8315 Bridledale Cir Lenexa, KS 66220

Estimated Value: $708,000 - $785,866

3

Beds

4

Baths

3,062

Sq Ft

$244/Sq Ft

Est. Value

About This Home

This home is located at 8315 Bridledale Cir, Lenexa, KS 66220 and is currently estimated at $748,467, approximately $244 per square foot. 8315 Bridledale Cir is a home located in Johnson County with nearby schools including Manchester Park Elementary School, Prairie Trail Middle School, and Olathe Northwest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2002

Sold by

Stull Wayne A

Bought by

Stull Wayne A and Stull Sally W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$223,000

Interest Rate

5.42%

Purchase Details

Closed on

Sep 26, 2001

Sold by

Stull Wayne A

Bought by

Stull Wayne A and Stull Sally W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,000

Interest Rate

6.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stull Wayne A | -- | Realty Title Company | |

| Stull Wayne A | -- | Realty Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Stull Wayne A | $223,000 | |

| Closed | Stull Wayne A | $225,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,670 | $78,511 | $17,216 | $61,295 |

| 2023 | $9,479 | $75,750 | $16,355 | $59,395 |

| 2022 | $9,235 | $71,990 | $16,355 | $55,635 |

| 2021 | $8,244 | $61,226 | $14,260 | $46,966 |

| 2020 | $7,742 | $56,925 | $14,260 | $42,665 |

| 2019 | $8,041 | $58,708 | $13,163 | $45,545 |

| 2018 | $8,028 | $57,972 | $13,163 | $44,809 |

| 2017 | $7,611 | $53,762 | $10,974 | $42,788 |

| 2016 | $7,085 | $51,175 | $10,917 | $40,258 |

| 2015 | $6,163 | $44,471 | $10,917 | $33,554 |

| 2013 | -- | $38,974 | $10,917 | $28,057 |

Source: Public Records

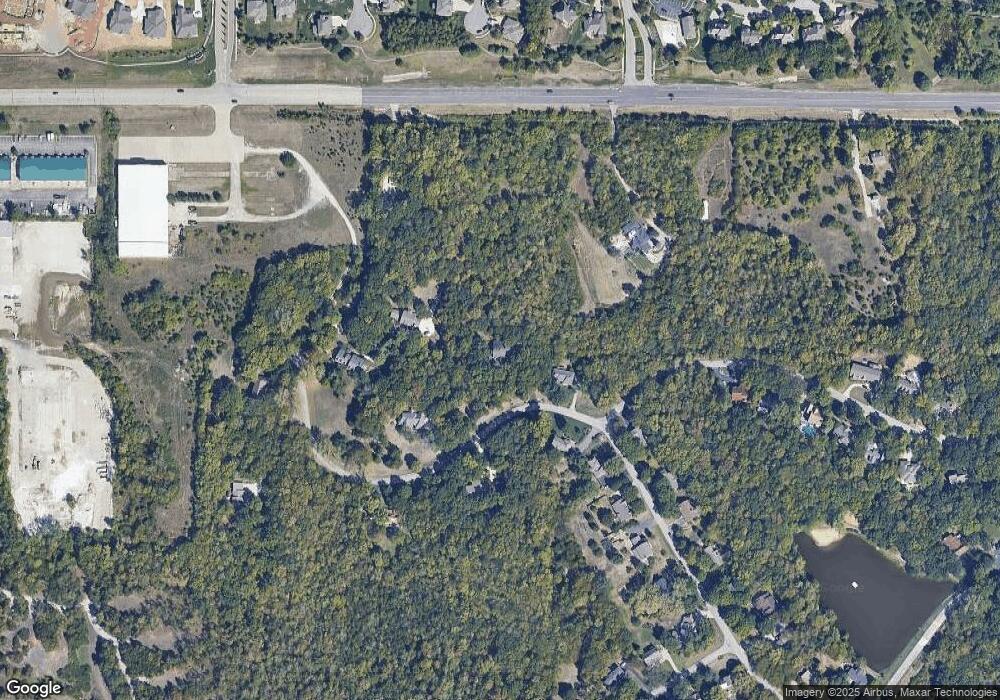

Map

Nearby Homes

- 21921 W 82nd Terrace

- 8164 Roundtree St

- 8160 Roundtree St

- 8211 Aurora St

- 8207 Aurora St

- 8212 Aurora St

- 8208 Aurora St

- 8181 Valley Rd

- 21920 W 82nd Terrace

- The Brookridge IV Plan at Bristol Highlands - The Estates

- The Courtland Reverse Plan at Bristol Highlands - The Estates

- The Madison II Plan at Bristol Highlands - The Estates

- 8005 Millridge St

- Sonoma 3-car Plan at Bristol Highlands - The Villas

- Hampshire Plan at Bristol Highlands - The Villas

- 21615 W 80th Terrace

- 8214 Aurora St

- 8217 Aurora St

- 8209 Aurora St

- 8213 Aurora St

- 8315 Bridle Dale Cir

- 8335 Bridledale St

- 21585 W 83rd St

- 8303 Bridledale Cir

- 8342 Bridledale St

- 8301 Bridle Dale Cir

- 8306 Bridledale Cir

- 8301 Bridledale Cir

- 8408 Bridledale St

- 8408 Bridle Dale St

- 8409 Bridledale St

- 21425 W 83rd St

- 21615 W 83rd St

- 8412 Bridledale St

- 8304 Bridledale Cir

- 8413 Bridledale St

- 8416 Bridledale St

- 21301 Bittersweet Dr

- 8416 Bridle Dale St

- 8417 Bridledale St