8712 Kiernan Ave Modesto, CA 95358

Estimated Value: $688,000 - $1,928,219

3

Beds

2

Baths

1,296

Sq Ft

$851/Sq Ft

Est. Value

About This Home

This home is located at 8712 Kiernan Ave, Modesto, CA 95358 and is currently estimated at $1,102,805, approximately $850 per square foot. 8712 Kiernan Ave is a home located in Stanislaus County with nearby schools including Dena Boer Elementary School, Salida Middle School - Vella Campus, and Joseph A. Gregori High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 2, 2022

Sold by

Bert 2022 Family Trust

Bought by

Kiernan Properties Llc

Current Estimated Value

Purchase Details

Closed on

Apr 21, 2022

Sold by

Bert Patrick J and Bert Dana R

Bought by

Bert 2022 Family Trust and Bert

Purchase Details

Closed on

Dec 12, 2017

Sold by

Hess Carol

Bought by

Bert Patrick J and Bert Dana R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$705,000

Interest Rate

3.9%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Apr 16, 2008

Sold by

Bert Karlene

Bought by

Hess Carol

Purchase Details

Closed on

Apr 9, 2008

Sold by

Bert Karlene

Bought by

Hess Carol

Purchase Details

Closed on

Apr 8, 2008

Sold by

Hertle Merna

Bought by

Hess Carol

Purchase Details

Closed on

Apr 4, 2008

Sold by

Bert Thomas

Bought by

Bert Karlene

Purchase Details

Closed on

Dec 23, 2002

Sold by

Hertle John L

Bought by

Hertle Ranch Lp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kiernan Properties Llc | -- | None Listed On Document | |

| Bert 2022 Family Trust | -- | None Listed On Document | |

| Bert Patrick J | $2,150,000 | Chicago Title Co | |

| Hess Carol | $386,663 | None Available | |

| Hess Carol | $386,663 | None Available | |

| Larsen Joanne | -- | None Available | |

| Hess Carol | -- | None Available | |

| Bert Karlene | -- | None Available | |

| Hertle Ranch Lp | -- | -- | |

| Hertle John L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bert Patrick J | $705,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,329 | $803,209 | $563,098 | $240,111 |

| 2024 | $9,898 | $687,082 | $611,321 | $75,761 |

| 2023 | $9,214 | $695,731 | $621,455 | $74,276 |

| 2022 | $8,868 | $685,546 | $612,726 | $72,820 |

| 2021 | $8,659 | $663,915 | $592,522 | $71,393 |

| 2020 | $7,462 | $568,261 | $564,100 | $4,161 |

| 2019 | $7,222 | $542,657 | $538,577 | $4,080 |

| 2018 | $6,453 | $467,723 | $463,723 | $4,000 |

| 2017 | $5,521 | $430,019 | $427,019 | $3,000 |

| 2016 | $5,398 | $419,384 | $416,384 | $3,000 |

| 2015 | $5,028 | $385,352 | $382,352 | $3,000 |

| 2014 | $5,737 | $452,489 | $449,489 | $3,000 |

Source: Public Records

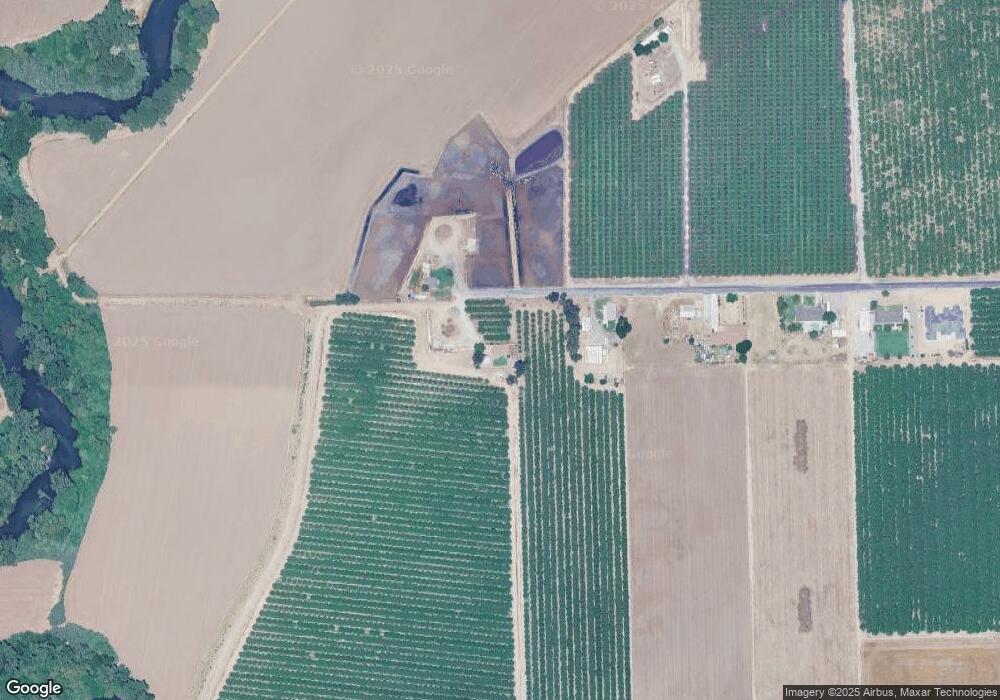

Map

Nearby Homes

- 1191 S Mohler Rd

- 1087 Kelcie Dr

- 1067 McVeigh Way

- 25926 S Austin Rd

- 873 Ruess Rd

- 818 Travaille Way

- 1774 Ruth Dr

- 1714 Melissa Dr

- 731 Dixie Ln

- 1621 Davis St

- 23811 S Jack Tone Rd

- 19708 S Jack Tone Rd

- 1763 W 4th St

- 1421 Denise Dr

- 351 Ruess Rd

- 118 Ruess Rd

- 11132 W Ripon Rd Unit E

- 359 Pecan Dr

- 532 County Ct

- 619 Pecan Dr

- 8725 Kiernan Ave

- 8630 Kiernan Ave

- 8542 Kiernan Ave

- 8512 Kiernan Ave

- 8436 Kiernan Ave

- 8349 Kiernan Ave

- 8437 Kiernan Ave

- 8343 Kiernan Ave

- 12000 E Moncure Rd

- 8142 Kiernan Ave

- 8333 Kiernan Ave

- 11708 E Moncure Rd

- 8043 Kiernan Ave

- 4355 N Gates Rd

- 11824 E Moncure Rd

- 4343 N Gates Rd

- 4737 Dunn Rd

- 4737 Dunn Rd

- 4936 Dunn Rd

- 4890 Dunn Rd