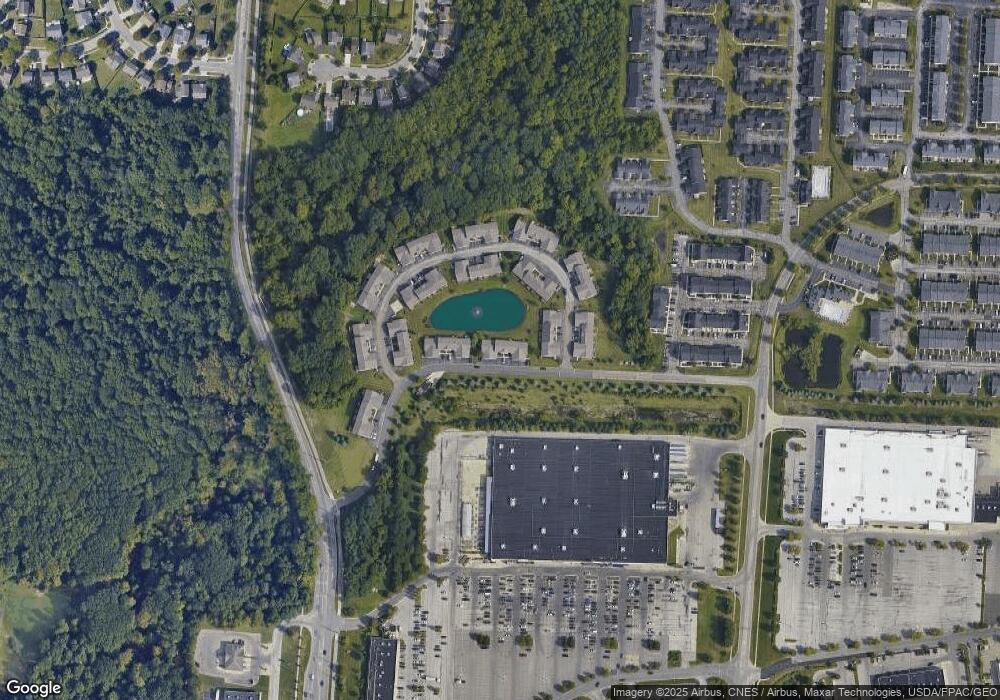

8006 Overmont Ridge Rd Blacklick, OH 43004

East Broad NeighborhoodEstimated Value: $257,830 - $271,000

3

Beds

4

Baths

1,713

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 8006 Overmont Ridge Rd, Blacklick, OH 43004 and is currently estimated at $265,458, approximately $154 per square foot. 8006 Overmont Ridge Rd is a home located in Franklin County with nearby schools including North Elementary School, Licking Heights Central, and Licking Heights High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 26, 2017

Sold by

Richards Catherine M

Bought by

Mitchell Amber M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,319

Outstanding Balance

$121,512

Interest Rate

3.86%

Mortgage Type

FHA

Estimated Equity

$143,946

Purchase Details

Closed on

Oct 15, 2004

Sold by

Toney Amber A and Lethunya Refiloe

Bought by

Richards Catherine M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,900

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 29, 2002

Sold by

The Ravines At Waggoner Park Ltd

Bought by

Toney Amber A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,900

Interest Rate

6.43%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mitchell Amber M | $148,000 | First Ohio Title Insurance | |

| Richards Catherine M | $139,900 | Foundation | |

| Toney Amber A | $130,900 | Connor Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mitchell Amber M | $145,319 | |

| Previous Owner | Richards Catherine M | $139,900 | |

| Previous Owner | Toney Amber A | $127,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,069 | $78,620 | $12,960 | $65,660 |

| 2023 | $4,177 | $78,610 | $12,950 | $65,660 |

| 2022 | $3,032 | $49,540 | $6,100 | $43,440 |

| 2021 | $3,049 | $49,540 | $6,100 | $43,440 |

| 2020 | $3,030 | $49,540 | $6,100 | $43,440 |

| 2019 | $2,727 | $41,270 | $5,080 | $36,190 |

| 2018 | $2,701 | $41,270 | $5,080 | $36,190 |

| 2017 | $2,832 | $41,270 | $5,080 | $36,190 |

| 2016 | $2,706 | $38,930 | $5,850 | $33,080 |

| 2015 | $2,663 | $38,930 | $5,850 | $33,080 |

| 2014 | $2,694 | $38,930 | $5,850 | $33,080 |

| 2013 | $124 | $3,605 | $3,605 | $0 |

Source: Public Records

Map

Nearby Homes

- 267 Brueghel Rd

- 8002 Overmont Ridge Rd

- 7991 Windsome Ct

- 301 Piney Creek Dr Unit 35

- 399 Dysar Run Dr Unit 28

- 370 Piney Creek Dr Unit 32

- 311 Hemlock Ravine Dr

- 326 Silver Maple Dr Unit 326

- 8253 Deering Oaks Dr Unit 8253

- 295 Pristine Path

- 7883 Grandlin Park Ct

- 545 River Pebble Dr

- 7831 Fairfax Loop Dr

- 7963 Brianna Dr

- 386 Douglasfir Dr Unit 386

- 8350 Hickory Overlook Unit 8350

- 98 Green Mill Unit 98

- 547 Marcum Rd

- 380 Oxford Oak Dr Unit 380

- 388 Oxford Oak Dr Unit 388

- 8006 Overmont Ridge Dr

- 8002 Overmont Ridge Dr

- 8014 Overmont Ridge Dr

- 8018 Overmont Ridge Dr

- 7996 Overmont Ridge Rd

- 7992 Overmont Ridge Rd

- 7988 Overmont Ridge Dr

- 203 Bollingen Unit 203

- 211 Bollingen

- 207 Bollingen

- 215 Bollingen

- 7980 Overmont Ridge Rd

- 241 Bollingen Unit 241

- 233 Bollingen

- 253 Bollingen Unit 253

- 206 Bollingen

- 245 Bollingen

- 256 Brueghel Unit 256

- 200 Brueghel Rd

- 214 Bollingen