9180 Yankee St Springboro, OH 45066

Clearcreek Township NeighborhoodEstimated Value: $533,000 - $873,481

3

Beds

4

Baths

5,105

Sq Ft

$124/Sq Ft

Est. Value

About This Home

This home is located at 9180 Yankee St, Springboro, OH 45066 and is currently estimated at $632,620, approximately $123 per square foot. 9180 Yankee St is a home located in Warren County with nearby schools including Clearcreek Elementary School, Springboro Intermediate School, and Springboro Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 7, 2005

Sold by

Emc Mortgage Corp

Bought by

Wagner Todd D and Haley Jill R

Current Estimated Value

Purchase Details

Closed on

Jan 11, 2005

Sold by

Rose Jay and Pitts Rose Tonya

Bought by

Emc Mortgage Corp

Purchase Details

Closed on

Jan 9, 1998

Sold by

Stevens Kenneth S

Bought by

Rose Jay and Rose Tonya

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

7.26%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 21, 1994

Sold by

Burzen Don W

Bought by

Stevens Kenneth S and Stevens Dawn M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

7%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 14, 1990

Sold by

Hecht Hecht and Hecht Richard J

Bought by

Burzen Burzen and Burzen Don N

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wagner Todd D | $255,000 | Resource Title Agency Inc | |

| Emc Mortgage Corp | $263,500 | -- | |

| Rose Jay | $280,000 | -- | |

| Stevens Kenneth S | $320,000 | -- | |

| Burzen Burzen | $259,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rose Jay | $210,000 | |

| Previous Owner | Stevens Kenneth S | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,882 | $227,440 | $41,770 | $185,670 |

| 2023 | $8,348 | $189,136 | $24,955 | $164,181 |

| 2022 | $8,348 | $189,137 | $24,955 | $164,182 |

| 2021 | $7,799 | $189,137 | $24,955 | $164,182 |

| 2020 | $7,272 | $153,769 | $20,290 | $133,480 |

| 2019 | $6,738 | $153,769 | $20,290 | $133,480 |

| 2018 | $6,733 | $153,769 | $20,290 | $133,480 |

| 2017 | $6,919 | $142,027 | $18,099 | $123,928 |

| 2016 | $7,200 | $142,027 | $18,099 | $123,928 |

| 2015 | $6,855 | $142,027 | $18,099 | $123,928 |

| 2014 | $6,855 | $127,680 | $17,030 | $110,650 |

| 2013 | $6,852 | $149,530 | $18,660 | $130,870 |

Source: Public Records

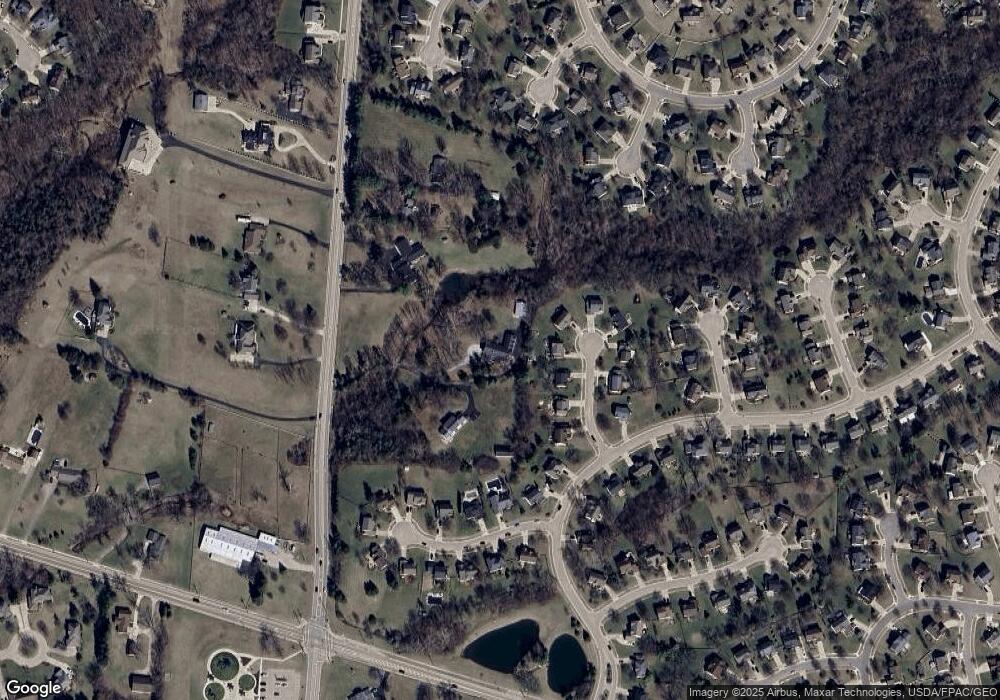

Map

Nearby Homes

- 340 Brookside Dr

- 85 Northbrook Ct

- 1264 Normandy Rue

- 9175 Bunnell Hill Rd

- 60 Brighton Ct

- 140 Wood Creek Ct

- 9791 Blue Spruce Dr

- 25 Sandelwood St

- 155 Clearsprings Dr

- 1015 W Lytle 5 Points Rd

- 157 Sandelwood St

- 16 Pebble Brook Place

- 285 Waterhaven Way

- 88 N Glen Oak Dr

- 165 Waterhaven Way

- 213 Bentridge Dr

- 44 Old Pond Rd

- 111 Rippling Brook Ln

- 5 Old Pond Rd

- 146 Rippling Brook Ln

- 35 Bentbrook Ct

- 25 Bentbrook Ct

- 45 Bentbrook Ct

- 15 Bentbrook Ct

- 9130 Yankee St

- 5 Bentbrook Ct

- 50 Bentbrook Ct

- 9230 Yankee St

- 215 Brookside Dr

- 30 Bentbrook Ct

- 40 Bentbrook Ct

- 20 Saddlebrook Ct

- 305 Brookside Dr

- 205 Brookside Dr

- 30 Saddlebrook Ct

- 40 Saddlebrook Ct

- 9250 Yankee St

- 50 Saddlebrook Ct

- 75 Millbrook Ct

- 25 Chase Ct