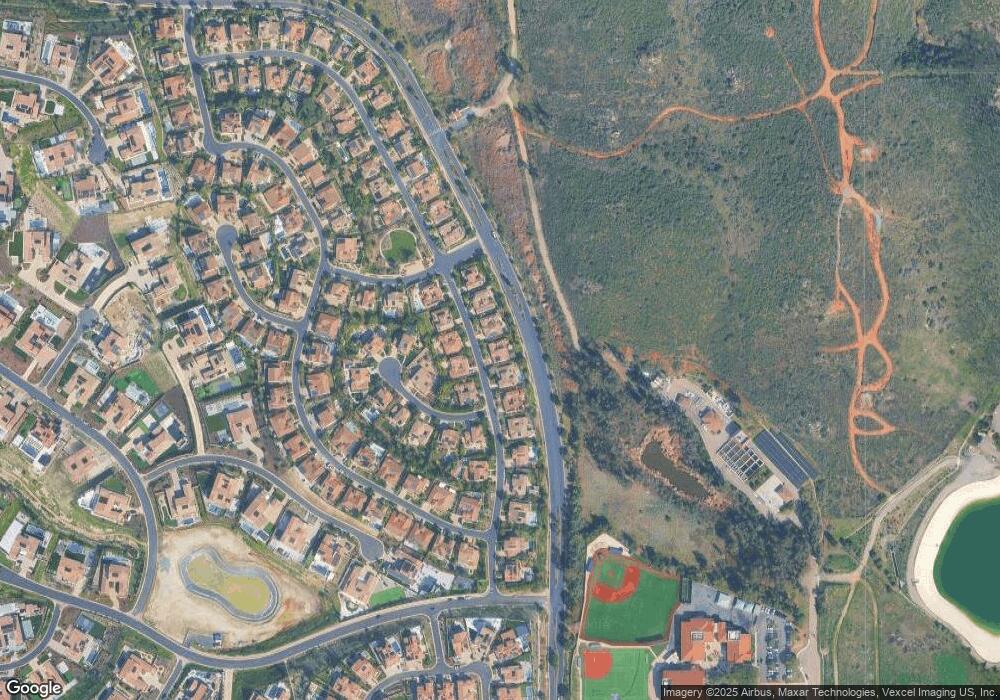

8724 Herrington Way San Diego, CA 92127

Del Sur NeighborhoodEstimated Value: $2,285,362 - $2,620,000

3

Beds

4

Baths

2,597

Sq Ft

$926/Sq Ft

Est. Value

About This Home

This home is located at 8724 Herrington Way, San Diego, CA 92127 and is currently estimated at $2,405,091, approximately $926 per square foot. 8724 Herrington Way is a home located in San Diego County with nearby schools including Del Sur Elementary School, Oak Valley Middle, and Del Norte High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 9, 2021

Sold by

Recabaren Valerie and Trust No I Trust A

Bought by

Recabaren Valerie and Valerie Recabaren Trust

Current Estimated Value

Purchase Details

Closed on

Nov 2, 2017

Sold by

Ahn Hyunah

Bought by

Recabaren Leonard and Trust #1

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$880,000

Outstanding Balance

$739,145

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$1,665,946

Purchase Details

Closed on

Aug 21, 2013

Sold by

Habing Douglas

Bought by

Ahn Hyunah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$680,000

Interest Rate

4.27%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 13, 2009

Sold by

Lennar Homes Of California Inc

Bought by

Ahn Hyunah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$761,443

Interest Rate

4.91%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Recabaren Valerie | -- | None Available | |

| Recabaren Leonard | $1,100,000 | Stewart Title Of California | |

| Ahn Hyunah | -- | Landsafe Title Services Inc | |

| Ahn Hyunah | $802,000 | North American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Recabaren Leonard | $880,000 | |

| Previous Owner | Ahn Hyunah | $680,000 | |

| Previous Owner | Ahn Hyunah | $761,443 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $19,442 | $1,251,609 | $682,696 | $568,913 |

| 2024 | $19,442 | $1,227,068 | $669,310 | $557,758 |

| 2023 | $18,945 | $1,203,009 | $656,187 | $546,822 |

| 2022 | $18,651 | $1,156,296 | $630,707 | $525,589 |

| 2021 | $18,509 | $1,156,296 | $630,707 | $525,589 |

| 2020 | $18,265 | $1,144,440 | $624,240 | $520,200 |

| 2019 | $17,882 | $1,122,000 | $612,000 | $510,000 |

| 2018 | $17,505 | $1,100,000 | $600,000 | $500,000 |

| 2017 | $15,102 | $889,344 | $488,213 | $401,131 |

| 2016 | $15,091 | $871,907 | $478,641 | $393,266 |

| 2015 | $14,920 | $858,811 | $471,452 | $387,359 |

| 2014 | $14,609 | $841,989 | $462,217 | $379,772 |

Source: Public Records

Map

Nearby Homes

- 8451 Hidden Cove Way

- 16055 Penny Ln

- 0 Camino Santa fe Dr Unit 21 250034399

- 15809 Concord Ridge Terrace

- 15744 Paseo Del Sur

- 15701 Concord Ridge Terrace

- 8318 The Landing Way

- 8528 Old Stonefield Chase

- 16750 Coyote Bush Dr Unit 18

- 16750 Coyote Bush Dr Unit 31

- 16750 Coyote Bush Dr Unit 107

- 9343 Bernardo Lakes Dr

- 17277 Reflections Cir

- 15609 Hayden Lake Place

- 8492 Blackburn Ln

- 8495 Christopher Ridge Terrace Unit 267-370-01-50

- 8458 Christopher Ridge Terrace

- 15763 Kristen Glen

- 16636 Gill Loop

- 15583 Rising River Place S

- 8736 Herrington Way

- 8730 Herrington Way

- 8718 Herrington Way

- 8725 Herrington Way

- 8736 Herrington Way

- 8712 Herrington Way

- 8719 Herrington Way

- 8731 Herrington Way

- 8713 Herrington Way

- 8742 Herrington Way

- 8706 Herrington Way

- 16259 Bluestar Way

- 16222 Bluestar Way

- 8707 Herrington Way

- 16271 Bluestar Way

- 16222 Blue Star Way

- 8748 Herrington Way

- 16234 Bluestar Way

- 16234 Blue Star Way

- 16220 Almanor Way