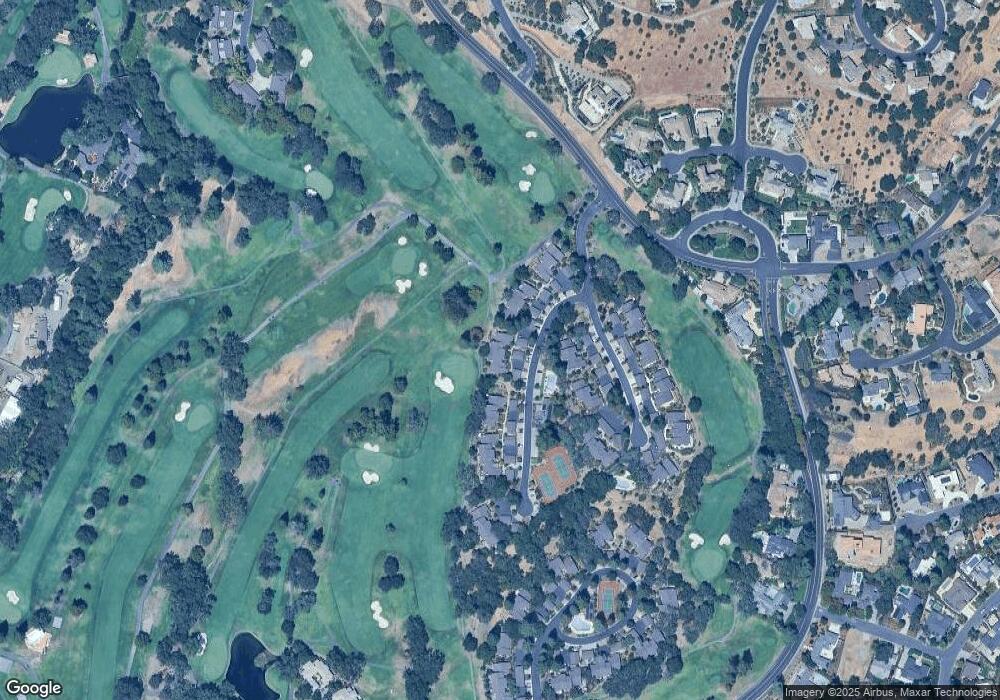

847 Acorn Way Unit 44 Napa, CA 94558

Silverado Resort NeighborhoodEstimated Value: $1,083,000 - $1,406,000

2

Beds

2

Baths

1,015

Sq Ft

$1,175/Sq Ft

Est. Value

About This Home

This home is located at 847 Acorn Way Unit 44, Napa, CA 94558 and is currently estimated at $1,192,389, approximately $1,174 per square foot. 847 Acorn Way Unit 44 is a home located in Napa County with nearby schools including Vichy Elementary School, Silverado Middle School, and Vintage High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 8, 2003

Sold by

Meadows Michael D and Meadows Susan

Bought by

Meadows Michael D and Meadows Susan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

5.18%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 3, 2000

Sold by

Heaney James A and Heaney Phyllis J

Bought by

Meadows Michael D and Coleman Susan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$385,000

Interest Rate

7.82%

Purchase Details

Closed on

May 12, 2000

Sold by

Heaney James A and Heaney Phyllis J

Bought by

Heaney James A and The James A Heany Revocable In

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meadows Michael D | -- | Chicago Title Co | |

| Meadows Michael D | $540,000 | First American Title Guarant | |

| Heaney James A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Meadows Michael D | $150,000 | |

| Closed | Meadows Michael D | $385,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,669 | $807,730 | $568,757 | $238,973 |

| 2023 | $9,669 | $792,089 | $557,605 | $234,484 |

| 2022 | $9,420 | $776,755 | $546,672 | $230,083 |

| 2021 | $9,310 | $761,721 | $535,953 | $225,768 |

| 2020 | $9,264 | $754,014 | $530,458 | $223,556 |

| 2019 | $9,086 | $739,426 | $520,057 | $219,369 |

| 2018 | $7,848 | $625,000 | $425,000 | $200,000 |

| 2017 | $7,089 | $560,000 | $355,000 | $205,000 |

| 2016 | $6,312 | $495,000 | $300,000 | $195,000 |

| 2015 | $5,594 | $460,000 | $280,000 | $180,000 |

| 2014 | $5,281 | $430,000 | $262,500 | $167,500 |

Source: Public Records

Map

Nearby Homes

- 848 Acorn Way

- 523 Westgate Dr

- 14 Maui Way

- 350 Deer Hollow Dr

- 1166 Castle Oaks Dr

- 833 Augusta Cir Unit 34

- 1167 Castle Oaks Dr

- 346 Deer Hollow Dr

- 164 Bonnie Brook Dr Unit 17

- 540 Westgate Dr

- 19 Gleneagle Cir

- 542 Westgate Dr

- 958 Augusta Cir

- 337 Alta Mesa Cir

- 2186 Monticello Rd

- 1600 Atlas Peak Rd Unit 432

- 1600 Atlas Peak Rd Unit 428

- 1600 Atlas Peak Rd Unit 224

- 1600 Atlas Peak Rd Unit 365

- 42 Fairways Dr

- 849 Acorn Way Unit 46

- 851 Acorn Way

- 846 Acorn Way

- 844 Acorn Way

- 843 Acorn Way

- 842 Acorn Way

- 841 Acorn Way

- 852 Acorn Way

- 853 Acorn Way

- 854 Acorn Way Unit 51

- 840 Acorn Way

- 898 Oak Leaf Way

- 855 Acorn Way

- 839 Acorn Way

- 899 Oak Leaf Way

- 856 Acorn Way Unit 53

- 895 Oak Leaf Way Unit 28

- 893 Oak Leaf Way

- 894 Oak Leaf Way