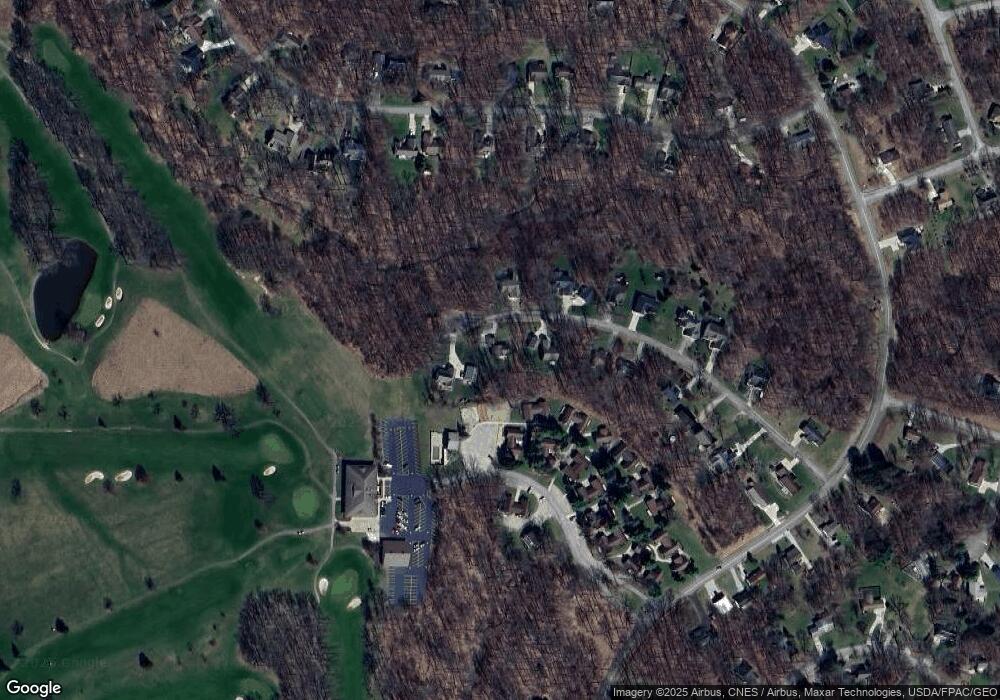

83 Valley Ct Howard, OH 43028

Apple Valley NeighborhoodEstimated Value: $259,000 - $290,000

3

Beds

1

Bath

1,232

Sq Ft

$221/Sq Ft

Est. Value

About This Home

This home is located at 83 Valley Ct, Howard, OH 43028 and is currently estimated at $272,808, approximately $221 per square foot. 83 Valley Ct is a home located in Knox County with nearby schools including East Knox Elementary School and East Knox High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2017

Sold by

Boggs Julia L and Boggs Brody

Bought by

Teeples Mark A and Teeples Erin L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,494

Outstanding Balance

$124,741

Interest Rate

3.96%

Mortgage Type

New Conventional

Estimated Equity

$148,067

Purchase Details

Closed on

Dec 7, 2012

Sold by

Gantt Christopher A and Gantt Julia L

Bought by

Gantt Julia L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,379

Interest Rate

3.25%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 26, 2007

Sold by

Obrien Shaun and Obrien Danielle

Bought by

Gantt Christopher A and Gantt Julia L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

6.16%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 24, 2000

Sold by

Avsec Martin J and Avsec Terese L

Bought by

O'Brien Shaun and O'Brien Danielle

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Teeples Mark A | $148,000 | None Available | |

| Gantt Julia L | -- | None Available | |

| Gantt Christopher A | $93,750 | None Available | |

| O'Brien Shaun | $7,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Teeples Mark A | $149,494 | |

| Previous Owner | Gantt Julia L | $114,379 | |

| Previous Owner | Gantt Christopher A | $125,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,818 | $70,160 | $5,460 | $64,700 |

| 2023 | $2,818 | $70,160 | $5,460 | $64,700 |

| 2022 | $2,329 | $49,760 | $3,870 | $45,890 |

| 2021 | $2,329 | $49,760 | $3,870 | $45,890 |

| 2020 | $2,218 | $49,760 | $3,870 | $45,890 |

| 2019 | $2,267 | $46,700 | $3,490 | $43,210 |

| 2018 | $2,122 | $46,700 | $3,490 | $43,210 |

| 2017 | $2,103 | $46,700 | $3,490 | $43,210 |

| 2016 | $1,977 | $43,240 | $3,230 | $40,010 |

| 2015 | $1,799 | $43,240 | $3,230 | $40,010 |

| 2014 | $1,802 | $43,240 | $3,230 | $40,010 |

| 2013 | $1,842 | $41,950 | $3,940 | $38,010 |

Source: Public Records

Map

Nearby Homes

- 2204 Apple Valley Dr

- 305 Apple Hill S

- 2406 Apple Valley Dr

- 116 Heatherwood Dr

- 865 Terrace View Dr

- 2422 Apple Valley Dr

- 657 Valleywood Heights Dr

- 434 Orchid Ct

- 956 Valleywood Heights Dr

- 577 Floral Valley Dr W

- 151 Heatherwood Dr

- 729 Valleywood Heights Dr

- 480 Baldwin Hgts Cir

- 480 Baldwin Heights Cir

- 916 Valleywood Heights Dr

- 745 Valleywood Heights Dr

- 843 Country Club Dr

- 741 Floral Valley Dr E

- 2527 Apple Valley Dr

- 229 Green Valley Dr

- 91 Valley Ct

- Lot 46 Fairway Hills

- 82 Valley Ct

- 428 Clubhouse Dr

- 74 Valley Ct

- 39 Valley Ct

- 63 Valley Ct

- 66 Valley Ct

- 66 Valley Ct

- Lot 36 Fairway Hills Subdivision

- 62 Valley Ct

- 51 Valley Ct

- 0 Valley Ct Unit 2600969

- 0 Valley Ct Unit Lot34 2324604

- 0 Valley Ct Unit 224005075

- 0 Valley Ct Unit 223004009

- 0 Valley Ct Unit Lot 46 2814121

- 0 Valley Ct Unit 2830256

- 0 Valley Ct Unit 217024635

- 0 Valley Ct Unit 20100554