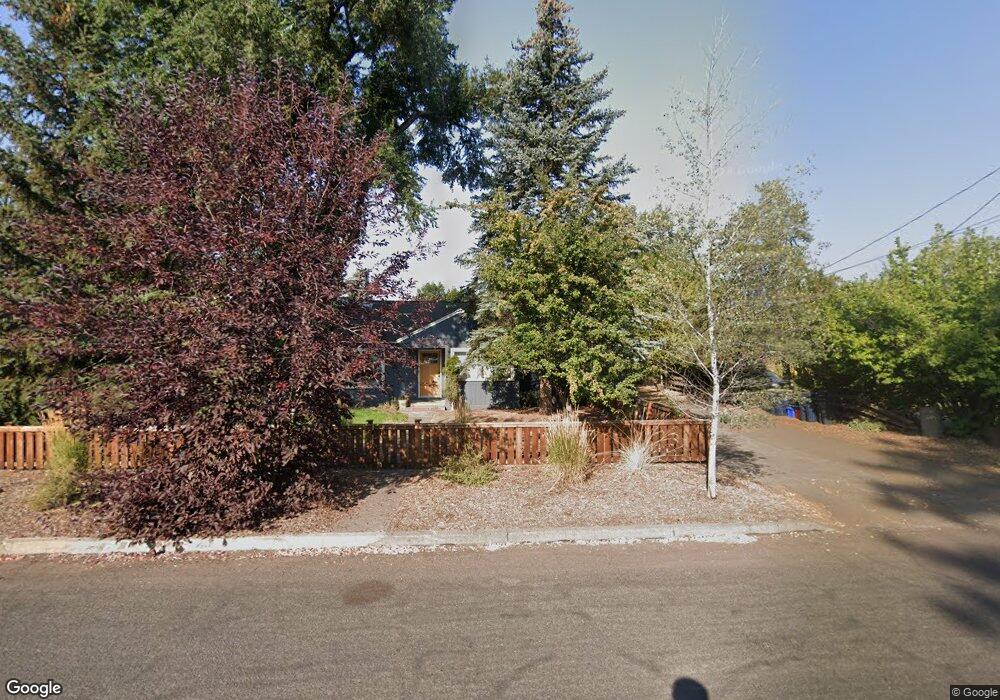

905 NE 9th St Bend, OR 97701

Orchard District NeighborhoodEstimated Value: $497,000 - $548,000

3

Beds

1

Bath

1,298

Sq Ft

$409/Sq Ft

Est. Value

About This Home

This home is located at 905 NE 9th St, Bend, OR 97701 and is currently estimated at $531,357, approximately $409 per square foot. 905 NE 9th St is a home located in Deschutes County with nearby schools including Juniper Elementary School, Bend Senior High School, and The Waldorf School of Bend.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 11, 2018

Sold by

Fisher Jenny

Bought by

Fisher Jenny and The Jenny Lee Fisher Living Trust

Current Estimated Value

Purchase Details

Closed on

Nov 16, 2011

Sold by

Wolsko Christopher V and Marino Elizabeth K

Bought by

Fischer Jenny L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,704

Outstanding Balance

$87,657

Interest Rate

4.4%

Mortgage Type

FHA

Estimated Equity

$443,700

Purchase Details

Closed on

Sep 25, 2006

Sold by

Dean Debra J

Bought by

Wolsko Christopher and Marino Elizabeth K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,652

Interest Rate

6.51%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fisher Jenny | -- | None Available | |

| Fischer Jenny L | $130,000 | Amerititle | |

| Wolsko Christopher | $269,575 | Amerititle |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fischer Jenny L | $126,704 | |

| Previous Owner | Wolsko Christopher | $215,652 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,874 | $170,120 | -- | -- |

| 2024 | $2,766 | $165,170 | -- | -- |

| 2023 | $2,564 | $160,360 | $0 | $0 |

| 2022 | $2,392 | $151,160 | $0 | $0 |

| 2021 | $2,396 | $146,760 | $0 | $0 |

| 2020 | $2,273 | $146,760 | $0 | $0 |

| 2019 | $2,209 | $142,490 | $0 | $0 |

| 2018 | $2,147 | $138,340 | $0 | $0 |

| 2017 | $2,084 | $134,320 | $0 | $0 |

| 2016 | $1,988 | $130,410 | $0 | $0 |

| 2015 | $1,933 | $126,620 | $0 | $0 |

| 2014 | $1,876 | $122,940 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 845 NE 8th St

- 649 NE Kearney Ave

- 608 NE 10th St

- 438 NE 9th St

- 645 NE Marshall Ave

- 643 NE Marshall Ave

- 429 NE Irving Ave

- 1401 NE 10th St

- 970 NE Norton Ave Unit Lot 7

- 717 NE Olney Ct

- 1532 NE 9th St

- 468 NE Olney Ave

- 3843 NE Petrosa Ave

- 1630 NE 13th St

- 1622 NE Parkridge Dr

- 642 NE Seward Ave

- 828 NW Hill St

- 1848 NE 14th St

- 1767 NE Lotus Dr Unit 1 and 2

- 111 NW Hawthorne Ave Unit 1