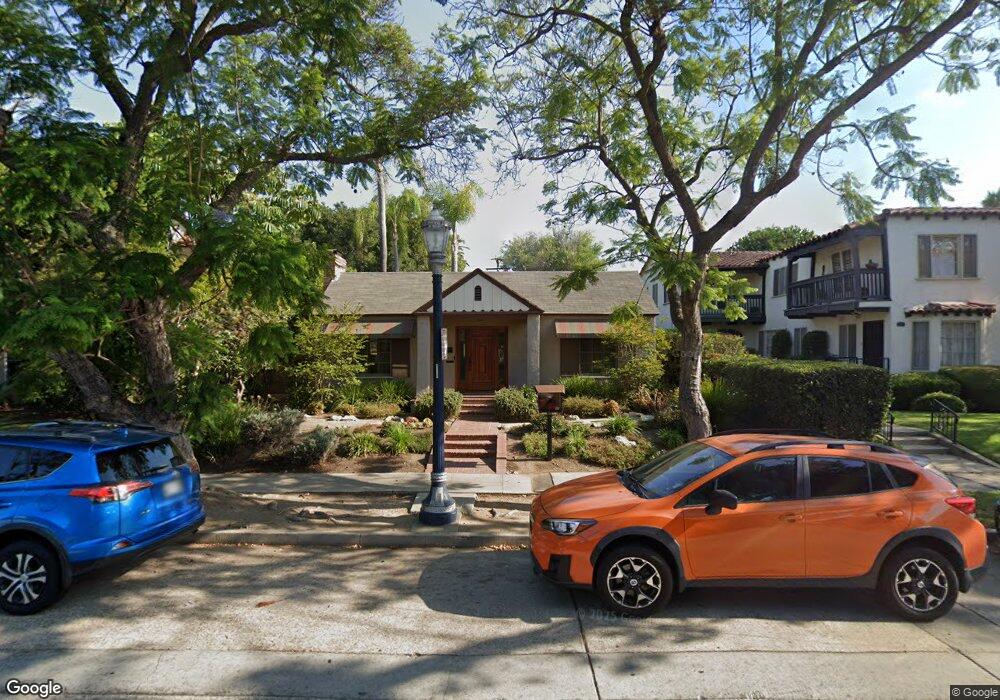

821 E 36th St Long Beach, CA 90807

California Heights NeighborhoodEstimated Value: $1,046,000 - $1,407,000

3

Beds

3

Baths

2,015

Sq Ft

$593/Sq Ft

Est. Value

About This Home

This home is located at 821 E 36th St, Long Beach, CA 90807 and is currently estimated at $1,194,642, approximately $592 per square foot. 821 E 36th St is a home located in Los Angeles County with nearby schools including Longfellow Elementary School, Hughes Middle School, and Long Beach Polytechnic High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 9, 2025

Sold by

Wener Nadine

Bought by

Wener Trust and Wener

Current Estimated Value

Purchase Details

Closed on

Feb 16, 2010

Sold by

Wener Nadine

Bought by

Nadine Wener Revocable Living Trust

Purchase Details

Closed on

Aug 13, 2008

Sold by

Gonzalez Wladimir Arturo

Bought by

Wener Nadine

Purchase Details

Closed on

Jul 25, 2008

Sold by

Leonardo Zeus and Hunter Margaret

Bought by

Wener Nadine

Purchase Details

Closed on

Sep 17, 2001

Sold by

Gazdik John P and Kacer Barbara A

Bought by

Leonardo Zeus

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Interest Rate

6.9%

Purchase Details

Closed on

Aug 3, 1995

Sold by

Heuvel Marion Vanden and Breglio Marion J

Bought by

Breglio James F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wener Trust | -- | None Listed On Document | |

| Wener Nadine | -- | None Listed On Document | |

| Nadine Wener Revocable Living Trust | -- | None Available | |

| Wener Nadine | -- | Fidelity National Title Co | |

| Wener Nadine | $540,000 | Fidelity National Title Co | |

| Leonardo Zeus | $375,000 | North American Title Co | |

| Breglio James F | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Leonardo Zeus | $275,000 | |

| Closed | Leonardo Zeus | $62,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,812 | $695,378 | $556,308 | $139,070 |

| 2024 | $8,812 | $681,744 | $545,400 | $136,344 |

| 2023 | $8,665 | $668,377 | $534,706 | $133,671 |

| 2022 | $8,133 | $655,272 | $524,222 | $131,050 |

| 2021 | $7,968 | $642,425 | $513,944 | $128,481 |

| 2019 | $7,852 | $623,372 | $498,701 | $124,671 |

| 2018 | $7,631 | $611,150 | $488,923 | $122,227 |

| 2016 | $7,012 | $587,421 | $469,939 | $117,482 |

| 2015 | $6,729 | $578,599 | $462,881 | $115,718 |

| 2014 | $6,679 | $567,266 | $453,814 | $113,452 |

Source: Public Records

Map

Nearby Homes

- 3581 Olive Ave

- 3435 Olive Ave

- 3725 Lime Ave

- 3605 Cerritos Ave

- 3565 Linden Ave Unit 255

- 3565 Linden Ave

- 3565 Linden Ave Unit 323

- 3565 Linden Ave Unit 226

- 3360 Myrtle Ave

- 3654 Cerritos Ave

- 3736 Lemon Ave

- 1168 E 37th St

- 3454 Cerritos Ave

- 3368 Linden Ave

- 3667 Elm Ave

- 3805 Linden Ave

- 3580 Gundry Ave

- 3905 California Ave

- 3403 Falcon Ave

- 3727 Walnut Ave

- 825 E 36th St

- 811 E 36th St Unit 15

- 811 E 36th St

- 815 E 36th St

- 817 E 36th St Unit 15

- 839 E 36th St

- 801 E 36th St

- 3610 Olive Ave

- 3616 Olive Ave

- 3615 Myrtle Ave

- 802 E 36th St

- 824 E 36th St

- 3595 Myrtle Ave

- 3620 Olive Ave

- 3619 Myrtle Ave

- 3590 Olive Ave

- 3585 Myrtle Ave

- 3601 Olive Ave

- 3624 Olive Ave

- 3625 Myrtle Ave