8885 Clearcreek Rd Springboro, OH 45066

Estimated Value: $174,000 - $243,000

2

Beds

1

Bath

1,028

Sq Ft

$204/Sq Ft

Est. Value

About This Home

This home is located at 8885 Clearcreek Rd, Springboro, OH 45066 and is currently estimated at $210,107, approximately $204 per square foot. 8885 Clearcreek Rd is a home located in Warren County with nearby schools including Franklin High School and The CinDay Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 15, 2015

Sold by

Bishop Steven D and Bishop Diana J

Bought by

The Steven Douglas Bishop & Diana Jean B and Bishop Diana Jean

Current Estimated Value

Purchase Details

Closed on

Feb 2, 2004

Sold by

The Bank Of New York

Bought by

Bishop Steven D and Bishop Diana J

Purchase Details

Closed on

Nov 5, 2003

Sold by

Johns Niles and Schulert Vera Lynn

Bought by

Bank Of New York and Eqcc Trust 2001-2

Purchase Details

Closed on

Jun 20, 1995

Sold by

Chambers Kathleen

Bought by

Vera Russell L and Vera Lynn Schubert

Purchase Details

Closed on

Aug 25, 1988

Sold by

Napier Ford and Napier Maultie

Bought by

Fletcher and Fletcher Kathleen

Purchase Details

Closed on

Jun 18, 1986

Sold by

Napier Napier and Napier Wade

Bought by

Napier Napier and Napier Ford

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Steven Douglas Bishop & Diana Jean B | -- | None Available | |

| Bishop Steven D | $70,000 | Sovereign Title Agency Llc | |

| Bank Of New York | $81,000 | Sovereign Title Agency Llc | |

| Vera Russell L | $69,500 | -- | |

| Fletcher | $32,000 | -- | |

| Napier Napier | $40,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,558 | $55,990 | $16,330 | $39,660 |

| 2023 | $2,197 | $43,862 | $8,736 | $35,126 |

| 2022 | $2,148 | $43,862 | $8,736 | $35,126 |

| 2021 | $2,028 | $43,862 | $8,736 | $35,126 |

| 2020 | $1,873 | $35,658 | $7,102 | $28,557 |

| 2019 | $1,696 | $35,658 | $7,102 | $28,557 |

| 2018 | $1,698 | $35,658 | $7,102 | $28,557 |

| 2017 | $1,716 | $32,802 | $6,727 | $26,075 |

| 2016 | $1,753 | $32,802 | $6,727 | $26,075 |

| 2015 | $1,753 | $32,802 | $6,727 | $26,075 |

| 2014 | $1,659 | $29,290 | $6,010 | $23,280 |

| 2013 | $1,367 | $34,640 | $7,100 | $27,540 |

Source: Public Records

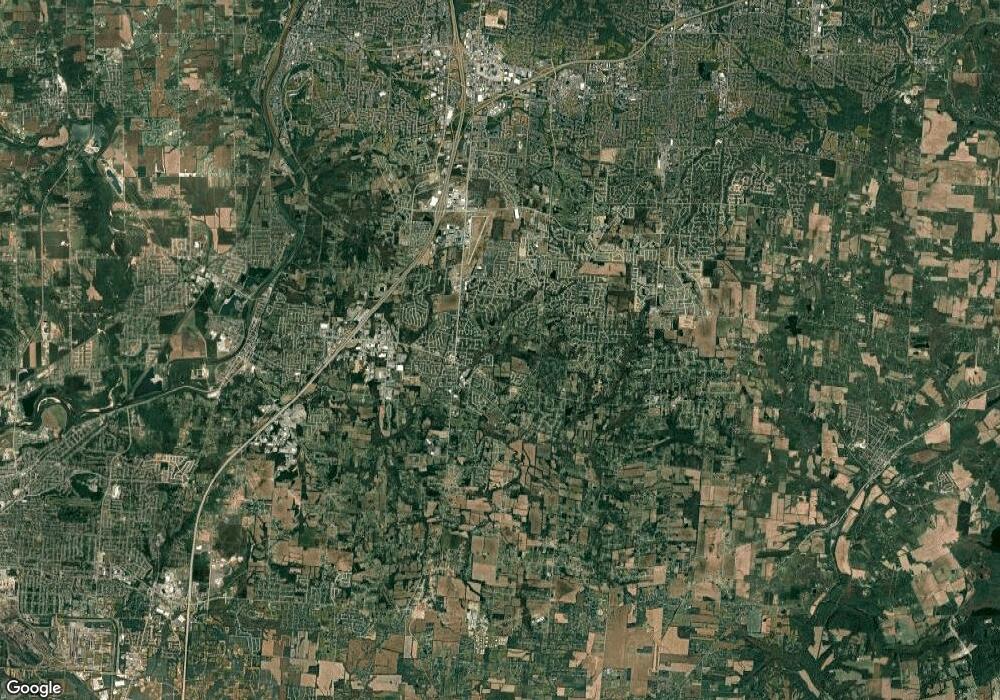

Map

Nearby Homes

- 420 Clearcreek Franklin Rd

- 375 Tamarack Trail

- 120 Bramblebush Ln

- 180 Teakwood Ln

- 450 Evergreen Dr

- 145 Cedar Hill Ln

- 510 Royal Springs Dr

- 120 Clearview Dr

- 23 Pheasant Run Cir Unit 9A

- 5561 Sagewood Dr

- 14 Ed Knoll Bend

- 2649 Factory Rd

- 45 Wadestone Ln

- 45 Wadestone St

- 20 Terradyne Trace

- The McPherson Plan at Wadestone - Designer Collection

- Winslow Plan at Wadestone - Masterpiece Collection

- Avery Plan at Wadestone - Designer Collection

- Emmett Plan at Wadestone - Designer Collection

- Rhodes Plan at Wadestone - Masterpiece Collection

- 510 Clearcreek Rd

- 8875 Clearcreek Rd

- 520 Clearcreek Rd

- 520 Clearcreek Franklin Rd

- 25 Clearcreek Rd

- 15 Clearcreek Rd Unit Lt 15

- 4.867ac Clearcreek Franklin Rd

- 8947 Clearcreek Rd

- 9022 Clearcreek Rd

- 440 Spruceway Dr

- 8947 Clearcreek Franklin Rd

- 430 Spruceway Dr

- 450 Clearcreek Rd

- 450 Clearcreek Franklin Rd

- 435 Spruceway Dr

- 420 Spruceway Dr

- 445 Spruceway Dr

- 440 Clearcreek Rd

- 440 Clearcreek Franklin Rd

- 9056 Clearcreek Rd