Estimated Value: $485,000 - $516,000

3

Beds

2

Baths

1,575

Sq Ft

$318/Sq Ft

Est. Value

About This Home

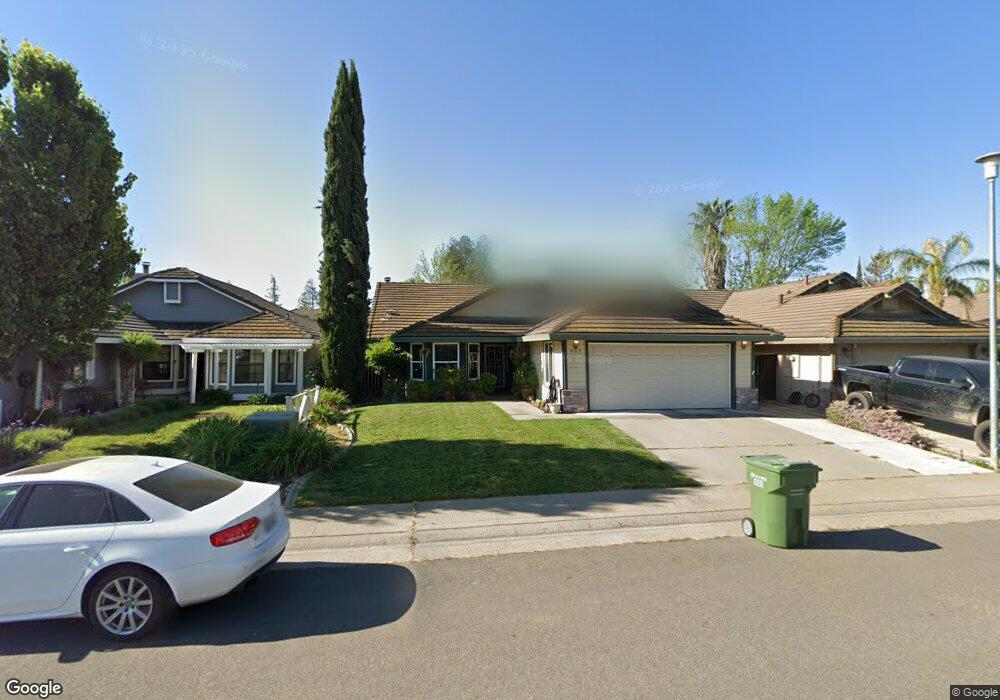

This home is located at 882 Cedar Canyon Cir, Galt, CA 95632 and is currently estimated at $500,115, approximately $317 per square foot. 882 Cedar Canyon Cir is a home located in Sacramento County with nearby schools including Lake Canyon Elementary School, Robert L. McCaffrey Middle School, and Liberty Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2001

Sold by

Furey Gregory J and Furey Mabel Lew

Bought by

Cruz John D and Cruz Susy S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,520

Outstanding Balance

$68,942

Interest Rate

7.09%

Mortgage Type

FHA

Estimated Equity

$431,173

Purchase Details

Closed on

Aug 23, 2001

Sold by

Va

Bought by

Furey Gregory J and Furey Mabel Lew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,520

Outstanding Balance

$68,942

Interest Rate

7.09%

Mortgage Type

FHA

Estimated Equity

$431,173

Purchase Details

Closed on

Feb 6, 1995

Sold by

Bennett & Compton Inc

Bought by

Va

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cruz John D | $178,000 | Financial Title Company | |

| Furey Gregory J | -- | Financial Title Company | |

| Va | -- | Chicago Title Company | |

| Bennett & Compton Inc | -- | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cruz John D | $175,520 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,976 | $268,626 | $73,854 | $194,772 |

| 2024 | $2,976 | $263,359 | $72,406 | $190,953 |

| 2023 | $3,290 | $258,196 | $70,987 | $187,209 |

| 2022 | $3,174 | $253,135 | $69,596 | $183,539 |

| 2021 | $3,176 | $248,173 | $68,232 | $179,941 |

| 2020 | $3,152 | $245,629 | $67,533 | $178,096 |

| 2019 | $3,084 | $240,813 | $66,209 | $174,604 |

| 2018 | $3,079 | $236,092 | $64,911 | $171,181 |

| 2017 | $2,919 | $226,562 | $63,639 | $162,923 |

| 2016 | $2,837 | $222,121 | $62,392 | $159,729 |

| 2015 | $2,981 | $218,785 | $61,455 | $157,330 |

| 2014 | $2,983 | $214,501 | $60,252 | $154,249 |

Source: Public Records

Map

Nearby Homes

- 908 Wildbrook Ct

- 866 Golden Heights Dr

- 1054 Starbrook Dr

- 1156 Monique St

- 1160 Monique St

- Residence 1883 Plan at The Cottages at Greenwood

- 2012 Seraphina St

- Residence 2448 Plan at Summerfield - Cedar Grove at Summerfield

- Residence 2760 Plan at Summerfield - Cedar Glen at Summerfield

- 1173 Monique St

- Residence 3308 Plan at Summerfield - Cedar Glen at Summerfield

- 1164 Monique St

- Residence 2072 Plan at The Towns at Greenwood

- Residence 2788 Plan at Summerfield - Cedar Glen at Summerfield

- 1169 Monique St

- 2016 Seraphina St

- Residence 1894 Plan at The Towns at Greenwood

- Residence 2018 Plan at Summerfield - Cedar Grove at Summerfield

- Residence 2203 Plan at Summerfield - Cedar Grove at Summerfield

- 2020 Seraphina St

- 886 Cedar Canyon Cir

- 878 Cedar Canyon Cir

- 890 Cedar Canyon Cir

- 874 Cedar Canyon Cir

- 999 Doradell Ct

- 881 Black Canyon Ct

- 994 Rossburn Ct

- 894 Cedar Canyon Cir

- 993 Doradell Ct

- 870 Cedar Canyon Cir

- 988 Rossburn Ct

- 987 Doradell Ct

- 866 Cedar Canyon Cir

- 877 Cedar Canyon Cir

- 885 Black Canyon Ct

- 999 Rossburn Ct

- 873 Cedar Canyon Cir

- 901 Black Canyon Ct

- 902 Cedar Canyon Cir

- 981 Doradell Ct