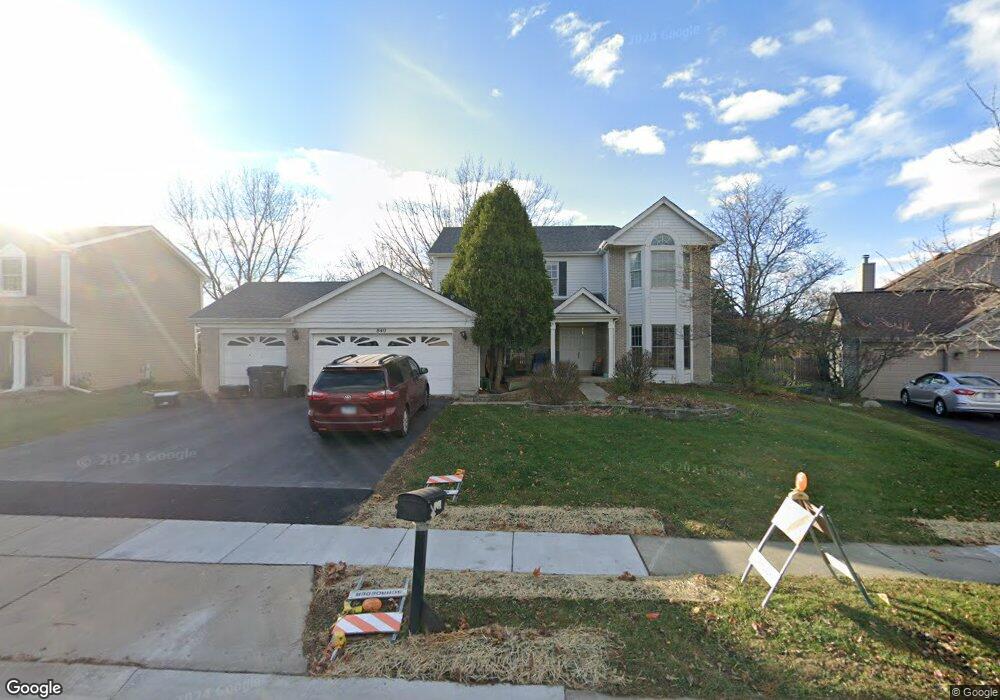

840 Bristol Dr Algonquin, IL 60102

High Hill Farms NeighborhoodEstimated Value: $428,648 - $565,000

4

Beds

3

Baths

2,598

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 840 Bristol Dr, Algonquin, IL 60102 and is currently estimated at $495,912, approximately $190 per square foot. 840 Bristol Dr is a home located in McHenry County with nearby schools including Westfield Community School, Kenneth E Neubert Elementary School, and Harry D Jacobs High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 23, 2012

Sold by

Cashen Donna J

Bought by

Cashen Daniel H

Current Estimated Value

Purchase Details

Closed on

Nov 12, 1998

Sold by

Mallon James E and Mallon Debra L

Bought by

Cashen Dan and Cashen Donna J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,400

Interest Rate

6.93%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Aug 24, 1995

Sold by

Wolf Gilbert R and Wolf Christine M

Bought by

Mallon James E and Mallon Debra L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,550

Interest Rate

7.76%

Purchase Details

Closed on

May 12, 1994

Sold by

First Bank National Assn

Bought by

Wolf Gilbert K and Wolf Christine M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,000

Interest Rate

8.48%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cashen Daniel H | -- | None Available | |

| Cashen Dan | $220,500 | -- | |

| Mallon James E | $219,500 | -- | |

| Wolf Gilbert K | $210,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Cashen Dan | $176,400 | |

| Previous Owner | Mallon James E | $197,550 | |

| Previous Owner | Wolf Gilbert K | $155,000 | |

| Closed | Cashen Dan | $33,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,926 | $134,892 | $24,144 | $110,748 |

| 2023 | $9,430 | $120,644 | $21,594 | $99,050 |

| 2022 | $9,783 | $120,073 | $21,044 | $99,029 |

| 2021 | $9,393 | $111,862 | $19,605 | $92,257 |

| 2020 | $9,150 | $107,902 | $18,911 | $88,991 |

| 2019 | $8,932 | $103,275 | $18,100 | $85,175 |

| 2018 | $8,522 | $95,405 | $16,721 | $78,684 |

| 2017 | $8,353 | $89,877 | $15,752 | $74,125 |

| 2016 | $8,234 | $84,297 | $14,774 | $69,523 |

| 2013 | -- | $82,046 | $13,783 | $68,263 |

Source: Public Records

Map

Nearby Homes

- 1820 Crofton Dr

- 741 Regal Ln

- 681 Majestic Dr

- 700 Fairfield Ln

- 2233 Dawson Ln Unit 312

- 1920 Jester Ln

- 1033 Interloch Ct Unit 32

- 2380 Dawson Ln Unit 165

- 1 N Hubbard St

- SWC Talaga and Algonquin Rd

- 18 Peach Tree Ct Unit 4154

- 000 County Line Rd

- 145 S Oakleaf Rd

- 1431 Essex St

- 7 Falcon Ridge Ct

- 1801 Arbordale Ln

- 721 Brentwood Ct

- 13 Brian Ct

- 1900 Waverly Ln

- 615 Harper Dr

- 850 Bristol Dr

- 830 Bristol Dr

- 751 Regal Ln

- 761 Regal Ln

- 841 Bristol Dr

- 820 Bristol Dr

- 1860 Crofton Dr

- 1870 Crofton Dr

- 851 Bristol Dr Unit 11

- 1 Regal Ct

- 810 Westbury Dr

- 861 Bristol Dr

- 1841 Westbury Dr

- 821 Westbury Dr

- 750 Regal Ln

- 1840 Crofton Dr

- 6 Regal Ct

- 800 Westbury Dr

- 740 Regal Ln

- 1831 Westbury Dr