8109 Paradiso Ct Littleton, CO 80125

Estimated Value: $3,213,834 - $4,367,000

5

Beds

6

Baths

5,332

Sq Ft

$716/Sq Ft

Est. Value

About This Home

This home is located at 8109 Paradiso Ct, Littleton, CO 80125 and is currently estimated at $3,817,611, approximately $715 per square foot. 8109 Paradiso Ct is a home located in Douglas County with nearby schools including Roxborough Elementary School, Roxborough Intermediate School, and Ranch View Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2008

Sold by

Sanders Cheryl L and Sanders Scott J

Bought by

Miller Bryan and Miller Marcy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,500,000

Outstanding Balance

$973,307

Interest Rate

6.1%

Mortgage Type

Unknown

Estimated Equity

$2,844,304

Purchase Details

Closed on

Jan 4, 2007

Sold by

River Canyon Real Estate Investments Llc

Bought by

Sanders Cheryl L and Sanders Scott J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,500,000

Interest Rate

5.87%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller Bryan | $2,365,000 | Land Title Guarantee Company | |

| Sanders Cheryl L | $545,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Miller Bryan | $1,500,000 | |

| Previous Owner | Sanders Cheryl L | $1,500,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $42,132 | $274,720 | $40,120 | $234,600 |

| 2023 | $42,315 | $274,720 | $40,120 | $234,600 |

| 2022 | $29,082 | $170,850 | $30,870 | $139,980 |

| 2021 | $30,208 | $170,850 | $30,870 | $139,980 |

| 2020 | $25,601 | $148,550 | $32,480 | $116,070 |

| 2019 | $25,682 | $148,550 | $32,480 | $116,070 |

| 2018 | $27,656 | $25,000 | $25,000 | $0 |

| 2017 | $24,839 | $157,750 | $25,000 | $132,750 |

| 2016 | $26,568 | $173,800 | $27,460 | $146,340 |

| 2015 | $12,853 | $173,800 | $27,460 | $146,340 |

| 2014 | $11,295 | $113,440 | $22,890 | $90,550 |

Source: Public Records

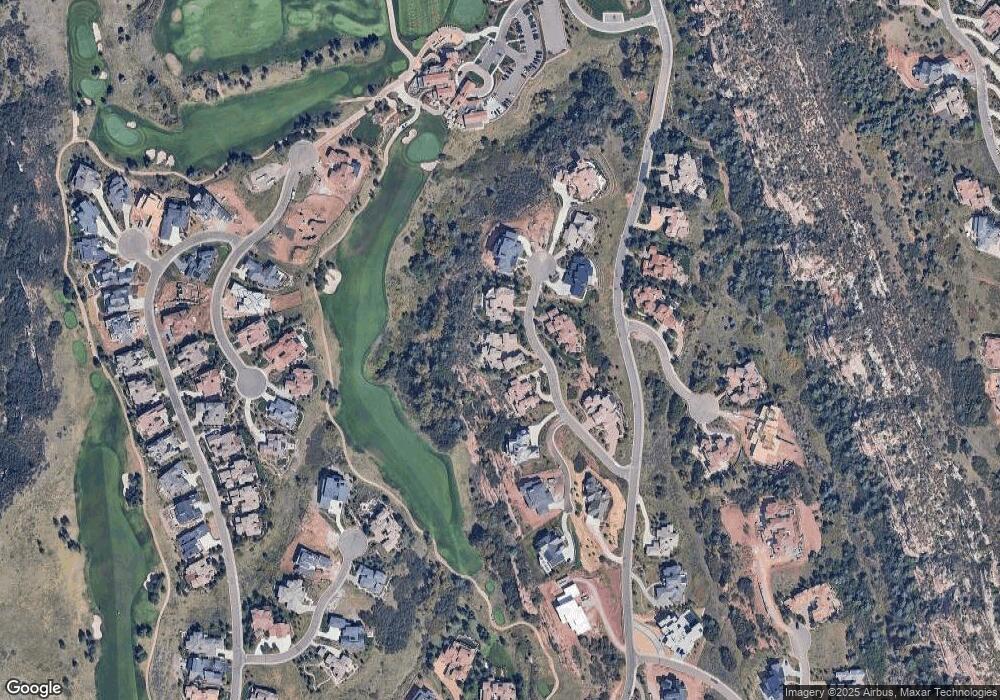

Map

Nearby Homes

- 8189 Paradiso Ct

- 7944 Dante Dr

- 8182 Palladio Ct

- 11364 Birolli Place

- 8193 Palladio Ct

- 8056 Galileo Way Unit 37253775

- 11374 Birolli Place

- 8002 Galileo Way

- 7935 Dante Dr

- 11415 Birolli Place

- 8095 Galileo Way

- 11160 Dolce Vita Place Unit 1

- 11160 Dolce Vita Place

- 7912 Galileo Way

- 8103 Raphael Ln

- 7868 Cicero Ct

- 8077 Raphael Ln

- 8122 Raphael Ln

- 7767 Dante Dr

- 8326 Raphael Ln

- 8091 Paradiso Ct

- 8131 Paradiso Ct

- 8108 Paradiso Ct

- 8073 Paradiso Ct

- 8153 Paradiso Ct

- 8152 Paradiso Ct

- 8066 Paradiso Ct

- 8189 Paradiso Ct Unit 108

- 8061 Paradiso Ct

- 7972 Dante Dr

- 8080 Palladio Ct

- 8196 Paradiso Ct

- 11342 Birolli Place

- 8069 Paradiso Ct

- 8086 Palladio Ct

- 11347 Birolli Place

- 8074 Palladio Ct

- 8200 Dante Dr

- 8204 Palladio Ct

- 8100 Palladio Ct