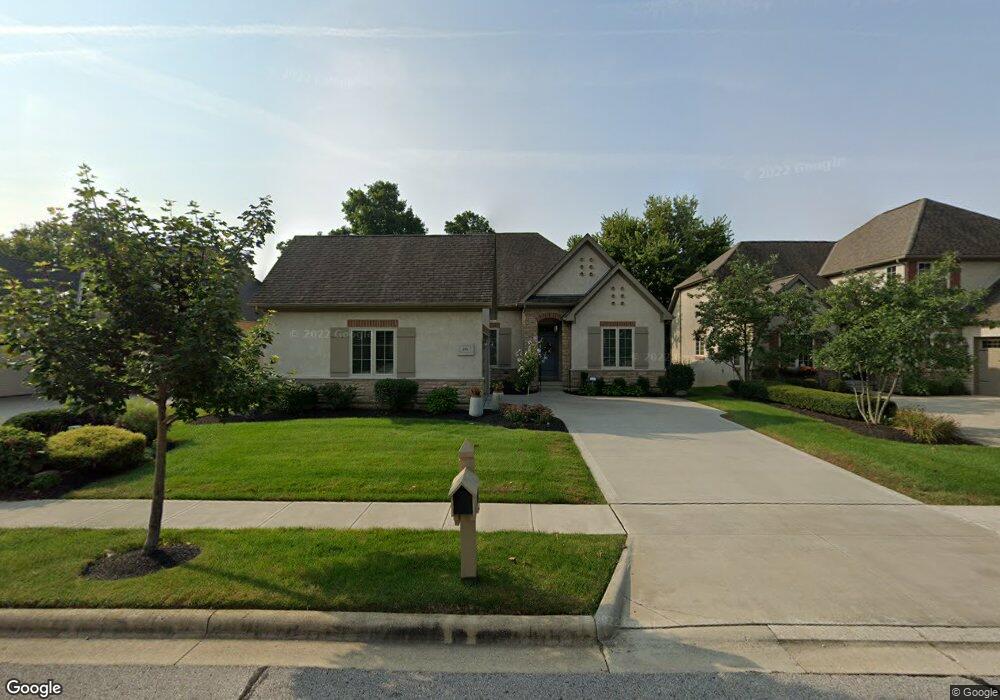

891 John Michael Way Columbus, OH 43235

Estimated Value: $552,000 - $773,000

3

Beds

3

Baths

1,953

Sq Ft

$343/Sq Ft

Est. Value

About This Home

This home is located at 891 John Michael Way, Columbus, OH 43235 and is currently estimated at $670,494, approximately $343 per square foot. 891 John Michael Way is a home with nearby schools including Bluffsview Elementary School, McCord Middle School, and Worthington Kilbourne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 15, 2023

Sold by

Canter William Richard

Bought by

Canter Family Trust and Canter

Current Estimated Value

Purchase Details

Closed on

Aug 6, 2015

Sold by

Canter W Richard and Canter Marcia Lang

Bought by

Canter William Richard and Canter Marcia Lang

Purchase Details

Closed on

Sep 21, 2012

Sold by

Romanelli And Hughes Building Co

Bought by

Canter W Richard and Canter Marcia Lang

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$352,930

Interest Rate

3.59%

Mortgage Type

Construction

Purchase Details

Closed on

Sep 26, 2005

Sold by

The Bigler Co Ltd

Bought by

Romanelli & Hughes Building Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Canter Family Trust | -- | None Listed On Document | |

| Canter William Richard | -- | Attorney | |

| Canter W Richard | $80,000 | None Available | |

| Romanelli & Hughes Building Co | $600,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Canter W Richard | $352,930 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,013 | $221,760 | $56,000 | $165,760 |

| 2023 | $12,481 | $221,760 | $56,000 | $165,760 |

| 2022 | $11,747 | $167,520 | $36,230 | $131,290 |

| 2021 | $10,838 | $167,520 | $36,230 | $131,290 |

| 2020 | $10,439 | $167,520 | $36,230 | $131,290 |

| 2019 | $9,974 | $145,640 | $31,500 | $114,140 |

| 2018 | $9,746 | $145,640 | $31,500 | $114,140 |

| 2017 | $8,938 | $145,640 | $31,500 | $114,140 |

| 2016 | $9,828 | $147,180 | $28,700 | $118,480 |

| 2015 | $9,830 | $147,180 | $28,700 | $118,480 |

| 2014 | $9,826 | $147,180 | $28,700 | $118,480 |

| 2013 | $3,680 | $101,290 | $26,075 | $75,215 |

Source: Public Records

Map

Nearby Homes

- 7522 Acela St

- 1101 Bluffway Dr

- 1109 Bluffway Dr

- 1041 Rosebank Dr

- 1232 Lochcarren Ct

- 1380 Tiehack Ct

- 7187 Lorine Ct

- 6908 Perry Dr

- 7164 Durness Place

- 7347 Fall Creek Ln Unit J

- 445 Thackeray Ave

- 210 Saint Antoine St Unit 25D

- 203 Saint Pierre St

- 865 Colony Way

- 1620 Park Row Dr Unit A

- 941 Clubview Blvd S

- 1678 Park Row Dr Unit B

- 1037 Ravine Ridge Dr

- 7383 Coldstream Dr

- 1672 Rushing Way

- 883 John Michael Way

- 899 John Michael Way

- 890 Thomas Joseph Ln

- 875 John Michael Way

- 882 Thomas Joseph Ln

- 898 Thomas Joseph Ln

- 907 John Michael Way

- 874 Thomas Joseph Ln

- 892 John Michael Way

- 900 John Michael Way

- 906 Thomas Joseph Ln

- 884 John Michael Way

- 908 John Michael Way

- 876 John Michael Way

- 916 John Michael Way

- 868 John Michael Way

- 844 John Michael Way

- 7109 James Emmett Place

- 836 John Michael Way

- 852 John Michael Way