8470 Corlee Ln Middletown, OH 45042

Madison Township NeighborhoodEstimated Value: $145,000 - $177,000

2

Beds

1

Bath

780

Sq Ft

$204/Sq Ft

Est. Value

About This Home

This home is located at 8470 Corlee Ln, Middletown, OH 45042 and is currently estimated at $159,423, approximately $204 per square foot. 8470 Corlee Ln is a home located in Butler County with nearby schools including Madison High School, St. John XXIII Catholic School, and Germantown Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2022

Sold by

Jacobs Mark T and Jacobs Beverly

Bought by

Kemper Dani Leigh and Monroe Dakota Keith

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,444

Outstanding Balance

$138,096

Interest Rate

5.51%

Mortgage Type

New Conventional

Estimated Equity

$21,327

Purchase Details

Closed on

Nov 21, 2007

Sold by

Hud

Bought by

Jacobs Mark T and Jacobs Beverly

Purchase Details

Closed on

Oct 26, 2006

Sold by

First Horizon Home Loan Corp

Bought by

Hud

Purchase Details

Closed on

Aug 28, 2006

Sold by

Bowman David

Bought by

First Horizon Home Loan Corp

Purchase Details

Closed on

Aug 2, 2002

Sold by

Tolson Michael L and Tolson Brenda N

Bought by

Bowman David and Bowman Amy Elizabeth Susan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,632

Interest Rate

6.7%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 1, 1990

Purchase Details

Closed on

Nov 1, 1985

Purchase Details

Closed on

Oct 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kemper Dani Leigh | $143,000 | Page Gregory S | |

| Kemper Dani Leigh | $143,000 | None Listed On Document | |

| Jacobs Mark T | $30,000 | Lakeside Title & Escrow Agen | |

| Hud | $94,383 | None Available | |

| First Horizon Home Loan Corp | $94,383 | None Available | |

| Bowman David | $82,500 | Midland Title Security Inc | |

| -- | $43,900 | -- | |

| -- | $76,000 | -- | |

| -- | $38,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kemper Dani Leigh | $144,444 | |

| Closed | Kemper Dani Leigh | $144,444 | |

| Previous Owner | Bowman David | $81,632 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,374 | $33,300 | $7,990 | $25,310 |

| 2023 | $1,364 | $31,660 | $7,990 | $23,670 |

| 2022 | $1,110 | $22,840 | $7,990 | $14,850 |

| 2021 | $997 | $22,840 | $7,990 | $14,850 |

| 2020 | $1,037 | $22,840 | $7,990 | $14,850 |

| 2019 | $1,424 | $24,600 | $7,990 | $16,610 |

| 2018 | $1,204 | $24,600 | $7,990 | $16,610 |

| 2017 | $1,191 | $24,600 | $7,990 | $16,610 |

| 2016 | $1,680 | $23,600 | $7,990 | $15,610 |

| 2015 | $1,195 | $23,600 | $7,990 | $15,610 |

| 2014 | $1,699 | $23,600 | $7,990 | $15,610 |

| 2013 | $1,699 | $23,970 | $7,990 | $15,980 |

Source: Public Records

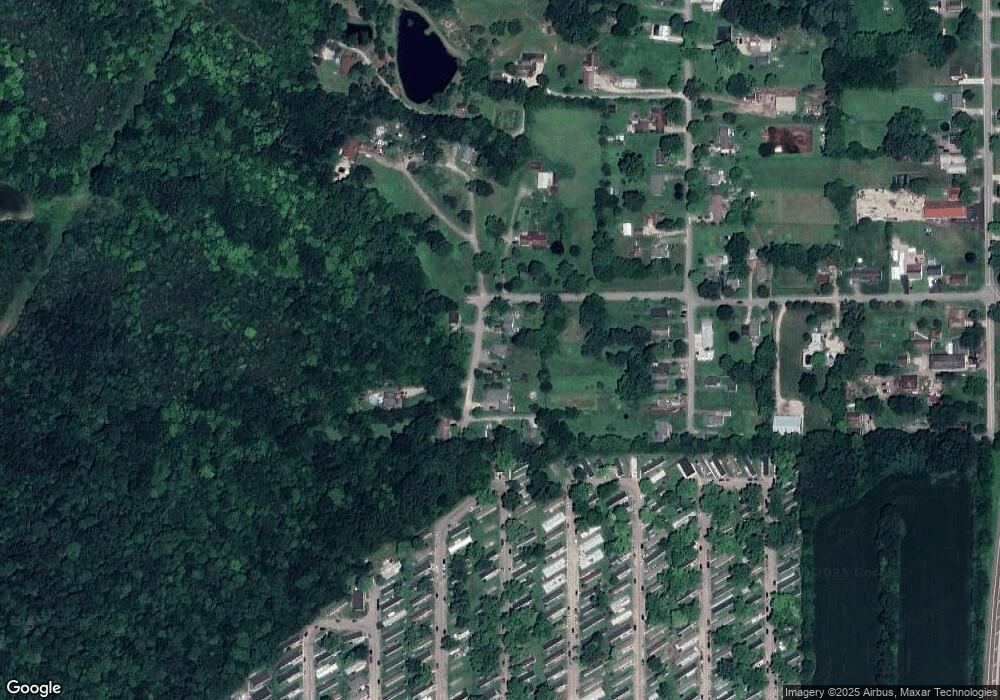

Map

Nearby Homes

- 8470 Corlee Rd

- 8384 Corlee Ln

- 6363 Germantown Rd

- 6339 Germantown Rd

- 8508 Thomas Rd

- 6104 Rivers Edge Dr

- 6110 Rivers Edge Dr

- 7943 Edgewater Dr

- 6987 Dalewood Dr

- 7331 Pinewood Dr

- 6828 Torrington Dr

- 8702 Windsong Ct

- 1721 Germantown Rd

- 8680 Plum Creek Ct

- 1816 Winona Dr

- 2981 Carmody Blvd

- 2985 Wilbraham Rd

- 2995 Carmody Blvd

- 7916 Middletown Germantown Rd

- 2810 N Verity Pkwy

- 8474 Corlee Ln

- 8468 Corlee Ln

- 8468 Corlee Rd

- 8474 Corlee Rd

- 8469 Corlee Ln

- 8476 Corlee Ln

- 8479 Corlee Ln

- 6617 Aljen Rd

- 6609 Aljen Rd

- 6623 Aljen Rd

- 6123 W Alexandria Rd

- 8445 Corlee Ln

- 8473 Corlee Ln

- 6613 Aljen Rd

- 6601 Aljen Rd

- 6641 Aljen Rd

- 8455 Corlee Ln

- 8455 Corlee Ln Unit 8463

- 8424 Corlee Ln

- 6610 Aljen Rd