8050 Cortona Dr Unit 24 Castillo Myrtle Beach, SC 29572

Grande Dunes NeighborhoodEstimated Value: $1,063,000 - $1,260,000

3

Beds

3

Baths

3,350

Sq Ft

$347/Sq Ft

Est. Value

About This Home

This home is located at 8050 Cortona Dr Unit 24 Castillo, Myrtle Beach, SC 29572 and is currently estimated at $1,163,079, approximately $347 per square foot. 8050 Cortona Dr Unit 24 Castillo is a home located in Horry County with nearby schools including Myrtle Beach Child Development Center, Myrtle Beach Primary School, and Myrtle Beach Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2019

Sold by

Spinazzola John R

Bought by

Overacre Jack R and Overacre Judy T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$484,000

Outstanding Balance

$425,522

Interest Rate

4.3%

Mortgage Type

New Conventional

Estimated Equity

$737,557

Purchase Details

Closed on

Feb 16, 2010

Sold by

Bishop George David

Bought by

Spinazzola John R

Purchase Details

Closed on

Dec 15, 2003

Sold by

Seacoast Communities Inc

Bought by

Bishop Dorothy J

Purchase Details

Closed on

Dec 4, 2002

Sold by

Grande Dunes Development Co Ll

Bought by

Seacoast Communities Inc

Purchase Details

Closed on

Dec 21, 2000

Sold by

Grande Dunes Development Company Llc

Bought by

City Of Myrtle Beach

Purchase Details

Closed on

Feb 14, 2000

Sold by

Myrtle Beach Farms Company Inc

Bought by

Grande Dunes Development Company Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Overacre Jack R | $615,000 | -- | |

| Spinazzola John R | $564,000 | -- | |

| Bishop Dorothy J | $802,609 | -- | |

| Seacoast Communities Inc | $163,000 | -- | |

| City Of Myrtle Beach | -- | -- | |

| Grande Dunes Development Company Llc | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Overacre Jack R | $484,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,106 | $87,052 | $45,776 | $41,276 |

| 2023 | $11,106 | $37,928 | $17,714 | $20,214 |

| 2021 | $10,249 | $37,928 | $17,714 | $20,214 |

| 2020 | $9,775 | $37,928 | $17,714 | $20,214 |

| 2019 | $11,256 | $43,676 | $17,714 | $25,962 |

| 2018 | $2,046 | $28,558 | $10,462 | $18,096 |

| 2017 | $1,989 | $28,558 | $10,462 | $18,096 |

| 2016 | -- | $28,558 | $10,462 | $18,096 |

| 2015 | $1,971 | $28,558 | $10,462 | $18,096 |

| 2014 | $1,775 | $28,558 | $10,462 | $18,096 |

Source: Public Records

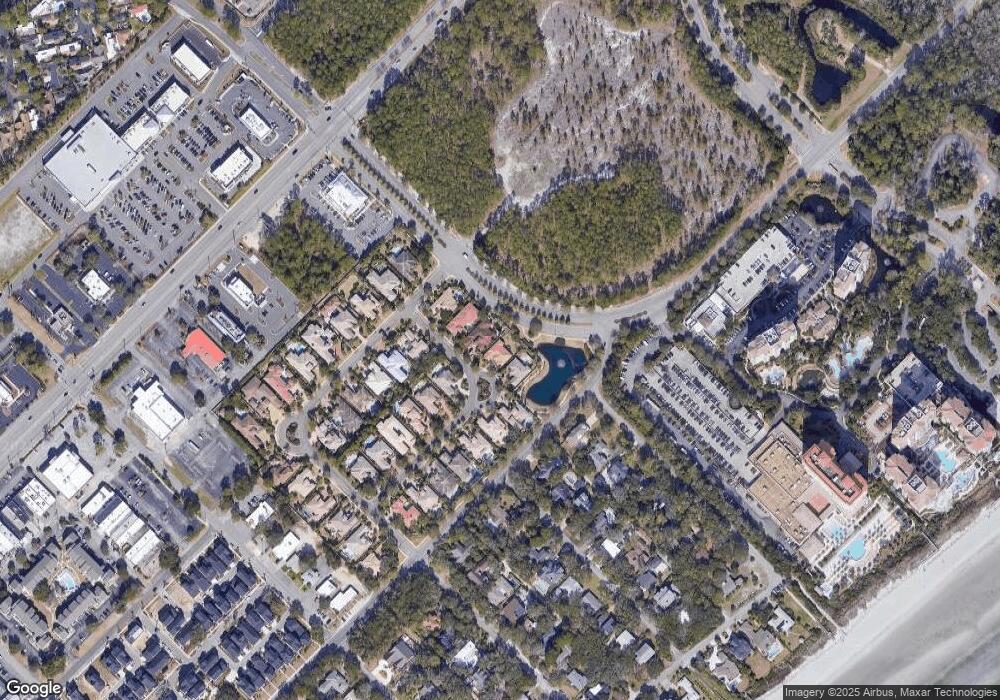

Map

Nearby Homes

- 215 82nd Ave N

- GRAHAM Plan at Beach View at Grande Dunes

- LAWRENCE Plan at Beach View at Grande Dunes

- KINGSTON Plan at Beach View at Grande Dunes

- FLETCHER Plan at Beach View at Grande Dunes

- HAYDEN Plan at Beach View at Grande Dunes

- 8411 Flamingo Ct

- 8411 Flamingo Ct Unit 7

- 8000 Beach Dr

- 8409 Flamingo Ct Unit 6

- Avery Plan at Promenade at Grande Dunes

- Haywood Plan at Promenade at Grande Dunes

- Warren Plan at Promenade at Grande Dunes

- 212 78th Ave N

- 8461 Waltzing Waves Ct Unit 24

- 8461 Waltzing Ct

- 8465 Waltzing Waves Ct

- 8465 Waltzing Waves Ct Unit 26

- 7700 Porcher Dr Unit 3305

- 7700 Porcher Dr Unit 3207

- 8050 Cortona Dr

- 8056 Cortona Dr Unit 25 Castillo Del Mar

- 8044 Cortona Dr

- 8062 Cortona Dr Unit 26 Castillo del Mar

- 8062 Cortona Dr Unit Castillo Del Mar

- 8062 Cortona Dr

- 8040 Cortona Dr

- 8051 Cortona Dr

- 8068 Cortona Dr Unit Castillo Del Mar, Lo

- 8068 Cortona Dr Unit 27 Castillo del Mar

- 8034 Cortona Dr

- 8034 Cortona Dr Unit 21 Castillo Del Mar

- 8027 Cortona Dr Unit Castillo Del Mar

- 8027 Cortona Dr

- 8076 Verona Dr

- 8076 Verona Dr Unit 28 Castillo Del Mar

- 8028 Cortona Dr Unit 20 Castillo del Mar

- 8172 N Ocean Blvd

- 8070 Verona Dr Unit 29 Castillo del Mar

- 8070 Verona Dr