8712 Central Ct Spring Valley, CA 91977

Estimated Value: $731,000 - $856,000

4

Beds

3

Baths

1,750

Sq Ft

$454/Sq Ft

Est. Value

About This Home

This home is located at 8712 Central Ct, Spring Valley, CA 91977 and is currently estimated at $793,937, approximately $453 per square foot. 8712 Central Ct is a home located in San Diego County with nearby schools including Bancroft Elementary School, Science, Technology, Engineering, Arts, And Math Academy, and Mount Miguel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2004

Sold by

Arenas Francisco Gonzalez and Estrada Lorena Luna

Bought by

Estrada Lorena Luna

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$88,035

Interest Rate

4.23%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$705,902

Purchase Details

Closed on

Aug 30, 2000

Sold by

Central Court Residential Partners Ltd

Bought by

Arenas Francisco Gonzalez and Luna Lorena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,720

Interest Rate

8.07%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Estrada Lorena Luna | -- | Fidelity National Title Co | |

| Arenas Francisco Gonzalez | -- | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Estrada Lorena Luna | $200,000 | |

| Closed | Arenas Francisco Gonzalez | $172,720 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,147 | $452,423 | $188,351 | $264,072 |

| 2024 | $6,147 | $443,553 | $184,658 | $258,895 |

| 2023 | $5,948 | $434,857 | $181,038 | $253,819 |

| 2022 | $5,841 | $426,332 | $177,489 | $248,843 |

| 2021 | $5,789 | $417,973 | $174,009 | $243,964 |

| 2020 | $5,553 | $413,688 | $172,225 | $241,463 |

| 2019 | $5,470 | $405,578 | $168,849 | $236,729 |

| 2018 | $5,292 | $397,627 | $165,539 | $232,088 |

| 2017 | $5,154 | $389,832 | $162,294 | $227,538 |

| 2016 | $4,958 | $382,189 | $159,112 | $223,077 |

| 2015 | $4,491 | $340,000 | $141,000 | $199,000 |

| 2014 | $4,258 | $320,000 | $133,000 | $187,000 |

Source: Public Records

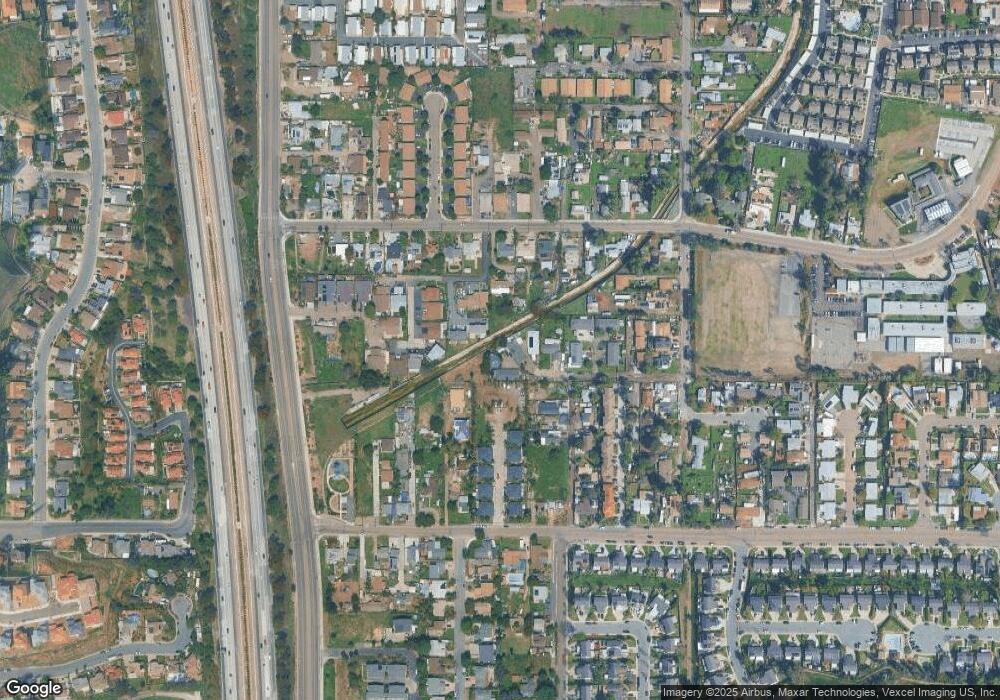

Map

Nearby Homes

- 2515 Sweetwater Rd Unit SPC 23

- 2515 Sweetwater Rd Unit 63

- 2515 Sweetwater Rd Unit 32

- 2515 Sweetwater Rd Unit 72

- 2551 Kings View Cir

- 8941 Arlingdale Way

- 1815 Sweetwater Rd Unit SPC 120

- 1815 Sweetwater Rd Unit 37

- 1815 Sweetwater Rd Unit 155

- 2707 Sweetwater Rd

- 8154 Golden Ave

- 9017 Valencia St

- 8644 Eileen St

- 8539 Vista Azul

- 8540 Vista Azul

- 1726 Helix St

- 2018 Barite St

- 9126 Valencia St

- 8932 Troy St

- 9149 Oso Rd

- 8708 Central Ct

- 8716 Central Ct

- 2259 - 226 Tyler

- 2259 Tyler Ct Unit 61

- 2261 Tyler Ct

- 8720 Central Ct

- 2259-61 Tyler Ct

- 2255 Tyler Ct Unit COURT

- 2255 Tyler Ct Unit 57

- 8705 Tyler St

- 2138 El Pasillo

- 2251 Tyler Ct

- 8732 Central Ct Unit A

- 8654 Ildica St

- 8734 Central Ct

- 2205 Tyler Ct Unit 7

- 2205 Tyler Ct

- 2136 El Pasillo

- 8658 Ildica St

- 2145 El Pasillo