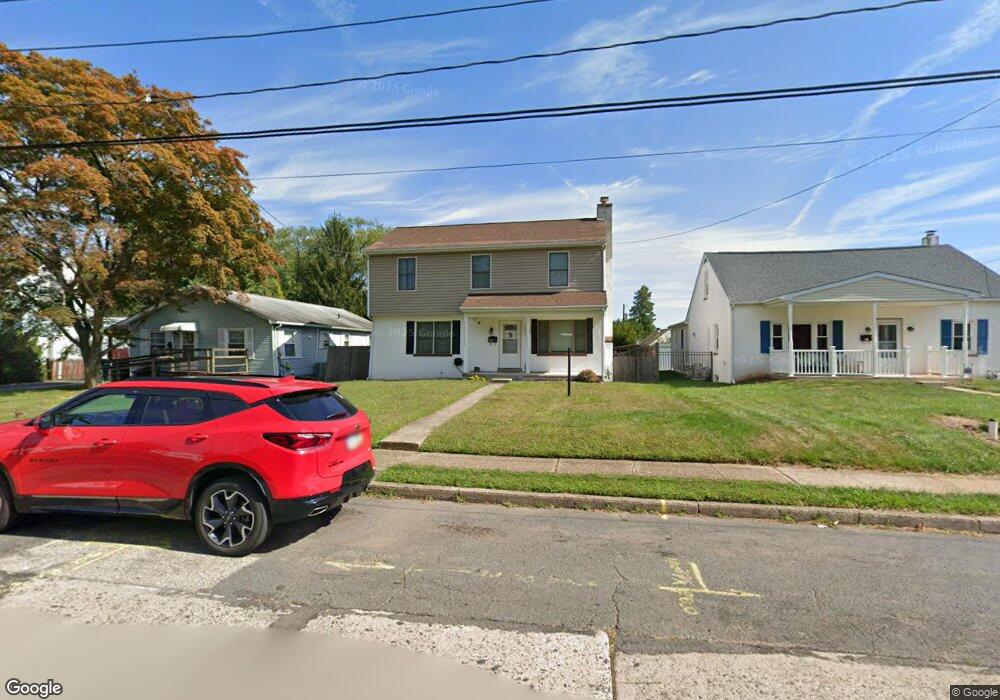

921 W 3rd St Lansdale, PA 19446

Estimated Value: $333,000 - $423,000

4

Beds

3

Baths

1,386

Sq Ft

$281/Sq Ft

Est. Value

About This Home

This home is located at 921 W 3rd St, Lansdale, PA 19446 and is currently estimated at $389,444, approximately $280 per square foot. 921 W 3rd St is a home located in Montgomery County with nearby schools including Oak Park El School, Penndale Middle School, and North Penn Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2021

Sold by

Kapusta Joanne and Ogorzalek Paul

Bought by

Kapusta Joanne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,194

Outstanding Balance

$127,079

Interest Rate

2.88%

Mortgage Type

FHA

Estimated Equity

$262,365

Purchase Details

Closed on

Oct 1, 2010

Sold by

Kapusta Joseph W and Zamarripa Janet Kapusta

Bought by

Ogorzalek Paul and Ogorzalek Joanne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,000

Interest Rate

4.39%

Purchase Details

Closed on

Nov 12, 2008

Sold by

Mcquaid Joseph J and Ippolito Michael V

Bought by

Kapusta Joseph W and Zamarripa Janet Kapusta

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kapusta Joanne | -- | None Listed On Document | |

| Ogorzalek Paul | $215,000 | None Available | |

| Kapusta Joseph W | $50,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kapusta Joanne | $139,194 | |

| Previous Owner | Ogorzalek Paul | $172,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,537 | $107,870 | -- | -- |

| 2024 | $4,537 | $107,870 | -- | -- |

| 2023 | $4,244 | $107,870 | $0 | $0 |

| 2022 | $4,110 | $107,870 | $0 | $0 |

| 2021 | $3,942 | $107,870 | $0 | $0 |

| 2020 | $3,823 | $107,870 | $0 | $0 |

| 2019 | $3,760 | $107,870 | $0 | $0 |

| 2018 | $1,008 | $107,870 | $0 | $0 |

| 2017 | $3,510 | $107,870 | $0 | $0 |

| 2016 | $3,467 | $107,870 | $0 | $0 |

| 2015 | $3,219 | $107,870 | $0 | $0 |

| 2014 | $3,219 | $107,870 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 204 N Valley Forge Rd Unit 7B

- 1028 Poplar St Unit 75

- 13 W End Dr

- 108 Allison Ct Unit 8

- 833 W 4th St

- 831 W Main St

- 1035 Forest Ave

- 21 S Valley Forge Rd Unit 213

- 920 Columbia Ave

- 1061 York Ave

- 217 Cherry Ln

- 340 Central Dr

- 405 Derstine Ave

- 302 W 8th St Unit 21

- 816 Kenilworth Ave

- 245 Cherry Ln

- 129 W Fifth St

- 128 S Broad St

- 39 E 5th St

- 750 Annes Ct