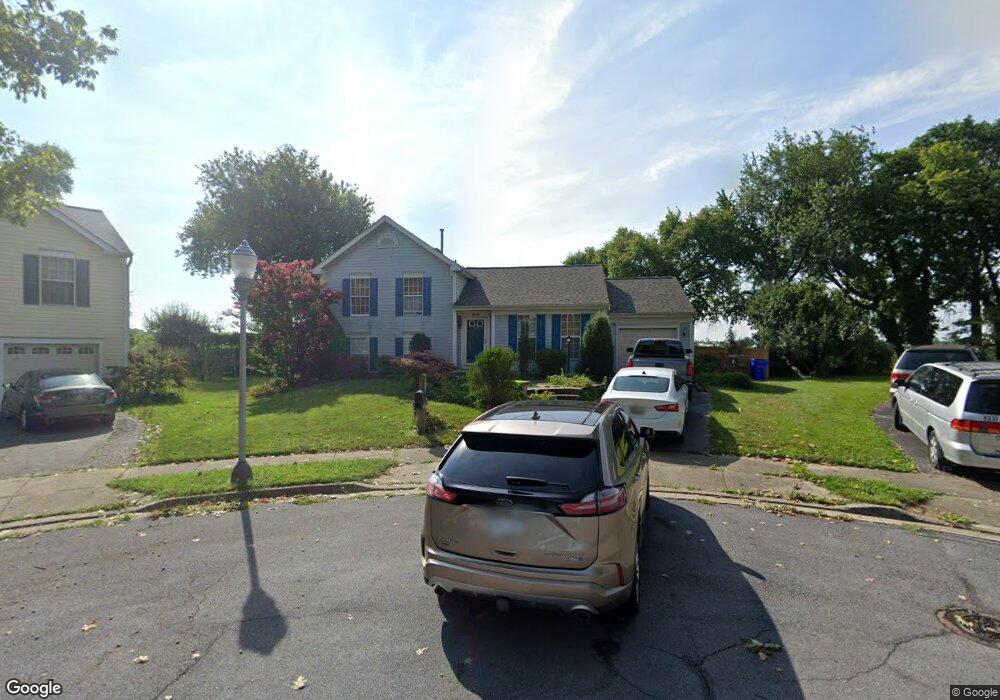

906 Twin Oak Ct Frederick, MD 21701

Fredericktowne Village NeighborhoodEstimated Value: $423,000 - $486,000

--

Bed

1

Bath

1,675

Sq Ft

$272/Sq Ft

Est. Value

About This Home

This home is located at 906 Twin Oak Ct, Frederick, MD 21701 and is currently estimated at $455,649, approximately $272 per square foot. 906 Twin Oak Ct is a home located in Frederick County with nearby schools including North Frederick Elementary School, Gov. Thomas Johnson Middle School, and Gov. Thomas Johnson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 9, 2023

Sold by

Austin Steven P

Bought by

Austin Steven P

Current Estimated Value

Purchase Details

Closed on

Jul 16, 2002

Sold by

Leisenring John D and Leisenring Cheryl L

Bought by

Austin Steve P and Austin Carlena

Purchase Details

Closed on

Dec 4, 1998

Sold by

Murray Matthew and Murray Patricia

Bought by

Leisenring John D and Leisenring Cheryl L

Purchase Details

Closed on

Sep 8, 1993

Sold by

Ryan Operations Gp

Bought by

Murray Matthew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,050

Interest Rate

7.21%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Austin Steven P | -- | None Listed On Document | |

| Austin Steven P | -- | None Listed On Document | |

| Austin Steve P | $189,500 | -- | |

| Leisenring John D | $150,000 | -- | |

| Murray Matthew | $134,350 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Murray Matthew | $135,050 | |

| Closed | Leisenring John D | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,854 | $367,300 | $110,400 | $256,900 |

| 2024 | $5,854 | $339,500 | $0 | $0 |

| 2023 | $5,412 | $311,700 | $0 | $0 |

| 2022 | $5,126 | $283,900 | $95,300 | $188,600 |

| 2021 | $4,944 | $279,200 | $0 | $0 |

| 2020 | $4,944 | $274,500 | $0 | $0 |

| 2019 | $4,753 | $269,800 | $85,300 | $184,500 |

| 2018 | $4,569 | $255,733 | $0 | $0 |

| 2017 | $4,311 | $269,800 | $0 | $0 |

| 2016 | $4,171 | $227,600 | $0 | $0 |

| 2015 | $4,171 | $227,267 | $0 | $0 |

| 2014 | $4,171 | $226,933 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1406 Willow Oak Dr

- 1518 Beverly Ct

- 1511 Beverly Ct

- 823 Stratford Way Unit A

- 811 Stratford Way Unit D

- 1501 Mohican Ct

- 1603 Berry Rose Ct Unit 3D

- 1605 Berry Rose Ct Unit A

- 1589 Carey Place

- 819 Aztec Dr

- 815 Holden Rd

- 1144 Holden Rd

- 1130 Holden Rd

- 518 Carroll Walk Ave

- 1133 Holden Rd

- 826 Creekway Dr

- 519 Prieur Rd

- 562 Union St

- 905 Holden Rd

- 813 Bond St

- 1313 Willow Oak Dr

- 1309 Willow Oak Dr

- 902 Twin Oak Ct

- 1317 Willow Oak Dr

- 1307 Willow Oak Dr

- 1314 Willow Oak Dr

- 1316 Willow Oak Dr

- 1312 Willow Oak Dr

- 904 Twin Oak Ct

- 1318 Willow Oak Dr

- 1310 Willow Oak Dr

- 1303 Willow Oak Dr

- 1308 Willow Oak Dr

- 903 Twin Oak Ct

- 1306 Willow Oak Dr

- 1301 Willow Oak Dr

- 905 Twin Oak Ct

- 900 Red Cedar Ct

- 902 Red Cedar Ct

- 1304 Willow Oak Dr