8656 Fresno Cir Unit 19 Huntington Beach, CA 92646

Southeast NeighborhoodEstimated Value: $808,000 - $1,111,000

3

Beds

2

Baths

1,287

Sq Ft

$745/Sq Ft

Est. Value

About This Home

This home is located at 8656 Fresno Cir Unit 19, Huntington Beach, CA 92646 and is currently estimated at $958,878, approximately $745 per square foot. 8656 Fresno Cir Unit 19 is a home located in Orange County with nearby schools including S.A. Moffett Elementary School, Isaac L. Sowers Middle School, and Edison High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 7, 2021

Sold by

Leopardo Robert M and Leopardo Jane E

Bought by

Zappala Joseph and Klett Carroll

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$676,000

Outstanding Balance

$610,699

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$348,179

Purchase Details

Closed on

May 9, 2002

Sold by

Hebert Marcella B

Bought by

Leopardo Robert M and Leopardo Jane E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,000

Interest Rate

6.83%

Purchase Details

Closed on

Oct 21, 1999

Sold by

Security Trust Company

Bought by

Hebert Raymond E and Hebert Marcella B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zappala Joseph | $845,000 | Ticor Title | |

| Leopardo Robert M | $325,000 | North American Title Co | |

| Hebert Raymond E | -- | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zappala Joseph | $676,000 | |

| Previous Owner | Leopardo Robert M | $235,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,274 | $914,654 | $826,067 | $88,587 |

| 2024 | $10,274 | $896,720 | $809,870 | $86,850 |

| 2023 | $10,046 | $879,138 | $793,990 | $85,148 |

| 2022 | $9,783 | $861,900 | $778,421 | $83,479 |

| 2021 | $5,210 | $443,551 | $352,102 | $91,449 |

| 2020 | $5,176 | $439,003 | $348,491 | $90,512 |

| 2019 | $5,116 | $430,396 | $341,658 | $88,738 |

| 2018 | $5,038 | $421,957 | $334,958 | $86,999 |

| 2017 | $4,972 | $413,684 | $328,390 | $85,294 |

| 2016 | $4,755 | $405,573 | $321,951 | $83,622 |

| 2015 | $4,709 | $399,481 | $317,115 | $82,366 |

| 2014 | $4,612 | $391,656 | $310,903 | $80,753 |

Source: Public Records

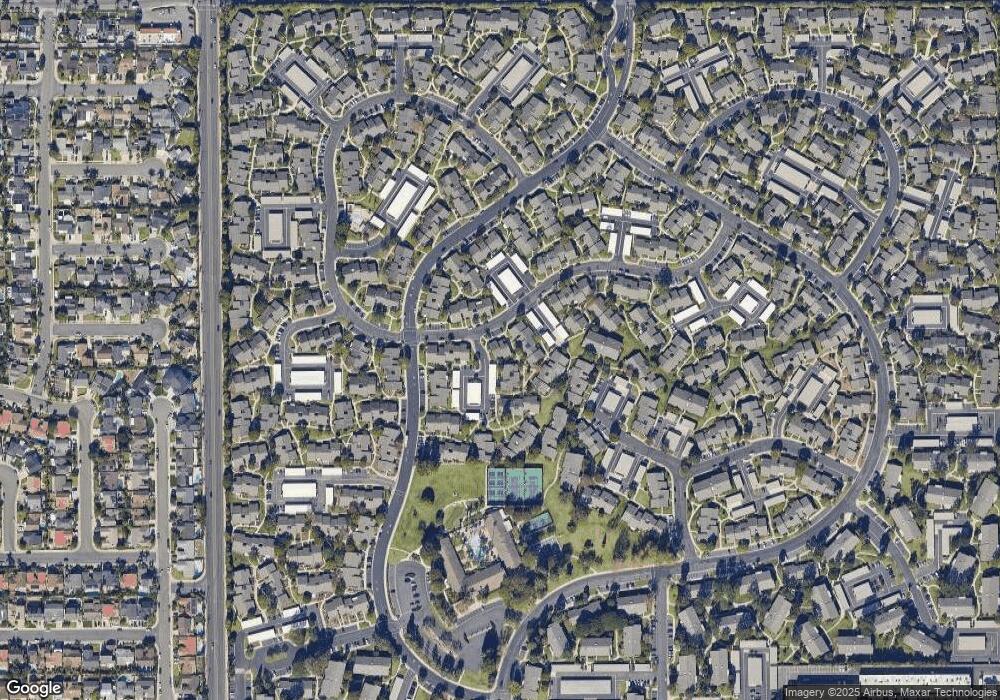

Map

Nearby Homes

- 8646 Butte Cir Unit 607E

- 8566 Larkhall Cir Unit 808A

- 8566 Larkhall Cir Unit 809D

- 8565 Larkhall Cir Unit 804A

- 8565 Larkhall Cir Unit 802C

- 8856 526C Sutter

- 8856 Sutter Cir Unit 522A

- 8565 Trinity Cir Unit 824D

- 8788 Coral Springs Ct Unit 203

- 8886 Plumas Cir Unit 1124-A

- 8565 Colusa Cir Unit 906C

- 8633 Portola Ct Unit 18G

- 8932 Amador Cir Unit 1309B

- 21032 Shepherd Ln

- 9001 Oceanwood Dr

- 8401 Atlanta Ave

- 8331 Snowbird Dr

- 21131 Greenboro Ln

- 8342 Seaport Dr

- 21211 Poston Ln

- 8656 Fresno Cir Unit 506A

- 8656 Fresno Cir Unit 506E

- 8656 Fresno Cir Unit 25

- 8656 Fresno Cir Unit 508 C

- 8656 Fresno Cir Unit 34

- 8656 Fresno Cir Unit 505C

- 8656 Fresno Cir Unit 33

- 8656 Fresno Cir Unit 507D

- 8656 Fresno Cir Unit 505B

- 8656 Fresno Cir Unit 26

- 8656 Fresno Cir Unit 507E

- 8656 Fresno Cir Unit 506D

- 8656 Fresno Cir Unit 506C

- 8656 Fresno Cir Unit 29

- 8656 Fresno Cir Unit 30

- 8656 Fresno Cir Unit 509B

- 8656 Fresno Cir Unit 505A

- 8656 Fresno Cir Unit 28

- 8656 Fresno Cir Unit 508A

- 8656 Fresno Cir Unit 22