Estimated Value: $873,000 - $1,015,000

3

Beds

1

Bath

1,171

Sq Ft

$780/Sq Ft

Est. Value

About This Home

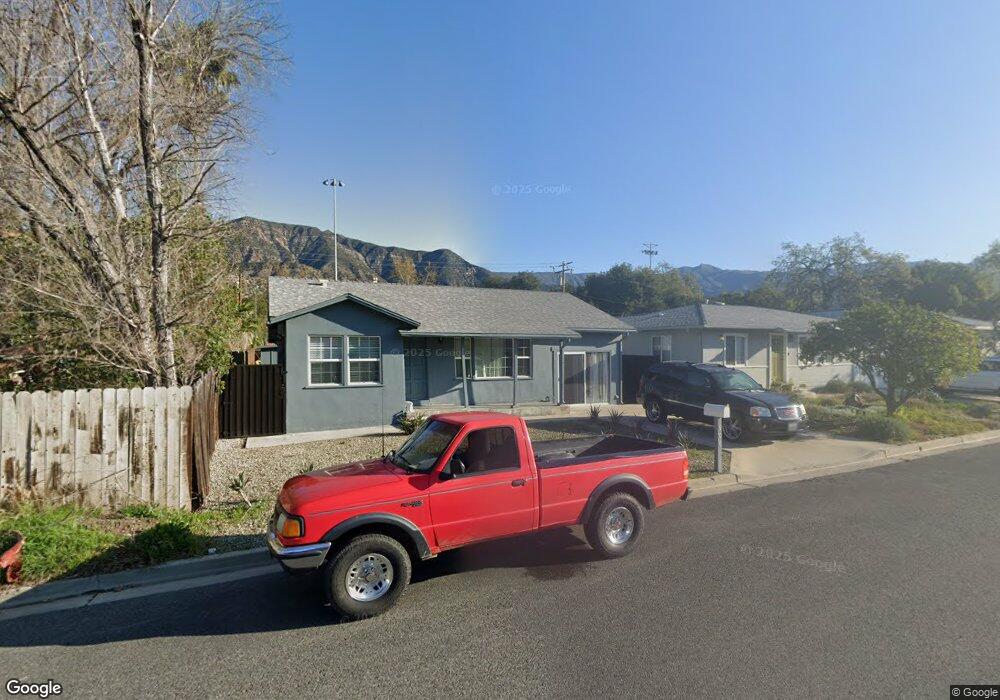

This home is located at 906 E Aliso St, Ojai, CA 93023 and is currently estimated at $913,290, approximately $779 per square foot. 906 E Aliso St is a home located in Ventura County with nearby schools including Topa Topa Elementary School, Meiners Oaks Elementary School, and Matilija Junior High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2005

Sold by

Esquivel Billi Cesar G

Bought by

Esquivel Ignacio and Esquivel Patricia Ceja

Current Estimated Value

Purchase Details

Closed on

Dec 17, 2003

Sold by

Brook Marcena

Bought by

Esquivel Ignacio and Esquivel Patricia Ceja

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,000

Interest Rate

5.97%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 9, 2003

Sold by

Randall Joe D

Bought by

Randall Robb L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,000

Interest Rate

5.97%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Esquivel Ignacio | -- | -- | |

| Esquivel Ignacio | -- | -- | |

| Esquivel Ignacio | $360,000 | Old Republic Title Company | |

| Brook Marcena | $360,000 | -- | |

| Randall Robb L | -- | -- | |

| Randall Robb L | -- | -- | |

| Randall Joe D | -- | -- | |

| Randall Joe D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Esquivel Ignacio | $288,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,805 | $520,357 | $419,421 | $100,936 |

| 2024 | $6,805 | $510,154 | $411,197 | $98,957 |

| 2023 | $6,575 | $500,151 | $403,134 | $97,017 |

| 2022 | $6,488 | $490,345 | $395,230 | $95,115 |

| 2021 | $6,520 | $480,731 | $387,481 | $93,250 |

| 2020 | $6,365 | $475,803 | $383,508 | $92,295 |

| 2019 | $6,184 | $466,475 | $375,989 | $90,486 |

| 2018 | $6,123 | $457,329 | $368,617 | $88,712 |

| 2017 | $6,012 | $448,363 | $361,390 | $86,973 |

| 2016 | $5,548 | $439,572 | $354,304 | $85,268 |

| 2015 | $5,503 | $432,971 | $348,983 | $83,988 |

| 2014 | $5,175 | $424,492 | $342,148 | $82,344 |

Source: Public Records

Map

Nearby Homes

- 310 N Fulton St

- 201 Drown Ave

- 608 E Ojai Ave

- 0 E Ojai Ave Unit 224929

- 0 E Ojai Ave Unit V1-33149

- 1214 Gregory St

- 211 Fox St

- 1201 Grand Ave

- 303 Lark Ellen Ave

- 312 Fox St

- 1309 Gregory St

- 216 E Aliso St

- 203 S Montgomery St

- 207 E Eucalyptus St

- 917 Grandview Ave

- 913 Mountain View Ave

- 910 Mercer Ave

- 0 N Ventura Unit TR25015633

- 741 Saddle Ln

- 102 W Matilija St