Unit 2 is a home located in Queens County with nearby schools including P.S. 68 - Cambridge, Joseph F. Quinn Intermediate School 77, and Sacred Heart School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 2024

Sold by

Vargas Betania

Bought by

Girgis Angel Aziz and Ibrahim Amad H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$734,700

Outstanding Balance

$723,722

Interest Rate

6.88%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$235,701

Purchase Details

Closed on

Mar 22, 2001

Sold by

Knox Patrick K and Knox Elizabeth

Bought by

Vargas Betania

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$306,150

Interest Rate

6.88%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Girgis Angel Aziz | $930,000 | -- | |

| Girgis Angel Aziz | $930,000 | -- | |

| Vargas Betania | -- | -- | |

| Vargas Betania | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Girgis Angel Aziz | $734,700 | |

| Closed | Girgis Angel Aziz | $734,700 | |

| Previous Owner | Vargas Betania | $306,150 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,142 | $35,832 | $10,362 | $25,470 |

| 2024 | $7,142 | $35,557 | $9,660 | $25,897 |

| 2023 | $6,738 | $33,546 | $8,678 | $24,868 |

| 2022 | $6,318 | $49,980 | $14,280 | $35,700 |

| 2021 | $6,284 | $44,820 | $14,280 | $30,540 |

| 2020 | $6,320 | $43,800 | $14,280 | $29,520 |

| 2019 | $6,199 | $43,320 | $14,280 | $29,040 |

| 2018 | $5,699 | $27,955 | $10,783 | $17,172 |

| 2017 | $5,376 | $26,374 | $10,290 | $16,084 |

| 2016 | $4,974 | $26,374 | $10,290 | $16,084 |

| 2015 | $2,781 | $24,883 | $12,706 | $12,177 |

| 2014 | $2,781 | $24,693 | $14,233 | $10,460 |

Source: Public Records

Map

Nearby Homes

- 60-48 80th Ave

- 78-30 62nd St

- 6027 78th Ave

- 5922 Cooper Ave

- 6020 Saint Felix Ave

- 62-16 80th Ave

- 60-27 Saint Felix Ave

- 7817 64th St

- 58-59 78th Ave

- 75-16 62nd St

- 78-14 64th Place

- 8010 59th St

- 62-22 80th Rd

- 7505 60th Place

- 647 Cooper Ave

- 62-53 80th Rd

- 7520 64th Place

- 7842 64th Ln

- 78-30 64th Ln

- 72-55 60th Ln