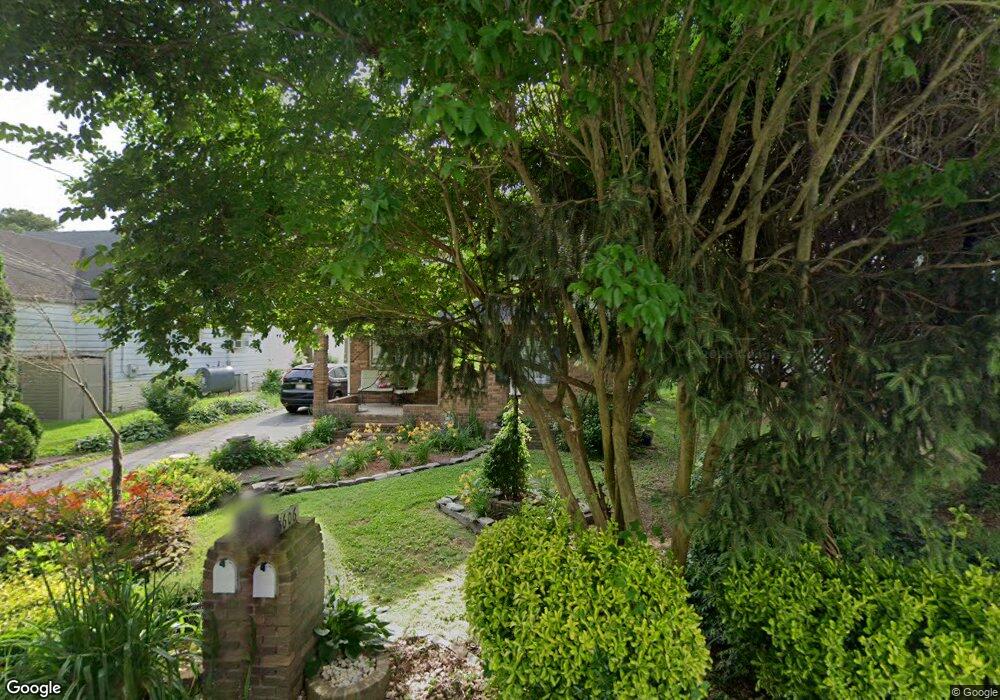

8606 Oak Rd Sparrows Point, MD 21219

Estimated Value: $351,000 - $421,000

Studio

1

Bath

1,491

Sq Ft

$260/Sq Ft

Est. Value

About This Home

This home is located at 8606 Oak Rd, Sparrows Point, MD 21219 and is currently estimated at $388,155, approximately $260 per square foot. 8606 Oak Rd is a home located in Baltimore County with nearby schools including Chesapeake Terrace Elementary School, Sparrows Point Middle School, and Sparrows Point High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2006

Sold by

Gerlach Adam W

Bought by

Mitsos Frank J and Mitsos Patricia M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,000

Outstanding Balance

$145,593

Interest Rate

8.99%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$242,562

Purchase Details

Closed on

Dec 14, 2005

Sold by

Gerlach Adam W

Bought by

Mitsos Frank J and Mitsos Patricia M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,000

Interest Rate

8.99%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 8, 2000

Sold by

Bentz Franklin T

Bought by

Gerlach Adam W and Gerlach Gail A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mitsos Frank J | $284,000 | -- | |

| Mitsos Frank J | $284,000 | -- | |

| Gerlach Adam W | $145,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mitsos Frank J | $227,000 | |

| Previous Owner | Mitsos Frank J | $227,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,280 | $276,433 | -- | -- |

| 2024 | $4,280 | $259,867 | $0 | $0 |

| 2023 | $2,055 | $243,300 | $75,600 | $167,700 |

| 2022 | $3,933 | $235,100 | $0 | $0 |

| 2021 | $3,760 | $226,900 | $0 | $0 |

| 2020 | $3,760 | $218,700 | $75,600 | $143,100 |

| 2019 | $3,510 | $214,567 | $0 | $0 |

| 2018 | $3,360 | $210,433 | $0 | $0 |

| 2017 | $3,187 | $206,300 | $0 | $0 |

| 2016 | $3,139 | $206,300 | $0 | $0 |

| 2015 | $3,139 | $206,300 | $0 | $0 |

| 2014 | $3,139 | $208,400 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 8610 Oak Rd

- 7708 S Cove Rd

- 2122 Lodge Forest Dr

- 2409 Woodridge Rd

- 2408 Woodridge Rd

- 2322 Lodge Forest Dr

- 2504 Oak Manor Rd

- 2217 Lodge Farm Rd

- 2926 Waterfront Way

- 0 Lodge Farm Rd

- 7428 Bay Front Rd

- 2400 Lincoln Ave Unit 2

- 2400 Lincoln Ave Unit 15

- 7349 Hughes Ave

- 2904 Shaws Rd

- 2318 Ruth Ave

- 2542 Sycamore Ave

- 7316A Hughes Ave

- 2636 Haddaway Rd

- 2524 Sycamore Ave