8379 Orchard Knoll Ln Unit 8379 Columbus, OH 43235

Olentangy High Bluffs NeighborhoodEstimated Value: $253,415 - $280,000

2

Beds

2

Baths

1,052

Sq Ft

$256/Sq Ft

Est. Value

About This Home

This home is located at 8379 Orchard Knoll Ln Unit 8379, Columbus, OH 43235 and is currently estimated at $268,854, approximately $255 per square foot. 8379 Orchard Knoll Ln Unit 8379 is a home located in Franklin County with nearby schools including Worthington Hills Elementary School, McCord Middle School, and Worthington Kilbourne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 9, 2024

Sold by

Michael Ruth E

Bought by

Chrisman Crystal S

Current Estimated Value

Purchase Details

Closed on

Apr 28, 2011

Sold by

Hamann Pamela S and Hamann David A

Bought by

Michael Ruth E

Purchase Details

Closed on

Feb 25, 2011

Sold by

Estate Of Sue F Scott

Bought by

Hamann Pamela S

Purchase Details

Closed on

May 23, 2008

Sold by

Estate Of Dean E Scott

Bought by

Scott Sue E

Purchase Details

Closed on

Oct 3, 2007

Sold by

Homsher Martha B and Estate Of Alice Claire Hoos

Bought by

Scott Dean E and Scott Sue E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 27, 1997

Sold by

Mid Ohio Development Corp

Bought by

Hoos Claire

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chrisman Crystal S | -- | Search2close | |

| Michael Ruth E | $118,500 | Independent | |

| Hamann Pamela S | -- | None Available | |

| Scott Sue E | -- | None Available | |

| Scott Dean E | $135,000 | Attorney | |

| Hoos Claire | $114,900 | Transohio Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Scott Dean E | $85,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,303 | $63,600 | $6,480 | $57,120 |

| 2023 | $3,196 | $63,595 | $6,475 | $57,120 |

| 2022 | $2,636 | $44,380 | $7,140 | $37,240 |

| 2021 | $2,432 | $44,380 | $7,140 | $37,240 |

| 2020 | $2,343 | $44,380 | $7,140 | $37,240 |

| 2019 | $2,301 | $40,330 | $6,480 | $33,850 |

| 2018 | $1,115 | $40,330 | $6,480 | $33,850 |

| 2017 | $2,062 | $40,330 | $6,480 | $33,850 |

| 2016 | $2,229 | $40,150 | $6,020 | $34,130 |

| 2015 | $1,115 | $40,150 | $6,020 | $34,130 |

| 2014 | $2,229 | $40,150 | $6,020 | $34,130 |

| 2013 | $1,109 | $40,145 | $6,020 | $34,125 |

Source: Public Records

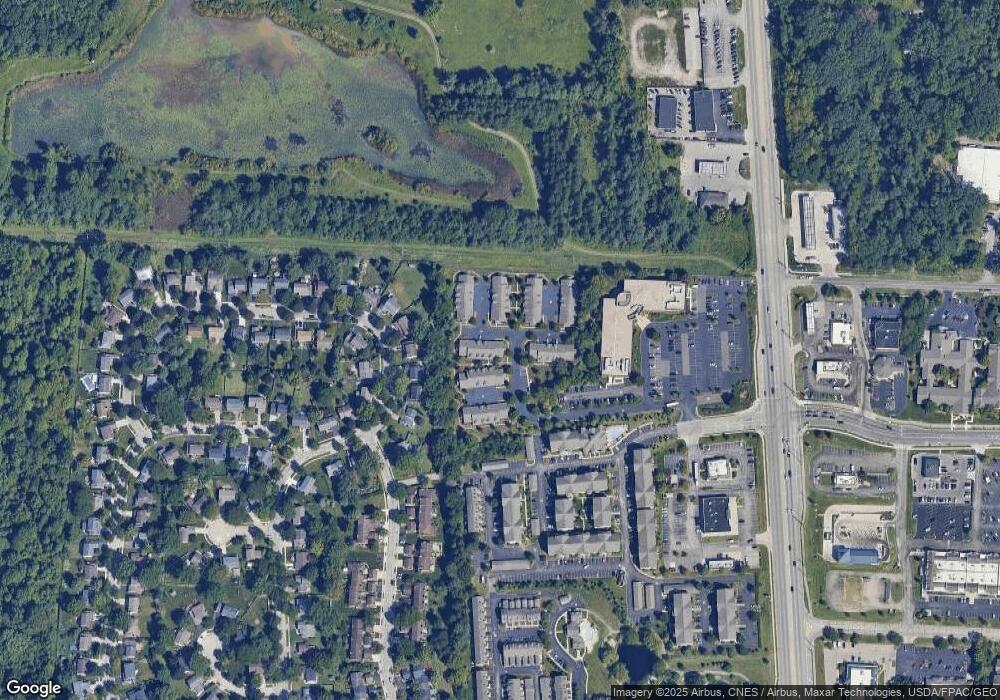

Map

Nearby Homes

- 8326 Bruntsfield Rd

- 128 Green Springs Dr

- 90 Northwoods Blvd Unit B

- 67 Highland Pointe Cir Unit 67

- 8749 Olenmead Dr

- 294 Lazelle Place Ln Unit Q294

- 45 Gold Meadow Dr

- 8747 Olenbrook Dr

- 8824 Rock Dove Rd

- 8750 Woodwind Dr

- 365 Cover Place

- 164 Cameron Ridge Dr Unit 164

- Fiona B Plan at Loch Lomond - Loch Lomond Hills

- 1474 Dogwood Loop

- Fiona A Plan at Loch Lomond - Loch Lomond Hills

- Fiona D Plan at Loch Lomond - Loch Lomond Hills

- Fiona C Plan at Loch Lomond - Loch Lomond Hills

- 1483 Dogwood Loop

- 0 Pocono Rd Unit 225030021

- 687 Sanville Dr

- 8381 Orchard Knoll Ln Unit 8381

- 8383 Orchard Knoll Ln Unit 8383

- 8414 Orchard Knoll Ln

- 8375 Orchard Knoll Ln

- 8373 Orchard Knoll Ln Unit 8373

- 8371 Orchard Knoll Ln Unit 8371

- 8416 Orchard Knoll Ln Unit 8416

- 8500 Nuthatch Way

- 8385 Orchard Knoll Ln Unit 8385

- 8410 Orchard Knoll Ln

- 8492 Nuthatch Way

- 8369 Orchard Knoll Ln Unit 8369

- 8506 Nuthatch Way

- 8418 Orchard Knoll Ln

- 8408 Orchard Knoll Ln

- 8486 Nuthatch Way

- 8406 Orchard Knoll Ln

- 8420 Orchard Knoll Ln

- 8355 Orchard Knoll Ln Unit 8355

- 8357 Orchard Knoll Ln Unit I8357