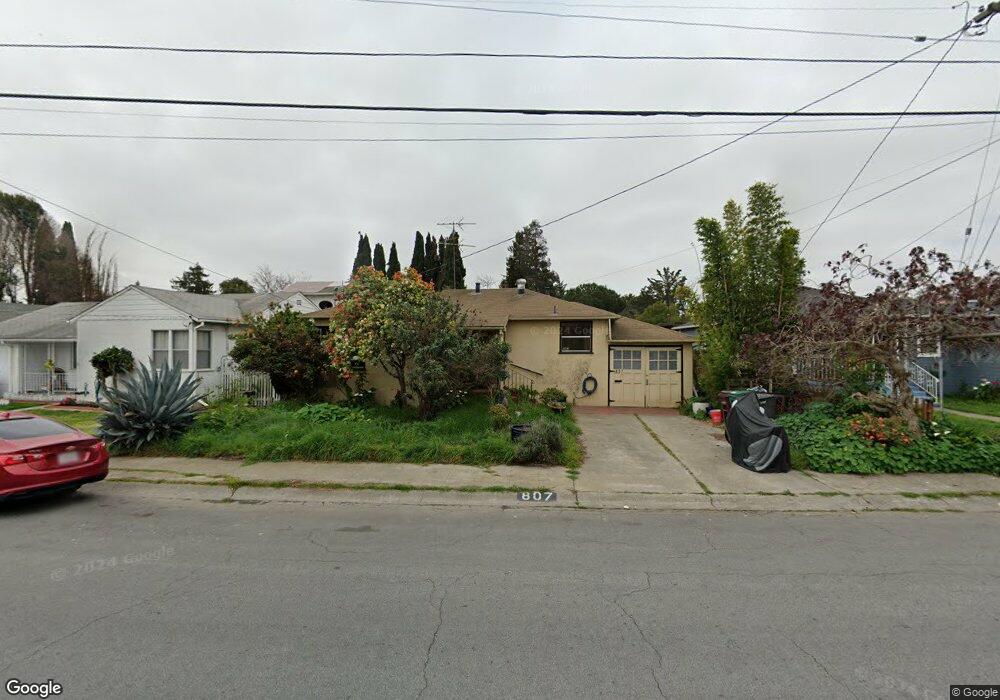

807 Paradise Blvd Hayward, CA 94541

Estimated Value: $567,000 - $629,775

2

Beds

1

Bath

808

Sq Ft

$739/Sq Ft

Est. Value

About This Home

This home is located at 807 Paradise Blvd, Hayward, CA 94541 and is currently estimated at $597,194, approximately $739 per square foot. 807 Paradise Blvd is a home located in Alameda County with nearby schools including Colonial Acres Elementary School, Edendale Middle, and San Lorenzo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2008

Sold by

Lasalle Bank National Association

Bought by

Thurlow Ralph W and Spiher David J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

5.01%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 18, 2008

Sold by

Rodriguez Julio

Bought by

Lasalle Bank Na and Ownit Mortgage Loan Trust Mortgage Loan

Purchase Details

Closed on

Aug 25, 2006

Sold by

Rodriguez Julio

Bought by

Rodriguez Julio and Rodriguez Delfino

Purchase Details

Closed on

Jun 21, 2006

Sold by

Palko Patrick P and Palko Lillian L

Bought by

Rodriguez Julio

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$419,200

Interest Rate

7.12%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 2, 2000

Sold by

Palko Patrick P and Palko Lillian

Bought by

Palko Patrick P and Palko Lillian L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thurlow Ralph W | $200,000 | Chicago Title Company | |

| Lasalle Bank Na | $369,000 | None Available | |

| Rodriguez Julio | -- | None Available | |

| Rodriguez Julio | $524,000 | Alliance Title Company | |

| Palko Patrick P | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Thurlow Ralph W | $160,000 | |

| Previous Owner | Rodriguez Julio | $419,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,067 | $250,533 | $77,260 | $180,273 |

| 2024 | $4,067 | $245,485 | $75,745 | $176,740 |

| 2023 | $3,706 | $247,535 | $74,260 | $173,275 |

| 2022 | $3,892 | $235,683 | $72,805 | $169,878 |

| 2021 | $3,530 | $230,925 | $71,377 | $166,548 |

| 2020 | $3,444 | $235,487 | $70,646 | $164,841 |

| 2019 | $3,435 | $230,871 | $69,261 | $161,610 |

| 2018 | $3,202 | $226,345 | $67,903 | $158,442 |

| 2017 | $3,059 | $221,907 | $66,572 | $155,335 |

| 2016 | $2,914 | $217,557 | $65,267 | $152,290 |

| 2015 | $2,848 | $214,291 | $64,287 | $150,004 |

| 2014 | $2,805 | $210,095 | $63,028 | $147,067 |

Source: Public Records

Map

Nearby Homes

- 19641 Medford Cir Unit 5

- 1470 171st Ave

- 16931 Melody Way

- 1530 172nd Ave

- 1560 170th Ave

- 18905 Standish Ave

- 263 Medford Ave

- 550 Blossom Way

- 20919 Locust St Unit K

- 20923 Haviland Ave

- 17324 Ehle St

- 823 Blossom Way

- 16557 E 14th St

- 16829 Daryl Ave

- 641 Jordan Way

- 1510 165th Ave

- 436 Grove Way

- 17220 Robey Dr

- 19539 Meekland Ave

- 17779 Rainier Ave

- 785 Paradise Blvd

- 815 Paradise Blvd

- 779 Paradise Blvd

- 823 Paradise Blvd

- 773 Paradise Blvd

- 831 Paradise Blvd

- 19050 Hampton Place

- 19050 Hampton Place

- 808 Paradise Blvd

- 19049 Hampton Place

- 816 Paradise Blvd

- 17577 Langton Way

- 767 Paradise Blvd

- 786 Paradise Blvd

- 839 Paradise Blvd

- 824 Paradise Blvd

- 19100 Hampton Place

- 19100 Hampton Place

- 780 Paradise Blvd

- 761 Paradise Blvd